OWL

Talons sharpened, eyes trained …

Peering into the darkest corners of East Devon since 2013!

Contact us at eastdevon.owl@gmail.com

Scroll down to read the latest posts and text search the archive of over 18,000 articles.

Contact us at eastdevon.owl@gmail.com

Scroll down to read the latest posts and text search the archive of over 18,000 articles.

Leader of EDDC gets a cameo quote in Leigh Day’s South West Water sewage pollution claim, latest Update 23.02.26:

Claim expands across Devon and Cornwall – Letter Before Action issued to South West Water and parent company Pennon Group PLC. Lead partner Oliver Holland describes this as “an important step in the claim”.

Which towns have been impacted by sewage pollution?

As sewage pollution continues to affect the lives and livelihoods of coastal and river-based communities throughout the UK, residents and businesses in the South West are taking action. They are bringing a group legal claim against South West Water Limited (South West Water) and Pennon Group Plc in relation to allegations that these companies are responsible for sewage pollution affecting their coastal communities.

The claim was initially brought on behalf of residents and businesses in Exmouth and Budleigh Salterton. It has since expanded to include other towns and beaches across South West Water’s area of appointment that are among the worst affected in the region. These include:

As highlighted in the recent Channel 4 docudrama, Dirty Business, sewage pollution is a widespread and severe issue across the country. The communities identified in this claim are among those most severely affected across the South West.

Local beaches play a vital role in these communities, with local economies heavily dependent on tourism. They are also culturally and socially significant, providing opportunities for sea swimming, water sports and access to the coastline. However, according to local reports, South West Water repeatedly discharges large volume of untreated sewage, with detrimental consequences for the condition and usability of these beaches.

The effects of these discharges have been acknowledged by both the Environment Agency and South West Water. In recent years, the Environment Agency has issued numerous ‘Advice Against Bathing’ notices in recent years, and South West Water has regularly stated on its website that discharges may affect bathing water quality.

More broadly, beaches across the South West have faced repeated disruption as a result of sewage pollution. The leader of East Devon District Council, Paul Arnott, has described the situation as an “ongoing civil emergency” following repeated closures from Seaton to Sidmouth.

In 2022, Surfers Against Sewage identified Longrock beach as “joint worst” in England for sewage alerts. More recently, during the August 2024 Bank Holiday weekend, red flag warnings were raised on Exmouth Beach to prevent people from entering the water. Fistral beach has also been affected, with sewage alerts leading to the cancellation of surf events.

Following last week’s Channel 4 docudrama on sewage pollution and the attitudes of the privatised water industry and regulators ” Dirty Business”; many National Newspapers wrote follow on pieces at the weekend.

The Guardian article started by describing Sarah Lambert’s experience and quoted Andy Tyerman of Exmouth’s anti-sewage pollution campaign Escape: “The situation is not getting better, things are getting tangibly worse.”

Dirty water, death and decline: the inside story of a privatisation scandal

www.theguardian.com (extract)

Sarah Lambert took her usual morning swim for 40 minutes off Exmouth town beach before her volunteer shift helping disabled people get access to the water.

A wheelchair user herself, Lambert’s regular sea swims twice a week between the lifeboat station and HeyDays restaurant were the perfect form of exercise for her disability.

It was August 2024, and a dry summer’s day on England’s south-west coast.

At 4.15pm, lifeguards shut the beach, erected red flags and asked people to leave the water after East Devon district council was alerted to a catastrophic burst of the main pipe pumping sewage to the town’s Maer Lane treatment works.

But it was too late for Lambert. She started vomiting later that day and was admitted to hospital suffering life-threatening sepsis after being infected by E coli and Citrobacter bacteria, both of which are commonly found in sewage.

Anger about the state of the privatised water industry in England intensified this week after the screening of Channel 4’s docudrama Dirty Business. It weaves the human tragedy of the death from E coli O157 poisoning of eight-year-old Heather Preen in 1999, who had paddled just the other side of the Exe estuary from Lambert’s swimming spot, with the unfolding of an environmental and public health crisis. It explores three decades of underinvestment by water companies, uncovered in part by amateur sleuths Peter Hammond and Ash Smith, as well as the cosy relationship between the water companies and those meant to be holding them to account.

Lambert is now frightened and anxious about sea swimming, the form of exercise she used to love. “I was seriously ill, I spent a week in hospital before I had to have 10 more days of intravenous antibiotics at home,” said Lambert, 47, who is part of a group environmental legal claim against the local water company, South West Water.

“It took me a long time to recover. I am disabled, so I am quite vulnerable, and I moved to Exmouth to be coastal. The sea is just on my doorstep, but I don’t swim there any more. None of this is right, none of this is acceptable.”

England remains an anomaly across the world, as the only country apart from Chile where water, a natural resource, is owned by private companies for profit. The then Conservative prime minister, Margaret Thatcher, promised in 1989 that privatisation would deliver higher investment.

But as far back as 2002, ministers were warned in a report, which has remained secret, that privatisation would allow large external private equity shareholders to load companies with debt, and the financial regulator Ofwat inevitably would lose any regulatory control.

Now, Prof Pedro Arrojo-Agudo, the UN special rapporteur on the human right to clean water, has singled out the English system for criticism, saying water should be managed as a publicly owned service, rather than run by private companies set up to benefit shareholders.

Lambert, like others across the country who closely monitor the performance of their water companies, agrees with the UN rapporteur.

“The situation is not getting better, things are getting tangibly worse,” said Andy Tyerman, of Exmouth’s anti-sewage pollution campaign Escape. “South West Water set its own target for 2025 to be a four-star performer. But they have never been anything higher than two-star for more than 10 years. They set a target of no more than 20 sewage spills on average; last year there were 40 spills on average. We seem to be going backwards to the 1990s.”………

The water company whistleblowers exposing shocking practices

The Times (Extract)

(Feargal Sharkey) says he has been contacted by a huge number of people in recent days who were infuriated by Dirty Business. “It portrayed in the starkest way possible the brutal reality of what’s been going on in the background: that even behind all of these sensational headlines and the Times campaign and the work that everybody’s done, you see the lengths the water companies, the Environment Agency and indeed the government, were going to to wilfully look the other way. Everybody in the country should be outraged. Peter and Ashley are just the beginning of an absolute tidal wave of anger that’s heading in the government’s direction.”

SWW pleaded guilty at Exeter magistrates’ court yesterday.

Mr Joseph Millington, acting on behalf of the Drinking Water Inspectorate (DWI) , called for the sentencing to take place at the crown court, where larger fines can be issued.

He said: “Given the high-profile nature of this case, and to ensure that the message is heard loud and clear by local residents that the criminal justice system will treat offences of this nature with the utmost seriousness, we respectfully submit that the crown court would be the most appropriate venue to deal with this case,”

But Mr Dominic Kay KC, representing South West Water, argued that sentencing should take place at the magistrates’ court. He said the company’s view was that the incident was at the “medium” level of culpability in sentencing guidelines.

Read on to find out who won this particular argument: the DWI or SWW? – Owl

Alex Ross www.independent.co.uk

A total of 143 people were confirmed to have caught the waterborne disease, which causes sickness and diarrhoea, after it entered the water network in Brixham almost two years ago, due to a damaged valve in the network.

The company, which initially said the water was safe to drink as cases first emerged, issued a “boil water” notice to thousands of households and businesses, instructing them not to drink tap water without boiling it first.

South West Water has admitted supplying water unfit for human consumption after an outbreak of cryptosporidiosis in a Devon seaside town that left dozens of people ill.

At Exeter Magistrates’ Court on Wednesday, the firm pleaded guilty to supplying water unfit for human consumption within the Littlehempston Water Supply Zone between 31 March and 1 June 2024.

Inside the courtroom were several residents from Brixham, some of whom claimed to have suffered medical conditions since the outbreak, including irritable bowel syndrome. They said the town had suffered “untold damage” as a result of the outbreak.

Water minister Emma Hardy also reacted to the guilty plea, describing it as a “crucial step toward accountability”. She said: “Contamination of drinking water is rare – but it is utterly unacceptable. The communities affected by this abhorrent incident in Brixham deserve answers.”

The prosecution was brought by the Drinking Water Inspectorate (DWI), which investigated the incident along with the UK Health Security Agency. The court heard that it was the DWI’s view that the offence was at the “higher end of culpability”.

Mr Joseph Millington, acting on behalf of the DWI, said: “Not only was this a high-profile case, but this incident impacted a significant number of people across a broad geographical area.

“It resulted in an adverse impact in the public confidence in water supply in the area.”

“Its effects were, some of the complaints say, long felt after the lifting of the boil water notices [which lasted eight weeks]. There was, of course, local inconvenience, economic impact, and impact on education throughout this incident.”

Mr Millington called for the sentencing to take place at the crown court, where larger fines can be issued.

He said: “Given the high-profile nature of this case, and to ensure that the message is heard loud and clear by local residents that the criminal justice system will treat offences of this nature with the utmost seriousness, we respectfully submit that the crown court would be the most appropriate venue to deal with this case,”

But Mr Dominic Kay KC, representing South West Water, argued that sentencing should take place at the magistrates’ court. He said the company’s view was that the incident was at the “medium” level of culpability in sentencing guidelines. District Judge Stuart Smith decided to keep the case in the magistrates’ court for sentencing, which will take place in June.

Among those in the public gallery was resident Tanya Matthews, who was one of the first people to report feeling unwell on social media, triggering a wave of similar complaints. After falling ill, the 42-year-old said she went to hospital with continued stomach complaints, and now suffers from irritable bowel syndrome.

She told The Independent: “I’m just glad we’ve got this far and someone will take accountability for what happened. The town and its people have suffered untold damage from the outbreak, and now we are being heard.”

Following the outbreak, locals had complained about a lack of communication from the company and the knock-on impact of the incident on tourism for the town.

There was also anger after South West Water initially said the water was safe to drink on 14 May, after the first confirmation of cases of cryptosporidiosis, before issuing the “boil water” notices a day later.

Following the outbreak, South West Water chief executive Susan Davy, who stepped down last year, said she was “truly sorry”.

Ms Davy said: “To those in the affected area and our customers across the southwest, I am truly sorry for the disruption and wider anxiety this has caused. While incidents like these are thankfully very rare, our customers expect a safe, clean, and reliable source of drinking water.”

Also speaking after Wednesday’s hearing, residents Lisa and Kris Horswill said they still do not drink tap water as a result of the outbreak. “Now they will get fined, but who will that hit? Those paying the bill, of course,” said Mrs Horswill, 54.

Caroline Voaden, MP for South Devon, said the admission was a “long time coming”.

She said: “I am glad that SWW have owned up to their serious failures. This awful event should never have happened.”

Marcus Rink, chief inspector of the DWI, said: “While such incidents are very rare, this incident had a significant impact on the public and the wider community. The court will now decide what the outcome of the failing should be.”

The case was adjourned for sentencing at Exeter Magistrates’ Court in June.

Water firms pleads guilty to Brixham bug outbreak

SWW admitted the offence, contrary to the Water Industry Act 1991, at Exeter Magistrates’ Court. It will be sentenced at a later hearing.

Brixham MP, Caroline Voadon, said:

“Last summer, the government finally started to overhaul our water industry by promising to abolish Ofwat. But progress has been glacially slow. They must go much further and faster – this industry must be properly regulated and held to account.”

Devon’s main water supplier has admitted to providing water unfit for human consumption following a parasite outbreak in Brixham.

In a hearing at Exeter magistrates’ court today (March 4), the firm admitted a charge brought by the Drinking Water Inspectorate.

In May 2024, the microscopic parasite Cryptosporidium entered the local water network through a damaged valve, leading to four hospitalisations and 143 cases of people falling ill with symptoms such as fever, stomach pain, vomiting, and diarrhoea.

The waterborne disease parasite is found in animals and human faeces, according to the UK Health Security Agency.

For nearly eight weeks, the town was under strict boil water notices. Up to 16,000 homes and businesses were affected and relied on bottled water stations distributed throughout the area.

The notice remained in effect until July 2024, causing significant disruption to daily life and the local economy.

Over the eight weeks, more than 1,000 technicians, engineers, and scientists worked 24/7 to sanitise the network, with just over 20 miles of pipes flushed 27 times at high velocity.

The company reported a total cost of £16.3 million in the dedicated tourism recovery fund, as well as a three-year commitment to help the region bounce back from the negative publicity.

In total, the outbreak cost South West Water £16.3 million in compensation it had to pay to affected customers.

MP Caroline Voadon serves the area, says

“This admission of guilt has been a long time coming. I am glad that SWW have owned up to their serious failures. This awful event should never have happened.

“But the mismatch between rhetoric and action plagues our broken water industry. Whether it is protecting customers or the environment, too many water firms say one thing, then do another.

“I want to thank the Drinking Water Inspectorate for bringing the case and the many campaigners who worked tirelessly to ensure the anguish they felt during the cryptosporidium outbreak was not forgotten.

“Last summer, the government finally started to overhaul our water industry by promising to abolish Ofwat. But progress has been glacially slow. They must go much further and faster – this industry must be properly regulated and held to account.”

Councillor Denise Bickley, Devon County Council Cabinet Member for Special Educational Needs and Disabilities (SEND), has welcomed the publication of the government’s education and SEND white paper, Every Child Achieving and Thriving.

Denise Bickley www.devon.gov.uk

“The publication of this white paper is a positive step. It clearly recognises the pressures facing the SEND system and the need to improve outcomes for children and young people.

“The focus on earlier intervention is welcome. Supporting children sooner can make a real difference to their lives and reduce the need for more intensive support later on.

“Clearer national standards and stronger joint working between education, health and care services are also important. Families need greater consistency and confidence, wherever they live.

“The white paper’s commitment to inclusion and workforce growth, including recruiting more teachers, is encouraging. These are essential foundations for a stronger system.

“Teachers need to be allowed to teach – and be respected for the knowledge and experience they bring to their role. Teaching assistants need to be recognised for the vital role they play in schools. We will see how the white paper, as it moves through consultation, addresses this.

“There is an obvious desire from schools and families for smaller class sizes and parents will want reassurance that funding will be sufficient to allow this – although if schools are given the tools to pool funding and work collaboratively, as laid out in the plans, this may well free up funding for complete reorganisation and innovative planning.

“I agree that all children should be stretched, as long as that is a comfortable, encouraging stretch and not pressured – but I am concerned about the suggestion of more statutory testing, now at Year 8.

“In general I like the tone of the paper; that it is a long term ambition with early help and collaboration at its heart. This is shared by Devon County Council.

“We are committed to working constructively with ministers, partners and families as these proposals are taken forward. With the right funding and long‑term planning, this reform has the potential to deliver a more stable and sustainable education system that works better for all children, families and schools.”

A new chapter begins

Devon’s libraries have seen a plot twist in their funding story after a move with “real intent” to secure them more cash.

Bradley Gerrard, local democracy reporter www.radioexe.co.uk

All of Devon’s 50 libraries are undergoing a consultation that could see hours cut and residents asked to travel to a library elsewhere when the one in their home town or village is closed.

But a late finance re-write for libraries was revealed in Devon County Council’s budget, that was backed by its councillors at the full council meeting this week (Tuesday 24 Feb).

Going into the meeting to confirm the council’s £839 million budget, libraries had been expected to find £650,000 in efficiency savings, but that has now been reversed.

The council said £225,000 would go to restoring the book fund back to its £500,000 level, and that an extra £425,000 had been found to support library delivery during any potential changes that could come about after the consultation on how they operate in the future.

The budget for libraries was due to fall from £7 million to nearly £6.5 million, but will now be kept over the higher figure.

Furthermore, the budget revealed that the council had identified £1 million to create a reserve for libraries and rural hubs that it said would “support genuine transformation and community-led improvement”.

Councillor Cheryl Cottle-Hunkin (Liberal Democrat, Torrington Rural) whose cabinet portfolio includes libraries, thanked her colleague Councillor James Buczkowski (Liberal Democrat, Cullompton) for his “hard work and commitment to libraries”.

“Libraries matter deeply and they are not an optional extra or luxury, but a lifeline for many,” she said.

“They are places of opportunity, learning, connection and safety, and for many residents they are the only warm, welcoming and free community space available to them.”

Cllr Cottle-Hunkin, who campaigned to save the council’s fleet of mobile libraries when the council was Conservative-controlled, said the scale of responses to the consultation on libraries had been “incredible”.

“We’ve had 22,000 responses, which is one of the biggest to a Devon County Council consultation and four times more than the library consultation in 2006,” she said.

“It speaks volumes about how much people value their libraries,” she added.

Cllr Cottle-Hunkin added that the £425,000 to support library delivery showed the administration was “serious about listening and responding to what communities tell us”, and that it meant the council would have the “flexibility to act responsibly and meaningfully to the consultation”.

“If we are serious about aspiration, literacy and opportunity, then investing in literacy resources is the right thing to do, and the creation of a £1 million reserve to support library transformation and rural hubs is not a small change but a real investment in doing things differently,” she said.

“It gives us the ability to be creative, to explore new income streams, build resilience, and gives us the flexibility to pilot new ideas to ensure rural and remote areas are not left behind.”

The consultation has stated that none of the county’s 50 libraries will close, but could be grouped into areas where at least one library would be open Monday to Saturday.

This so-called network model has angered some campaigners, though, because they feel that many residents won’t be able to travel to a neighbouring library, especially if they are elderly or vulnerable and rely on public transport.

However, the council has said it is also seeking views on the use of volunteers and community managed libraries, where local organisations could take on day-to-day running with support from the council and Libraries Unlimited.

And there are even potential proposals to use technology to allow registered users to enter libraries outside staffed times.

The consultation closed on 22 February, and the council will now analyse the responses.

Cllr. Paul Arnott has set the record straight on the twists and turns in Local Government Reorganisation (LGR) negotiations that have taken place in Devon in the last year and a half. This has been revealed in papers released for the 25 February EDDC council meeting in response to a question from Tory group leader Cllr. Mike Goodman.

Backstory Paul Arnott’s ring side seat started in 2024 when East Devon held the chair of the Devon Districts’ Forum as Leader EDDC. Despite denying rumours as late as October 2024 that LGR would be attempted (it was not in Labour’s Manifesto), councils were instructed in December to prepare plans by the following March. Tory controlled Devon County Council (DCC) immediately proposed cancelling the May elections so as not to distract from their “fast track devolution” plan. This was turned down by the government as Owl reported in February (2025) “First Devon county loses bid to cancel elections and join fast track to devolution now its bottom of the league for funding”. The Tories lost control of DCC in the subsequent elections and newly elected county councillor Paul Arnott became Deputy Leader DCC whilst remaining Leader EDDC.

Cllr Mike Goodwin’s question follows up a critical press article he wrote in October last year (referenced) below.

Cllr. Paul Arnott’s reply reads:

As leader of the Council I am very glad to take the opportunity provided by Cllr Goodman to address the matter of LGR, which sits in the wider context of his role as Chair of the Devon Area Conservatives. Cllr Goodman has offered implied criticism of my conduct which he has been aware I have been unable to answer until after submission. [See Devon authority changes need to be clear and coherent, Sidmouth Herald last October]. It is worth noting that at no time has he attempted to discuss this with me.

1. The context in which Local Government Reorganisation (LGR) sits is worth recalling. Although Devolution and Strategic Mayoral Authorities were in the July 2024 Labour manifesto, LGR was not. As late as the Local Government Association Conference in Harrogate in October 2024, ministers were denying rumours that LGR would be attempted.

2. In December 2024, all councils were written to be MHCLG to say they would be required to prepare outline plans for LGR by March.

3. Cllr Goodman’s Conservative County administration (he has been Devon chair since January), instead of doing substantial preparatory work, at first attempted in February to cancel the May 2025 County elections which they feared they would lose. (They went on to do so, down from over 40/60 members to 7.) They wanted to turn Devon & Torbay into a single megaunitary, even though this had explicit dissent from Torbay, which would give cover to their “cancelling” democracy.

4. This outrageous attempt to rob the people of Devon of the right to vote and to earn themselves a further year, perhaps two, of unelected power was denied them by the government. The legacy problem they had thus created is that they had not worked up any credible proposal from Devon CC for the end of March.

5. For the calendar year of 2024, East Devon held the chair of the Devon Districts’ Forum. I was able to have many discussions which made a number of risk factors in devising a response from EDDC obvious to me.

This was a febrile set of circumstances in which politically the two traditional parties of power were likely to favour self-interest.

6. This was unacceptable. The chair of the DDF passed to West Devon in January 2025, and I was happy to work with Districts’ Leaders and CEOs in the context of the above to devise a plan based not on self-interest but in the public interest. The idea emerged of:

7. This was devised in good faith, meeting the population numbers seemingly required and having many other strengths. The obvious concern in the 4:5:1 was that Torbay were not very committed to the 4 (ultimately, they did not support it) and that Exeter were wholly uncommitted to the 5 (ultimately, they too did not support the 4:5:1)

8. In April 2025, the government responded to the various draft submissions, stating that they required full and final ideas by the end of November 2025

9. In May 2025, County elections were held. The Conservatives lost control (now 7/60) and Reform are 16/60 with no prospect of an administration. In a scenario very nearly mirroring the Democratic Alliance at East Devon, the Liberal Democrats took control of County with NOC but with good relations with the Greens and Independents.

10.Given my own experience in LGR matters in Devon and as a leader for half a decade, the County Leader asked me to step into the void of the LGR PH at County. This provided me with no conflict of interest, although of course care must be taken. It was known that EDDC would continue to develop the Council instruction to explore 4:5:1.

11.On being re-elected Leader at EDDC for a sixth term in May 2025, I announced that a new Deputy Leader John Loudoun would lead in internal and external discussions around developing 4:5:1. This has been immaculately observed and I give personal thanks to John and our officers for their excellent work.

12.Unfortunately, on taking up my role in late May, just six months ago with submission looming, it soon became apparent that County had been left without any political direction of travel at all by the outgoing Conservatives. My ask of their officers was to look at 4:5:1 as an option, and also to look at a single Unitary respecting the existing Unitaries of Plymouth and Torbay. This ask arose from evidence presented at County of a sincerely perceived risk of disaggregating children’s and adults’ services into two.

13.While the evidence was being assessed at both the Districts and at County, I am proud that I worked very hard to try and make up for the dreadful democratic deficit looming through the abolition of the Districts by developing the structural and policy concepts for Neighbourhood Area Committees. My intention was and remains that these should be put in place under any future option chosen by the government.

14.By September 2025, it was becoming clear that in all good faith the Districts, under advice from KPMG and others continued to favour 4:5:1. Meanwhile, the County, itself using sound internal and external advice, favoured 9:1:1. The most fundamental difference in opinions was around interpretation of shared data re social services. There is nothing wrong with such a difference of view which may have arisen from each idea engaging with the data stressing alternative fundamentals. There is nothing awry in this, and it has been common in LGR across England.

15.We then entered the period where submission decisions would need to be made across all Devon authorities. Cllr Goodman errs when he said I “proposed” the idea of 9:1:1 from the County perspective. That was the Leader seconded by another member of Cabinet. I abstained at both councils. I was content to explain the idea of 9:1:1, however, and the people of East Devon and Devon had every right to hear and consider its merits and demerits. Anyone paying attention would have seen my repeated public statements that ONLY 4:5:1 and 9:1:1 observed the key exam question which was that any proposal was required to consider and offer proof that it could work for ALL the authority areas across Devon. I spoke in praise of both proposals only last Friday at DCC Full Council, and have done so consistently including in meetings with DALC and others.

16.The suspected proposals from Labour authorities duly came to pass – for a hugely expanded Plymouth (which is at least an experienced unitary), a hugely expanded Exeter (a city council whose proposed boundary expansions make little sense) and in Labour’s joint submission, an expanded Torbay – which Torbay doesn’t want. The rest of us in Labour’s vision are put in the obviously non-viable “Rural & Coastal”

17.To answer Cllr Goodman’s question. Despite his attempts to personalise this in council and in the press, I am proud that the two councils I have been elected to have acted impeccably in the last six months to devise proposals which consider the common good of all Devonians, and that we have done so in a situation where both the Conservatives and Labour have pursued “I’m alright, Jack” policies and proposals.

18.As he knows, the Secretary of State will now consider which proposals will go to stakeholder consultation in the new year. In my view, it is to be hoped that the SoS has the independence of mind to include both 4:5:1 and 9:1:1 as options. I am pleased that both have been put forward.

A group legal claim against South West Water alleging sewage pollution into coastal waters is harming businesses and individuals has been expanded across Devon and Cornwall.

Sandra Laville www.theguardian.com

Thousands more individuals could now join the first environmental community group legal action against a water company over the impact of sewage pollution.

Until now 1,400 people from Exmouth had joined the legal action but Leigh Day said on Wednesday it was being expanded to residents and businesses across Dawlish, Sidmouth, Teignmouth in Devon and Newquay and Penzance in Cornwall.

The claim argues failings by South West Water are wide and entrenched in many coastal towns across the Devon and Cornwall region, rather than just the Exmouth area.

Tina Naldrett, 62, a nurse from Dawlish, has joined the claim, after years in which she has seen the pollution at her beach get worse.

“When the sea is clear, and you can see your feet, the sun is on your back and you hear the gulls, it is free magic,” she said. “But more often I take friends into the water and we see sanitary products floating past, the plastic from tampons, actual effluent and the foam from effluent. It is getting worse.

“Water companies don’t own the sea. We are an island nation, the sea belongs to us all and for water companies to use the sea in this way feels immoral and ethically bankrupt.”

In 2024 South West Water discharged 544,429 hours of raw sewage into seas and coastal waters, including an overflow at Salcombe Regis that discharged for almost the whole year – making it the longest sewage release duration across all the storm overflow sites in England and Wales.

Last July Ofwat issued a £24m enforcement penalty against South West Water identifying systemic failings in the way it maintained and operated its wastewater treatment works and sewer networks dating back to at least 2017.

Spills of raw sewage via combined storm overflows are only allowed, and considered legal, if they take place after exceptional circumstances, such as extreme rainfall, when the system is at risk of being overwhelmed. But more than half of South West Water’s treatment plants were spilling regularly into the environment, Ofwat said.

The legal claim launched in 2024 has attracted more than 1,400 people from the Exmouth, Lympstone and Budleigh Salterton areas. They object to the repeated use of storm overflows to discharge raw sewage into the sea, triggering bathing alerts and beach closures and preventing people from using the coast.

Oliver Holland, who leads the claim, said the expansion of the legal action across Devon and Cornwall was an important step.

“South West Water has a track record of very poor environmental performance, and my clients allege this has badly impacted their lives and livelihoods. By outlining my clients’ claims and expanding in this way, we are ensuring anyone who feels they have been impacted by sewage pollution in Dawlish, Sidmouth, Teignmouth, or at Longrock beach or Fistral beach in Cornwall, has the opportunity to take action.”

South West Water has been contacted for comment.

Guardian readers respond to Polly Toynbee’s article on the government’s plans to overhaul local government (18th Feb)

Polly Toynbee is correct to point out the foolishness of a massive local government reorganisation, given other priorities (Is No 10 seeking its own destruction? Why else would it botch its council plans and hand a victory to Farage?, 18 February).

What she does not mention is that this reorganisation will lead to a large increase in inequality. The district councils that are being abolished are rising from the ashes as town and parish councils and, unlike other councils, they can set their own precept and cannot be capped. The largest town councils have budgets of more than £5m and more than 124 parish councils have budgets of over £1m. These councils tend to be in the wealthier suburban and rural areas, and can protect their residents from austerity, unlike residents of large, disadvantaged urban areas.

If you live in an area with a parish council, you will have a good library, open spaces and playgrounds will be well maintained, and you will have a thriving youth club. If you do not, your library will have closed and your playground will be covered in glass where the teenagers drink on a Saturday night following the closure of their youth club.

The government is giving grants to disadvantaged areas, but they will revert to their previous state within a few years due to a lack of local government funding. Despite the warm words from the chancellor, the cuts continue.

David Kennedy

Menston, West Yorkshire

The government seems bent on replacing one broken system with another. Local authorities have two broad functions. One is to deliver services equitably, efficiently and economically. The other is to be the living, beating heart of the communities they serve, offering local leadership and advocacy. It is, of course, a question of balance. Councils need to be big enough to be efficient, but small enough to care. Governments do not seem to understand that.

Unitary councils are certainly more publicly relatable than the two-tier system. But in choosing a population baseplate of around 500,000, this government has made it clear that any concept of local responsiveness has been abandoned in favour of an ill-conceived search for savings. It is no better than planning on the back of a fag packet.

Two “super councils”, as proposed where I live, will simply be too large to be responsive to the needs of such a large and diverse range of towns and smaller population centres. Perversely, it will also be too small to justify a combined mayoral authority, because it is not an economic entity on its own. The proposals represent another centralising nail in the coffin of local government.

Of course, if you just want your bins collected, none of that matters. But as a former three-time council chief executive, I pray for another U-turn.

Bernard Quoroll

Guildford, Surrey

Why Labour is wasting energy on an unnecessary reform of local government is, as Polly Toynbee points out, puzzling. A cynic might suggest that the reason is something scarcely mentioned in the debate: larger authorities with fewer councillors representing local interests offer more scope for the kind of large-scale planning that is needed to take forward the government’s ambitious growth strategy.

Westminster finds local council opposition to new runways, roads, railways, housing estates, power stations and so on a nuisance. Maybe local government reorganisation is driven by a desire to weaken it.

Peter Taylor-Gooby

Canterbury

Polly Toynbee has hit the local government reorganisation nail on the head. As a senior county council officer, I went through the reorganisation in the 1990s. Far from creating a more rational system, it resulted in a hotchpotch of new authorities, some of which struggled to establish sound services, and a puzzling set of changes to county councils. The process took up huge amounts of time and money, and diverted attention from planning and delivering good services into sorting out thousands of details such as changed boundaries, contracts and responsibility for future liabilities (not unlike Brexit).

The adage that form should follow function seemed to be less important than working on the assumption that reorganisation was an easy panacea. Looking at exactly what needs doing and seeing how well you could do it through minimal organisational change makes more sense – less exciting, but the public needs good services, not political excitement.

Andrew Seber

Winchester

My district council, East Devon, is due to be abolished in the name of “efficiency” some 50 years after it was created from an efficiency bonfire of urban and rural councils. The district only consumes 7% of the tax it collects from me, so I see little scope for savings. All the local services it manages – maintaining electoral rolls, running elections, dealing with household waste, street cleaning, local planning, collecting council tax etc – are essential. The only certainty is that I will have fewer councillors to turn to.

There is no consensus on how district councils should be reorganised in Devon, and my fear is that rural areas will be cast adrift from the inherently more efficient urban ones. As for mayors, even Andy Burnham might struggle to make himself known in a county that is 70 miles wide and 70 miles deep, with little public transport.

David Daniel

Budleigh Salterton, Devon

High Court battle looms over NHS vaccination building

Bradley Gerrard, Local Democracy Reporter www.radioexe.co.uk

A High Court battle looks set to be sparked over a long-running dispute to retain an NHS drive-through vaccination centre.

The owners of Greendale Farm Shop have revealed that after losing an appeal over the issue at the Planning Inspectorate, they are now taking their fight to the next level.

A spokesperson for the firm confirmed that they did not agree with the outcome of the recent appeal on a legal basis, and so have just submitted a challenge in the High Court.

“The NHS wants to stay put and they have a lease on the building,” a spokesperson for Greendale said.

“We made our appeal to the Planning Inspectorate under four grounds and we don’t believe all of those have been made reference to in the decision notice.”

The saga has been rumbling on for years, with Greendale removing a chicken shed from the same site, and according to official documents, “a new larger structure was erected in the same place which permitted development rights did not permit”.

A 2023 planning application by Greendale sought to retain the building, but that was refused by East Devon District Council because it was outside the boundary where development was permitted and because it believed there was an “absence of a robust justification and evidence of need” for the site.

That decision was taken to the Planning Inspectorate, which sided with the council. East Devon subsequently issued an enforcement notice demanding the building and parking area be returned to agricultural use.

Greendale’s owners again took their plight to the government planning arbitrator in a bid to overturn the enforcement notice.

However, in a fresh decision issued late in January this year, the Planning Inspectorate upheld the enforcement notice, meaning it supported the council’s belief that the building has to be taken down.

The NHS Vaccination Centre has a drive-through provision, and is different to the much larger structure that also served as a vaccination centre during lockdown and which is on nearby Greendale Business Park land.

That larger building is no longer used by the NHS, but is occupied by an alternative health provider, and planning permission for that building has been previously approved.

East Devon states the reasons for its enforcement notice on the drive-through building are that it is “outside of any recognised development boundary”, even though it is just metres from the well-used Greendale Farm Shop and Cafe.

It is also virtually directly opposite Mud-Ventures play site, which was itself the subject of a Planning Inspectorate decision in its favour. In that case, the council also felt it was outside the area where development should occur, but the Planning Inspectorate felt the building was in keeping with others on the site and that Mud Ventures was unlikely to draw huge amounts of extra traffic given that people were likely to use more than one of Greendale’s services once there.

The council called the drive-through building “unjustified and unsustainable development in the countryside”, and that “its nature as a drive-thru vaccination centre means that people are likely to access the site via private car”, which is contrary to its policies linked to encouraging developments that can be accessed by public transport.

“It is not considered that there are material circumstances to outweigh the adverse impacts of development in this location which justify a departure from policy,” the council said in its enforcement notice.

“The environmental harm is considered to outweigh the social benefits that would be derived from the provision of a permanent building for the NHS to roll out their vaccination programme.”

The appellants had claimed that the enforcement notice was “defective”, and while the Planning Inspectorate stated he had “sympathy” with that suggestion, ultimately it found in favour of the council, albeit suggesting amendments to the enforcement notice.

The Planning Inspectorate agreed that while there were benefits to a vaccination centre, it had not been demonstrated that the service could not be better delivered elsewhere.

The documents also state that the NHS lease ends in March 2026, but it is not clear if that has been extended in the meantime.

Exmouth pollution mentioned again in a national newspaper. – Owl

“No family should go through this,” said Alice Clarke after her seven-year daughter, Willow, fell ill after swimming last summer at Carlyon Bay, Cornwall. Willow was ill for 12 days, vomiting, unable to keep food down and losing weight.

Adam Vaughan www.thetimes.com

The parasite cryptosporidium was eventually concluded to be the cause. “It was terrifying. Willow thought she was going to die,” said Clarke, a teaching assistant from Devon.

Willow, who recovered, was not alone in 2025. More than 1,200 people became sick after swimming in designated bathing waters across England last year, despite three quarters of those official swimming spots being rated “good” or “excellent”.

The figures, reported to the charity Surfers Against Sewage (SAS), showed Exmouth in Devon accounted for 192 cases of sickness after people had been in the water. Though the water quality was rated excellent when regulators undertook official tests during the summer, other research has found Exmouth can drop to poor during the winter months.

Hove Lawns in East Sussex and Polzeath in Cornwall also featured highly despite both being classed as excellent, having 103 and 102 sickness reports respectively.

Analysis by SAS of data from water company sewage spill maps suggests they dumped raw sewage into bathing waters across England for almost 125,000 hours last year despite dry conditions.

As the full maps only went online in late 2024, it is impossible to compare with previous years. However, demonstrating how wet it has been recently, sewage has already been spilled for 46,141 hours in 2026, less than two months into the year.

A “fountain of filth”, a temporary art installation featuring figures based on real people with cloudy water pouring from their mouths, has opened next to the Thames. Paid for by Channel 4 to promote its new fact-based water pollution drama Dirty Business, the fountain includes models based on the surfer Lizzie Cresswell and the Save Windermere campaigner Matt Staniek.

The Fountain of Filth JAMES VEYSEY/SHUTTERSTOCK

Cresswell, an SAS activist who said she had become ill several times after surfing, said she had done “lots of poses throwing up” for the 3D scan of her that was turned into the statue. “I’ve had eye infections, ear infections. It is horrific that we’re doing the things that we love doing and I’ve been sick multiple times.”

Staniek, who brought week 120 of his Greta Thunberg-style sewage strike to London on Monday, said: “It’s about bringing England’s largest lake into the fold and demonstrating to people that if it’s happening to Windermere in a Unesco World Heritage Site and a national park, then no river is safe from this.”

Jonathan Kneebone, director of the Glue Society art collective, who designed the fountain, said that the bronze-like statues of people were printed as hollow sections like “bits of macaroni”. The structure, on the Southbank in London, took three months to build but will be taken down in three days. “I love the fact that it feels like public art that should be here all the time,” Kneebone said.

Suzi Finlayson, a 47-year old swimmer from Bognor Regis, had travelled up to see the art installation. Like several other swimmers at the end of 2023, she fell ill at Aldwick beach in Sussex after swimming. She suffered a bacterial infection that reached one of her heart valves, requiring open heart surgery and leaving her reliant on weekly blood tests to this day.

“I’m still living with the consequences of that and something needs to be done about the public impact of what this sewage dumping is doing,” said Finlayson, who has reluctantly given up sea swimming.

Separately on Monday, Yorkshire Water was ordered by Derby crown court to pay a £733,333 fine for polluting a stream three times in less than 12 months. An Environment Agency investigation found several releases of untreated sewage had killed fish and insects along a waterway in Poolsbrook Country Park, near Chesterfield, during 2018 and 2019.

A spokesman for the industry body Water UK said: “Sewage spills are awful and we are working to end them as fast as we physically can. That’s why we are tripling investment over the next five years to halve spills from storm overflows and upgrade the capacity of 1,700 wastewater treatment works.”

The Times Clean it Up campaign is calling for better regulation and investment to safeguard the nation’s rivers and seas.

Did you watch it last night – available on catch-up! Starts by mentioning South West Water- Owl

How to respond

Owl is sceptical about the use of box ticking surveys and questionnaires. They seem designed to meet procedural requirements easily processed by computer, rather than gather genuine feedback.

The issues surrounding the elimination of the tier of local government closest to residents with consequential dilution of elected representation are profound.

Ironically, the government claims it is removing a tier of local government, district councils, while, at the same time, planning to add another on top, the strategic mayoral authority. This form of devolution does not bring local decision making closer to people.

Owl will, therefore, be sending in a narrative response and not be completing the “survey”.

See this companion post describing the proposals.

The Consultation

Nitty gritty (Taken from the gov.uk website)

This consultation will last for 7 weeks from 5 February 2026 to 23:59 on 26 March 2026.

Enquiries:

For any enquiries about the consultation please contact:

lgrconsultationresponse@communities.gov.uk

How to respond:

You may respond by completing the online survey.

If you are responding in writing, please make it clear which proposal you are responding to. You can email your response to the questions in this consultation to lgrconsultationresponse@communities.gov.uk

Alternatively written responses should be sent to:

LGR Consultation

Fry Building 2NE

Ministry of Housing, Communities and Local Government

2 Marsham Street

London

SW1P 4DF

When replying please include your name and indicate in which council area your home or organisation address is located:

We would also like you to confirm whether you are replying as a named consultee, submitting an official response on behalf of an organisation that is not on the list of named consultees, or replying as an individual.

Using the online survey

Ticking the Boxes

What to expect if you use the online survey

The same set of questions are asked of each of the five proposals. You do not have to respond to all five but it is unclear how a nil response will be treated.

Each question requires you to select, on a six point scale, how strongly you agree or disagree with the question, viz: strongly agree, somewhat agree, neither agree nor disagree, somewhat disagree, strongly disagree, don’t know.

The questions ask do you agree/disagree:

These questions are followed by a free text box to explain the answers you have provided to questions 1-7, referring to the question numbers as part of your answer. You may also use the box to provide any other comments you have on the proposal.

Proposals 3 to 5 involve boundary changes so each has an additional question followed by a free text box.

The additional question is: to what extent do you agree or disagree that the proposal sets out a strong public services and financial sustainability justification for boundary change?

Owl gets to the heart of each proposal

Five proposals have been submitted to the government and are subject to consultation. Here is Owl’s summary of each.

(A companion post explains how to take part in the consultation.)

No 1 Devon County Council proposal

Arguably the simplest, Plymouth and Torbay are left alone and a third “Devon Unitary” created to include all existing districts and Exeter city.

Points to note

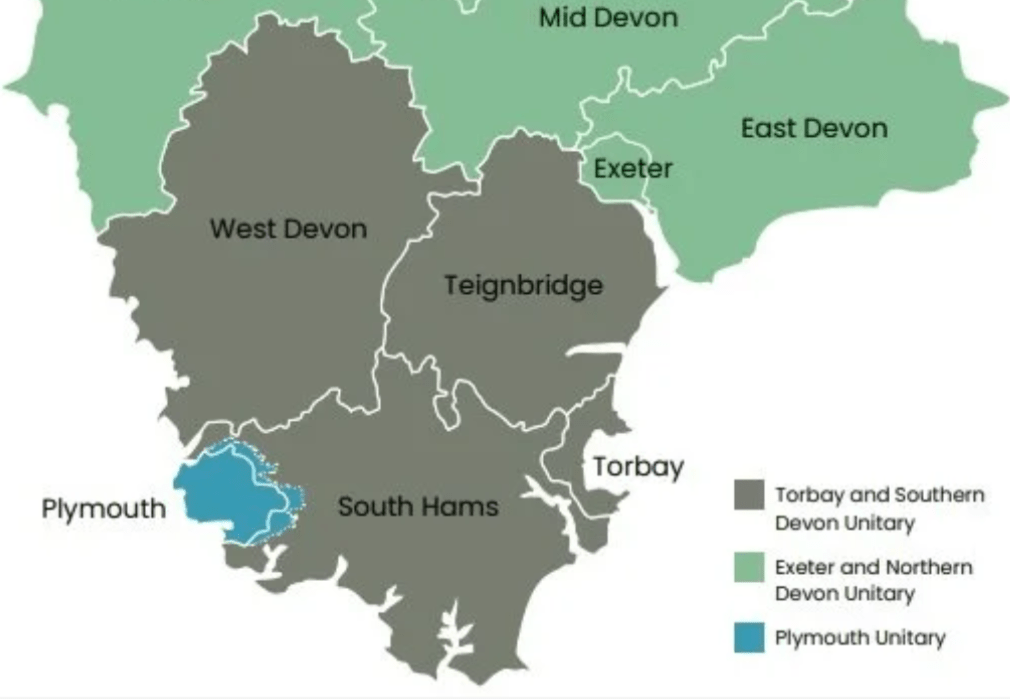

Nos 2 & 3 District council proposals

These two proposals are very similar, one is simply a minor tweak on the other. South Hams, Teignbridge and West Devon have broken away from the earlier consensus amongst district councils. The difference revolves around whether or not to make a modest increase in the size of Plymouth. The proposed expansion involves switching parts of four parishes, currently in South Hams but on the edge of Plymouth, to include them in what is called the “Plymouth Policy Area”. The purpose is to stop Plymouth expanding across the Dartmoor National Park boundary, maintaining clarity and coherence in planning authority responsibilities. See dotted line on map below:

This division amongst district councils illustrates just how divisive LGR has become. It would appear that only around 6,000 residents would be affected but it is obviously important to them.

Similar issues crop up in proposals 4 and 5.

The government really has stirred up a hornets’ nest.

Both proposals are derived from the very first 5:4:1 district proposals in which the geographic county is split into three unitary councils.

Points to note

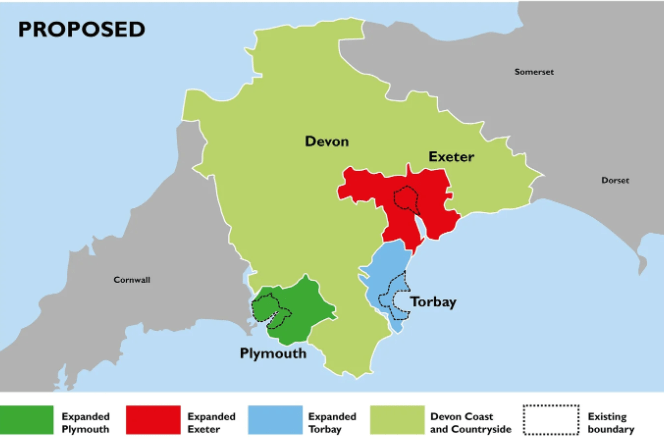

No 4 Exeter City Council and Plymouth City Council proposal

This is arguably the most radical proposal creating 4 unitaries, involving a lot of boundary changes. Three of these imply significant expansion of areas adjacent to Plymouth, Torbay and Exeter. These three areas would become compact “urban” unitaries with the rest of Devon lumped into a surrounding horseshoe of “Coast and Countryside”.

See the Proposal 4 map:

Points to note

No 5 Torbay’s proposal to be left alone

This insular proposal takes Exeter’s and Plymouth’s proposal (4 above) but says “no thank you” to the idea of adding 22 parishes to Torbay. Torbay proposes these parishes should be lobbed into the “Coast and Countryside” rump, making it an even greater nightmare to administer.

Points to note

You can find all the detailed cases made for each of these five proposals at: www.devonlgr.co.uk.

The Government “Mission Statement”

So it’s all about growth. It does nothing to address impending bankruptcy and the ballooning costs of social care and provision for children with special educational needs. More importantly the centralisation it seeks, reducing your access to councillors and making councils more remote, is the antithesis of what most people think devolution means. – Owl

“Our ambition is to simplify local government, ending the two-tier system and establishing new single-tier unitary councils that are responsible for all local government services in an area. Our vision is clear: stronger local councils in charge of all local services, equipped to drive economic growth, improve local public services, and lead and empower their communities.

Strong local government will help grow the economy and drive up living standards – the government’s number one mission. With one council in charge, we will see quicker decisions to grow our towns and cities and connect people to opportunity. Reorganisation will speed up house building, get vital infrastructure projects moving, and attract new investment – with more people able to buy their own homes and access high-quality local jobs.

New unitary councils must support wider devolution structures. Our ambition is that all of England can access devolved powers by establishing Strategic Authorities – groups of councils working together over areas that people recognise and live and work in – to make the key decisions over strategic scale and to drive economic growth. Strategic Authorities use their powers over housing, planning, transport, energy, skills, employment support and more to deliver growth and opportunity to communities across the country. In the Devon, Plymouth and Torbay area, the Devon and Torbay Combined County Authority is already established, this does not include Plymouth. “

“Council tax is regressive and it was never designed to fund something as complex as adult social care or children’s services,” – Councillor James Buczkowski (Liberal Democrat, Cullompton), the cabinet member for finance.

Is Local Government Reorganisation dealing with this sort of thing? – Owl

Devon’s largest council looks set to hike council tax by the most it is allowed to do as it faces rising costs for its most vital services and looks to bolster its reserves.

Bradley Gerrard, local democracy reporter www.radioexe.co.uk

Devon County Council’s cabinet approved the budget proposal that will see the council ask to increase council tax by 4.99 per cent, taking a Band D property’s bill to £1,891.

That includes a 2 percentage point increase for adult social care, the department that is the biggest draw on the council’s cash at more than £395 million out of its more than £839 million service budget for the forthcoming financial year.

The budget proposals, which include adding £18 million into the council’s reserves, now have to go before full council next week to be ratified.

Councillor James Buczkowski (Liberal Democrat, Cullompton), the cabinet member for finance, said the council was only spending what it was getting in through income, and was not using reserves or borrowing to fund its day-to-day spending.

But Cllr Buczkowski said while he welcomed the government’s three-year funding settlement, which gives councils like his more visibility, there was an increasing reliance on council tax.

“Council tax is regressive and it was never designed to fund something as complex as adult social care or children’s services,” he said.

“The pressure is national in nature and should not be loaded onto local residents.”

He added: “If we don’t increase council tax, then the funding gap would fall on service reductions and that’s unfair.”

Cllr Buczkowski said the government has claimed Devon’s so-called ‘core’ funding is rising, but that rise assumes councils increase council tax by the most amount they are allowed to, and collect 100 per cent of it, which it is believed no council achieves. He said increase in funding from government was only around £900,000.

He noted the proposal to increase council tax by 4.99 per cent was “not taken lightly”.

Cllr Buczkowski said the plan was to put £18 million into reserves to help bolster its rainy day fund, a pot that has dwindled in recent years. The council had £222 million of reserves in March 2021 but this fell to £125 million at March 2024 and remains at a similar level now.

Devon has recently had a major boost as part of a national announcement whereby the government will pay off 90 per cent of its overspend on special educational needs and disabilities (SEND).

That is due to hit around £221 million in April, but Devon is expected to have about £194 million of that paid off.

Cllr Buczkowski was keen to stress the cash was clearing a deficit, and so did not mean the council now has more money to spend.

He added that £41.7 million that the council had been keeping to one side as part of the Safety Valve agreement – an initial mechanism aimed at helping councils rid themselves of SEND overspends but which has now been scrapped – will be moved into another reserves pot.

It is likely some or all of this cash could be required to pay off the 10 per cent of its SEND overspend that Westminster isn’t covering.

Once again, adult social services and children’s services make up the lion’s share of the day-to-day spending at County Hall. The pair are set to cost more than £660 million in the 2026/27 financial year, nearly four-fifths of the service budget.

Some senior Liberal democrat county councillors have urged the government to postpone plans to reorganise Devon’s council system following the U-turn on local elections.

Tony Gussin/Bradley Gerrard,www.northdevongazette.

On Monday (February 16) the government announced it had abandoned plans to delay 30 council elections in England, with Exeter among them, following advice this could be unlawful.

Now some councillors in Devon are urging the government to also consider its local government reorganisation plans that would see district and county councils scrapped in favour of larger unitary authorities.

In North Devon and Torridge, the proposal submitted to the government would see the creation of a ‘super council’ combining East Devon, Mid Devon, North Devon, Torridge and Exeter.

The government is meant to make a decision by this July and provisional elections for the new councils have been pencilled in for May 2027.

The original reason given for postponing elections of existing councils this year, with Exeter the nearest locally, was because it was felt councils would not be able to run elections this year and deal with the requirements of the restructuring.

Now some of Devon’s most senior Liberal Democrats have called for the restructure process to be delayed, with an urge for the decision to be taken sooner rather than later.

Councillor Paul Arnott, the deputy Devon County Council leader and cabinet member for the restructure process, said: “My ask of the government is to have a look at how local government reorganisation LGR has gone for you since December 2024 when you decided not just to attempt devolution, which is already a failure, but to go for total local government reorganisation.

“It has gone catastrophically, so please now consider a postponement.”

He said the intended timetable – with the government’s decision on how Devon should be organised set for July and interim elections for those new councils in May 2027 – was “neither realistic or sustainable.”

He added: “So my message to the government is to courteously ask they postpone the process, but to do so now and not change their minds at the 11th hour, like they have just done with this year’s local elections.”

Councillor Julian Brazil, the leader of Devon County Council, welcomed the fact the local elections would now be on but expressed “dismay at what is going on in government.”

He said: “I think it is a sorry state of affairs when the government is descending from chaos to farce, and they will forever be known as the hokey cokey government – in then out.

“It’s quite chaotic.”

Reform UK nationally challenged the government over its decision to postpone the 30 local elections, but ministers this week climbed down from that position.

The move means 13 seats out of Exeter’s 39 will be up for grabs. Labour holds eight of the seats being contested.

David Reed MP pays tribute to those who contacted him about election cancellation

Eh? – Owl

David Reed MP, the Conservative member for Exmouth and Exeter East, said the initial decision to postpone the elections had “sparked significant concern locally”, with many voters contacting his office to say they were angry about losing their chance to vote.

“This is the right outcome,” Mr Reed said.

“Local people should never have their vote taken away, and I’m pleased that voters in Exeter will now get their say at the ballot box.

“I challenged ministers repeatedly to reverse this decision and allow these elections to go ahead, and I’m glad they have listened.

“The people of Exeter will now have the opportunity to vote, which is exactly how our democracy should work.”

Mr Reed also paid tribute to those who contacted his office during the period of uncertainty:

“This is a victory for everyone who wrote in, signed petitions, and spoke up,” he added.

“The strength of feeling across Exeter was clear. People care deeply about their democratic rights, and they were right to demand answers.”Extract from www.radioexe.co.uk

Exeter Observer’s view of the ON/OFF May election fiasco:

Secretary of State Steve Reed withdraws decision following legal advice in face of Reform UK High Court challenge, leaving city council leader Phil Bialyk facing electoral oblivion.

Monday 16 February 2026

Martin Redfern exeterobserver.org/

Exeter’s local elections are to go ahead as originally planned on Thursday 7 May after the government reversed their cancellation in the face of a High Court challenge brought by Reform UK.

Secretary of State Steve Reed has written to the leaders of the 30 affected councils – which were told their May elections would be cancelled three weeks ago – to tell them that he has instead “decided to withdraw his decision” following “recent legal advice”.

A High Court hearing had been due to take place on Thursday in response to a judicial review claim brought by Reform UK against Steve Reed’s decision. The government has now said it will pay Reform UK’s costs in bringing the claim.

Two-thirds of the affected local authorities – which Steve Reed had labelled “zombie councils” in an opinion piece for The Times just before cancelling their elections – are Labour-led.

Exeter City Council leader Phil Bialyk, who told last July’s city council meeting that he had no intention of asking to postpone democracy this year, then told January’s meeting that he would do so after all.

He subsequently sought to insist that the council would not be “suspending democracy” before green-lighting the elections cancellation the following day. He now claims that he welcomes the news the elections will go ahead.

The cancellation would have meant Labour retaining power in Exeter for two more years until the city council is dissolved in April 2028.

Eight Labour councillors, among them deputy leader Laura Wright, would have kept their seats in May instead of standing for re-election – and been paid £145,924 in allowances they would otherwise not have received had they lost their seats.

Phil Bialyk would also have carried on as council leader – a role in which he received more than £32,000 in allowances and expenses during 2024-25 – with the support of his local party.

Instead, now that the city council elections will take place as planned, Labour will have to defend these eight seats in May. As it currently has a majority of three, it has to win six or more of the thirteen seats which are up for election to stay in control of the council.

It looked very vulnerable in most of these seats before the elections were cancelled, after losing more than half of its support across Devon in the May 2025 county council elections and all the county hall seats it previously held in Exeter.

Its popularity had subsequently fallen further before it showed Exeter’s electors that it could not be trusted with democracy. Now it has to convince them that it can be trusted with their votes.

The Exeter Observer has written at length on the events and briefings leading up to the decision taken by the City Council to request cancellation of the May elections. (See above reference)

Here are extracts describing the briefing given to Councillors

….These “reasons” are followed by a table summarising “the costs and resources required to deliver a local election”.

This shows that while Exeter’s May 2026 elections might have cost around £265,000 to deliver, almost all the costs involved would have been for services provided not by council officers but by external venues, temporary staff, logistics contractors, printers and the postal service.

So what this section of the report shows is that running local elections actually limits the council’s in-house capacity – the criterion for cancellation specified by the minister and repeated by the council monitoring officer in the report – to the tune of half a dozen council employees, none of whom are senior directors, for a few weeks each year.

The list of anticipated reorganisation tasks that follows – apparently intended to exaggerate their extent – fails to mention either that their substantive progression depends on the government’s decision on what form Devon’s new unitaries will take, which is months away, or that the staff of all eleven existing Devon councils will bear the brunt of the work when it comes.

The aggrandising report instead reads as if Exeter City Council expects to deliver local government reorganisation across all of Devon – yet also admits that a meeting with MHCLG in which “expectations will be clarified” has not yet taken place.

It only touches on the adverse impact of cancelling the elections on local democracy once, when it says: “Postponing elections could result in residents feeling disenfranchised by not being able to vote”.

Rather than seeing this as a decisive reason not to cancel, the report instead considers it a “risk” which it says, incoherently, “should be mitigated by clear communication to residents outlining if that is the view to be expressed to government, the reasons for the postponement and identified savings to be repurposed [sic].”

The chief executive simply does not seem to grasp that Exeter’s electors won’t only be “feeling” disenfranchised when they cannot vote in May – they will actually be disenfranchised.

When the city council convened on Tuesday 13 January, no-one present could have been in any doubt about the meeting’s real purpose. Yet Labour council members had remarkably little to say about the report’s flimsy claims – although Ruth Williams said she found it “completely balanced and fair”…..

This is then followed by a detailed account of the meeting in a similar vein [an entertaining read – Owl]

It is now being widely reported that Steve Reed, Secretary of State for Housing, Communities and Local Government, would be making £63 millions available to local authorities undergoing reorganisation to fund the reinstated elections.

Prime Minister Keir Starmer has abandoned plans to postpone local elections for councils in May in yet another U-turn for the government. Source: Independent

Labour had initially announced plans to cancel elections in 30 areas this year, impacting 4.5 million people, in order to free up “capacity” to undertake an overhaul of council structures.

A Ministry of Housing, Communities and Local Government (MHCLG) spokesperson said: “Following legal advice, the Government has withdrawn its original decision to postpone 30 local elections in May.

“Providing certainty to councils about their local elections is now the most crucial thing and all local elections will now go ahead in May 2026.”

The news was welcomed by Reform UK leader Nigel Farage, who said “we took this Labour government to court and won.”