A 2020 report by the Committee on Climate Change, on which Hall sits as an expert on coastal erosion and flooding, found 1.2m homes at significant risk of flooding and a further 100,000 subject to coastal erosion by 2080 – which, although it sounds safely distant, will be within the lifetime of most of those born so far this century.

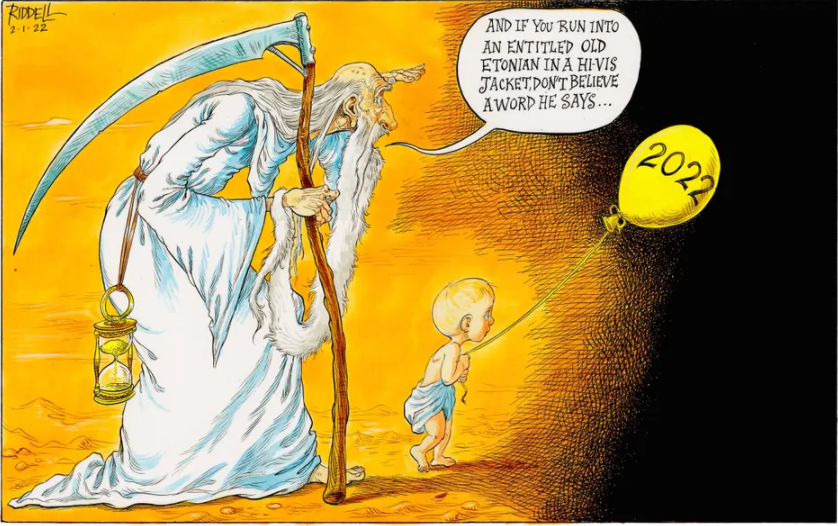

Look carefully at the graphic to see the little pink spots along the Devon and Cornwall coast and read on – Owl

Andrew Anthony www.theguardian.com

From a distance, the beach at Winterton-on-sea in Norfolk looks like the opening scene of Saving Private Ryan, with hundreds of grey bodies lying motionless across the sand. On closer inspection, it becomes clear they are not fallen soldiers but a huge colony of seals taken to the land for pupping season.

It’s an amazing annual sight that draws tourists and nature-lovers from across the country, but another process is taking place that is pushing people back – the growing threat of coastal erosion. Just along from where the armies of grey seals lay with their white pups, there used to stand the Dunes Cafe, a much-loved beach facility with a large and loyal clientele.

A year ago it was demolished to prevent its imminent collapse as a result of land lost to sea and storms. The ground where it stood is, like the cafe itself, no longer there. It’s a story of disappearance taking place all along the eastern coast of England, but particularly in East Anglia, that bulbous protrusion jutting into the North Sea.

That climate change and rising sea levels take their toll on the landscape is an old story, but one with an urgent new twist. “The sea level’s been rising since the last ice age, 20,000 years ago or so,” says Jim Hall, professor of climate and environmental risk at Oxford University’s Environmental Change Institute. “And it’s going faster. We’re probably not seeing its effect very much yet on the coast, though we will in the future.”

A 2020 report by the Committee on Climate Change, on which Hall sits as an expert on coastal erosion and flooding, found 1.2m homes at significant risk of flooding and a further 100,000 subject to coastal erosion by 2080 – which, although it sounds safely distant, will be within the lifetime of most of those born so far this century.

Two years ago, the US-based climate change research group Climate Central went further. It produced a map showing areas of the UK at risk of being underwater by 2050. They included sections of north Norfolk, all of the Lincolnshire coast and much of Cambridgeshire, along with parts of East Yorkshire, Merseyside and the Bristol area. According to the group, this would happen even if “moderate” attempts were made to combat climate change.

Such predictions are based on highly complex, and disputed, modelling, yet there are significant warning signs that such an outcome is growing rapidly more plausible. Last month, scientists monitoring the Thwaites Glacier in Antarctica, an ice shelf the size of Great Britain, warned it is in danger of collapse.

“It’s being melted from below by warm ocean waters, causing it to lose its grip on the underwater mountain,” said Peter Davis from British Antarctic Survey and the International Thwaites Glacier Collaboration.

He said research suggested that the ice shelf will begin to break apart within two decades. Should there be a complete collapse, it would lead to a highly consequential rise in sea levels of 60cm. That may be a worst-case scenario, but it will almost certainly have a notable impact on the British coastline.

In a sense Norfolk is a real-time lesson in how weather and sea can drastically alter a landscape. After the Dunes Cafe was dismantled, a chef called Alex Clare set up a mobile silver Airstream cafe to cater to locals and visitors at the car park next to where the cafe once stood. He’s had to move the Airstream four times in eight months, as sections of the dunes on which the car park sits have collapsed into the sea under pressure from storms and high tides.

“In the last two weeks,” Clare told me, “a strip about as long as this caravan has disappeared. You hear about erosion, but you don’t know what it means, what it involves, until you witness it. And it’s a shock to see the physical transformation.”

The car park owner has tried to slow the erosion by laying down large concrete blocks on the beach, but it’s the definition of a losing battle.

Winterton’s coast possesses a bleak beauty, enhanced by the fact that the village sits back from the sea, behind a broad wall of dunes. By contrast, at Hemsby, a mile or so south, the town, with its amusement arcades and fairgrounds, stretches all the way to the shoreline. Four years ago, there was a line of seven chalets close to the edge of the sandy cliffs that drop down to the beach.

They all had to be knocked down as the land beneath them began to fall into the sea. The local council is looking at sea defences, but the only workable answer involves large-scale investment and a major process of sandscaping. That is what took place at Bacton, 15 miles north along the coast from Winterton.

A four-mile-long dune was built to protect Bacton Terminal, which supplies around a third of the UK’s gas and had been moving steadily closer to the cliff edge, literally and metaphorically. Designed by the Dutch engineering company Royal HaskoningDHV, it involved the placement of 1.8 million cubic metres of sand along the beaches near the terminal.

The design relies on the sand being shifted into place by wind, waves and tides. The Dutch are world leaders in land reclamation and protection, having over the years reclaimed more than a sixth of Holland’s landmass from the sea.

“In the long run,” says Professor Hall, “any coast protection is temporary. We’ve been doing engineering to protect the coast for a very long time. Almost half of the UK coast has some kind of protection – sea walls, revetments, promenades, that kind of thing. The Victorians were inveterate promenade builders.”

Such protections don’t stop the sea rising. They merely fix, for a while, the point of the shore profile. At Happisburgh, near Bacton, wooden revetments did that job, until they collapsed 20 years ago, leading to a sudden and damaging exposure to the sea.

“Once you lose [the protection], there’s a lot of pent-up erosion capacity,” says Hall.

Although there is growing media coverage of coastal erosion, it’s as Alex Clare said: knowledge of the thing isn’t the same as experiencing it. “There’s a bit more recognition that the sea level is rising fast,” says Hall. “But I don’t think coastal communities have really understood what the future holds.” He believes there should be an “honest conversation” between government, local government and the affected communities.

While the money required to protect cities like London and Hull will have to be found, that’s not likely with isolated villages. When I visited Norfolk last month, the locals seemed fatalistic or in denial, pointing out that the situation was worse somewhere else, either up or down the coast. As I drove back, it began to rain, and that night the weather deteriorated. The next day there was a large landslide at Mundesley, near Bacton, with a huge chunk of the cliff face collapsing on to the beach. Above it, houses stood on the precipice, their future looking about as secure as Norwich’s position in the Premier League.

As Pete Revell, station manager at Bacton HM Coastguard, said, Mundesley was viewed as stable by comparison with nearby Happisburgh, and the landslide came as “a bit of a surprise”. It certainly shocked local resident Antony Lloyd, who said he was “very nervous and agitated about any further incidents.” He was finding it hard to sleep and thought he would have to move.

Of course, the occasional landfall or loss of beachside chalets is hardly cause for national panic. But like canaries in a coal mine, the inhabitants of the villages strung along Norfolk’s shifting coastline are a warning of a worrying future. There are processes under way whose outcomes are unavoidable, and those that can potentially be arrested. But it will require unblinking foresight and long-term action, neither of which are our national strong suits.

If you take the path north from Winterton’s beach car park you come to the roped-off seal sanctuary. Beyond, seals and their pups lie still and vulnerable in the dunes, hundreds of yards from the shore, as if waiting for the sea to rescue them. And come it will, not now or next year, but much sooner than we care to think.

2 Primley Gardens Sidmouth EX10 9LERef. No: 21/3309/FUL | Validated: Tue 21 Dec 2021 | Status: Awaiting decision

2 Primley Gardens Sidmouth EX10 9LERef. No: 21/3309/FUL | Validated: Tue 21 Dec 2021 | Status: Awaiting decision