- Roofing over silage clamp phase 2

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1092/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1092/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Roofing over silage clamp

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1091/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1091/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Roofing over existing silage clamp phase 3

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1093/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Lower Woodbeare Farm Kentisbeare Devon EX15 2DDRef. No: 23/1093/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - The removal of a conservatory and the erection of a single storey rear and side extension

4 Summerfield Woodbury Devon EX5 1JFRef. No: 23/1094/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

4 Summerfield Woodbury Devon EX5 1JFRef. No: 23/1094/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - T1: Oak – trimming of elements fouling existing overhead cable (Telecom). Tree branches are resting on cable and distorting/ putting pressure on cable. Trimming to be carried out to releive pressure on cable with 0.5m clearance around cable.

115 St Johns Road Exmouth Devon EX8 4EHRef. No: 23/1085/TRE | Validated: Fri 19 May 2023 | Status: Awaiting decision

115 St Johns Road Exmouth Devon EX8 4EHRef. No: 23/1085/TRE | Validated: Fri 19 May 2023 | Status: Awaiting decision - Change of use of 2 buildings to 2 residential dwellings and the installation of windows and doors. The demolition of 2 separate buildings.

Halls Farm Feniton Devon EX14 3EURef. No: 23/1084/PDQ | Validated: Thu 18 May 2023 | Status: Awaiting decision

Halls Farm Feniton Devon EX14 3EURef. No: 23/1084/PDQ | Validated: Thu 18 May 2023 | Status: Awaiting decision - T1, Holm Oak : crown lift over garage by removing first 4 secondary branches from limb over roof.

Fairleigh Manor Road Sidmouth Devon EX10 8RRRef. No: 23/1082/TRE | Validated: Thu 18 May 2023 | Status: Awaiting decision

Fairleigh Manor Road Sidmouth Devon EX10 8RRRef. No: 23/1082/TRE | Validated: Thu 18 May 2023 | Status: Awaiting decision - Outline application for the conversion of a redundant agricultural chicken shed to one dwelling

Hillview Awliscombe EX14 3PHRef. No: 23/1071/OUT | Validated: Wed 17 May 2023 | Status: Awaiting decision

Hillview Awliscombe EX14 3PHRef. No: 23/1071/OUT | Validated: Wed 17 May 2023 | Status: Awaiting decision - Proposed single storey rear extension, extend and raise existing terrace with railing.

101 Higher Woolbrook Park Sidmouth EX10 9EDRef. No: 23/1076/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

101 Higher Woolbrook Park Sidmouth EX10 9EDRef. No: 23/1076/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Certificate of Lawful Development for Existing use as single dwelling

The Old Clyst Valley Pumping Station Exmouth Road Clyst St Mary Devon EX5 1ATRef. No: 23/1077/CPE | Validated: Wed 17 May 2023 | Status: Awaiting decision

The Old Clyst Valley Pumping Station Exmouth Road Clyst St Mary Devon EX5 1ATRef. No: 23/1077/CPE | Validated: Wed 17 May 2023 | Status: Awaiting decision - Construction of loft conversion and raising of roof.

28 Oak Close Ottery St Mary Devon EX11 1BBRef. No: 23/1073/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision

28 Oak Close Ottery St Mary Devon EX11 1BBRef. No: 23/1073/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision - Single storey side extension and demolition of existing garage.

2 Glebe Close Exmouth EX8 2QURef. No: 23/1068/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision

2 Glebe Close Exmouth EX8 2QURef. No: 23/1068/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision - Variation of S106 agreement relating to provision and management of ecology area on application 14/0088/FUL (Construction of a new country house) to reduce the area of land covered by the agreement and agree changes to the management of it.

Oat Errish Farm Membury Axminster EX13 7TZRef. No: 23/1078/V106 | Validated: Thu 18 May 2023 | Status: Awaiting decision

Oat Errish Farm Membury Axminster EX13 7TZRef. No: 23/1078/V106 | Validated: Thu 18 May 2023 | Status: Awaiting decision - Single storey side/rear extension.

11A Ascerton Close Sidmouth EX10 9BSRef. No: 23/1062/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision

11A Ascerton Close Sidmouth EX10 9BSRef. No: 23/1062/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision - Construction of road to allow access to fields when ground is very wet

The Meade Sanctuary Lane Woodbury Exeter EX5 1EXRef. No: 23/1052/AGR | Validated: Mon 15 May 2023 | Status: Awaiting decision

The Meade Sanctuary Lane Woodbury Exeter EX5 1EXRef. No: 23/1052/AGR | Validated: Mon 15 May 2023 | Status: Awaiting decision - Installation of vents and flues on north, west and east elevations, removal of window on north elevation.

Unit B Weston Park Devonshire Road Heathpark Industrial Estate HonitonRef. No: 23/1056/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Unit B Weston Park Devonshire Road Heathpark Industrial Estate HonitonRef. No: 23/1056/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Construction of agricultural storage building.

Land East Of Little Ash Cottages Fenny BridgesRef. No: 23/1046/FUL | Validated: Mon 15 May 2023 | Status: Awaiting decision

Land East Of Little Ash Cottages Fenny BridgesRef. No: 23/1046/FUL | Validated: Mon 15 May 2023 | Status: Awaiting decision - Proposed alterations to existing boundary wall and reinstatement of railings to boundary.

Myrtle Cottage Clyst St Mary EX5 1BBRef. No: 23/1055/LBC | Validated: Wed 17 May 2023 | Status: Awaiting decision

Myrtle Cottage Clyst St Mary EX5 1BBRef. No: 23/1055/LBC | Validated: Wed 17 May 2023 | Status: Awaiting decision - Proposed alterations to existing boundary wall and reinstatement of railings to boundary.

Myrtle Cottage Clyst St Mary EX5 1BBRef. No: 23/1054/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision

Myrtle Cottage Clyst St Mary EX5 1BBRef. No: 23/1054/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision - Single storey side/rear extension, involving demolition of conservatory and chimneystack on the side of the existing two-storey extension.

Old School House Cotleigh Devon EX14 9HJRef. No: 23/1044/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision

Old School House Cotleigh Devon EX14 9HJRef. No: 23/1044/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision - Listed building consent for Single storey side/rear extension, involving demolition of conservatory and chimneystack on the side of the existing two-storey extension.

Old School House Cotleigh Devon EX14 9HJRef. No: 23/1045/LBC | Validated: Wed 17 May 2023 | Status: Awaiting decision

Old School House Cotleigh Devon EX14 9HJRef. No: 23/1045/LBC | Validated: Wed 17 May 2023 | Status: Awaiting decision - Proposed steel framed agricultural building.

Hitts Farm Whimple Devon EX5 2NYRef. No: 23/1035/AGR | Validated: Wed 17 May 2023 | Status: Awaiting decision

Hitts Farm Whimple Devon EX5 2NYRef. No: 23/1035/AGR | Validated: Wed 17 May 2023 | Status: Awaiting decision - Proposed galvanized steel framed agricultural building

Hitts Farm Whimple Devon EX5 2NYRef. No: 23/1033/AGR | Validated: Wed 17 May 2023 | Status: Awaiting decision

Hitts Farm Whimple Devon EX5 2NYRef. No: 23/1033/AGR | Validated: Wed 17 May 2023 | Status: Awaiting decision - T1 Oak – Remove T2 Field Maple – Remove T3 Oak – Remove

15 Honey Ditches Drive Seaton Devon EX12 2NURef. No: 23/1036/TRE | Validated: Mon 15 May 2023 | Status: Awaiting decision

15 Honey Ditches Drive Seaton Devon EX12 2NURef. No: 23/1036/TRE | Validated: Mon 15 May 2023 | Status: Awaiting decision - T1, birch – dismantle and fell.

Broad Oak Lodge Ford Lane West Hill Devon EX11 1XERef. No: 23/1022/TRE | Validated: Mon 15 May 2023 | Status: Awaiting decision

Broad Oak Lodge Ford Lane West Hill Devon EX11 1XERef. No: 23/1022/TRE | Validated: Mon 15 May 2023 | Status: Awaiting decision - T1: Red Oak – dismantle to the ground.

St Nicholas Church DunkeswellRef. No: 23/1025/TCA | Validated: Mon 15 May 2023 | Status: Awaiting decision

St Nicholas Church DunkeswellRef. No: 23/1025/TCA | Validated: Mon 15 May 2023 | Status: Awaiting decision - Excavation for parking/pull in area along front boundary

8 Broadpark Sandy Lane Brampford Speke Devon EX5 5HPRef. No: 23/1021/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision

8 Broadpark Sandy Lane Brampford Speke Devon EX5 5HPRef. No: 23/1021/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision - Variagated Holly: dismantle to the ground.

Flat 8 1 Seagull House Morton Crescent Exmouth EX8 1BERef. No: 23/1026/TCA | Validated: Mon 15 May 2023 | Status: Awaiting decision

Flat 8 1 Seagull House Morton Crescent Exmouth EX8 1BERef. No: 23/1026/TCA | Validated: Mon 15 May 2023 | Status: Awaiting decision - Proposed single storey side extension

Fields Afar Sidmouth Road Rousdon DT7 3RDRef. No: 23/1024/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision

Fields Afar Sidmouth Road Rousdon DT7 3RDRef. No: 23/1024/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision - Proposed 2 storey side extension, single storey garage to rear.

High Barn Ottery St Mary Devon EX11 1PJRef. No: 23/1013/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision

High Barn Ottery St Mary Devon EX11 1PJRef. No: 23/1013/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision - Installation of a vinyl mounted sign on the front of the Crows Nest at the top of the building

Port Royal Club The Esplanade Sidmouth Devon EX10 8BGRef. No: 23/1015/ADV | Validated: Fri 19 May 2023 | Status: Awaiting decision

Port Royal Club The Esplanade Sidmouth Devon EX10 8BGRef. No: 23/1015/ADV | Validated: Fri 19 May 2023 | Status: Awaiting decision - Construction of 4 no. 2 bed apartments, 2 no. 1 bed apartments and 1 no. 2 bed dwelling with associated hard and soft landscaping, retaining wall and engineering works, access and parking

Land Adjacent Regis House Lyme Road Uplyme Devon DT7 3TJRef. No: 23/1004/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision

Land Adjacent Regis House Lyme Road Uplyme Devon DT7 3TJRef. No: 23/1004/FUL | Validated: Thu 18 May 2023 | Status: Awaiting decision - Certificate of Lawful development for proposed replacement of lime render on west elevation.1 Sid Bank Sid Lane Sidmouth EX10 9AWRef. No: 23/0989/CPL | Validated: Mon 15 May 2023 | Status: Withdrawn

- Removal of existing conservatory, replace with new single storey extension with first floor balcony

Lyndhayne House Woodbury Salterton EX5 1PYRef. No: 23/0974/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision

Lyndhayne House Woodbury Salterton EX5 1PYRef. No: 23/0974/FUL | Validated: Wed 17 May 2023 | Status: Awaiting decision - The development of a battery energy storage system, connected to the National Grid, along with associated works including drainage, access and landscaping.

Land At Saundercroft Farm WhimpleRef. No: 23/0962/MFUL | Validated: Thu 18 May 2023 | Status: Awaiting decision

Land At Saundercroft Farm WhimpleRef. No: 23/0962/MFUL | Validated: Thu 18 May 2023 | Status: Awaiting decision - Erection of a barn

Quercus Fields Cooks Lane AxminsterRef. No: 23/0873/AGR | Validated: Thu 18 May 2023 | Status: Awaiting decision

Quercus Fields Cooks Lane AxminsterRef. No: 23/0873/AGR | Validated: Thu 18 May 2023 | Status: Awaiting decision - Proposed replacement of the existing No. 2 mobile caravans with No. 1 wooden chalet and associated scheme of soft landscaping

Land South Of Lockseys Lane Branscombe EX12 3BXRef. No: 23/0853/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision

Land South Of Lockseys Lane Branscombe EX12 3BXRef. No: 23/0853/FUL | Validated: Tue 16 May 2023 | Status: Awaiting decision - Installation of new tarmac entrance, layout changes, vehicle barriers and alterations to boundary treatments.

Bicton Common Yettington Model Airfield Carpark, Grid Ref SY 03771 86378Ref. No: 23/0851/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Bicton Common Yettington Model Airfield Carpark, Grid Ref SY 03771 86378Ref. No: 23/0851/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Proposed single storey side extension.

The Applegarth Chardstock Devon EX13 7BTRef. No: 23/0828/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

The Applegarth Chardstock Devon EX13 7BTRef. No: 23/0828/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Proposed new dwelling and removal of existing garage and formation of new car standing space

Wymcot Church Road Whimple Devon EX5 2TARef. No: 23/0804/FUL | Validated: Mon 15 May 2023 | Status: Awaiting decision

Wymcot Church Road Whimple Devon EX5 2TARef. No: 23/0804/FUL | Validated: Mon 15 May 2023 | Status: Awaiting decision - Retrospective application for the retention of a summerhouse/ field store.

Wishes Broadhembury EX14 3LNRef. No: 23/0681/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision

Wishes Broadhembury EX14 3LNRef. No: 23/0681/FUL | Validated: Fri 19 May 2023 | Status: Awaiting decision - Remedial/re-roofing works to the existing pitched and flat roof coverings including ancillary works to flashings.

Thorndon House Rewe Exeter EX5 4EURef. No: 23/0572/LBC | Validated: Tue 16 May 2023 | Status: Awaiting decision

Thorndon House Rewe Exeter EX5 4EURef. No: 23/0572/LBC | Validated: Tue 16 May 2023 | Status: Awaiting decision

Daily Archives: 29 May 2023

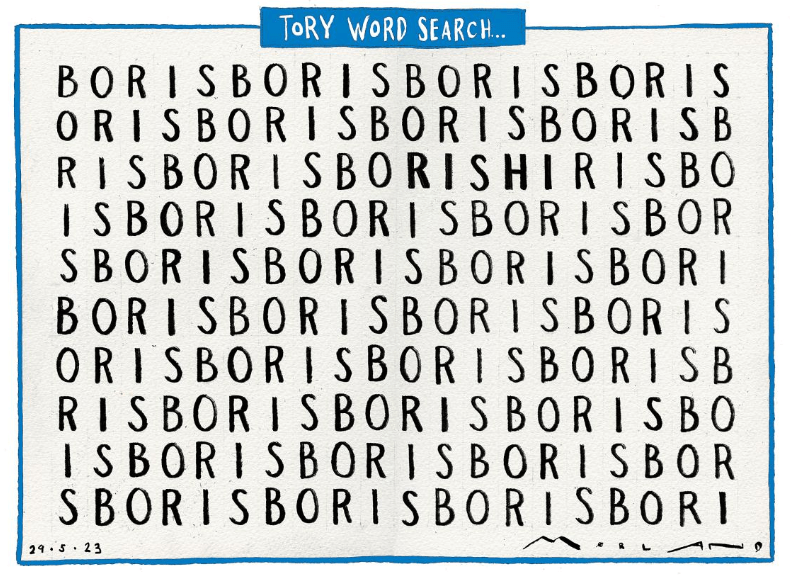

Revealed: Top Tory word search!

2% tax on UK rich list families ‘could raise £22bn a year’

Similar wealth taxes in Norway, Spain and Switzerland had helped to reduce inequality and eased the cost of living crisis for some of the poorest people in those countries.

Won’t happen because guess who is on the list? – Owl

Rupert Neate www.theguardian.com

A modest wealth tax on the richest 350 families in the UK could raise more than £20bn a year – enough to fund the construction of 145,000 new affordable homes a year – according to research by fairer taxation campaigners.

A 2% tax on assets above £10m held by all members of the Sunday Times rich list could raise as much as £22bn, according to analysis by Tax Justice UK, the Economic Change Unit and the New Economics Foundation (NEF).

The campaigners said similar wealth taxes in Norway, Spain and Switzerland had helped to reduce inequality and eased the cost of living crisis for some of the poorest people in those countries. They called on the government to carry out urgent reform of the “fundamental unfairness in the tax system which means that income from work is taxed more than income from investments, rent and inheritances”.

Lukasz Krebel, economist at NEF thinktank, said: “This year’s rich list shows that at a time when so many of us are struggling with the cost of living, the very wealthiest in society continue to thrive.

“Yet this elite group aren’t taxed as much as those of us who earn our living, leaving us with less money to invest in hospitals, schools and parks. We can share the wealth that we all create by increasing taxes on the very rich. By doing this, we can repair our public services, power our future with locally made energy from the wind and sun, and create jobs and thriving neighbourhoods for all of our families.”

The richest 250 families in the UK are sitting on combined wealth of £748bn, according to the annual Sunday Times rich list published last week, an increase from £704bn the previous year.

Those on the rich list include the prime minister Rishi Sunak and wife Akshata Murty at number 275 out of 350, with £529m, and the 32-year-old Duke of Westminster, with £9.9bn, at number 11.

The campaigners pointed out that less than a quarter of the 100 wealthiest people on the Sunday Times rich list appear in the same publication’s annual tax list celebrating those who pay the most tax.

“Because assets are generally taxed at a lower rate than income, many of the wealthiest people in the UK are likely to be paying a relatively low tax rate,” the campaigners said. “However, it should be noted that some on the list with ‘non-domicile’ status or who are fully based offshore for tax purposes may not be paying UK tax on all earnings.”

Robert Palmer, executive director of Tax Justice UK, said: “The growing wealth of those on the rich list highlights the inequality in our tax system, where those who are already wealthy from investments, rent and inheritances are taxed relatively lightly compared to those who get their income from work. It can’t be right that many working people are paying a higher effective tax rate than some of the very wealthiest in our society, especially when we are seeing falling living standards and increasing bills for the majority.

“The government must urgently bring forward reforms to fix our broken tax system, bringing in higher taxes on wealth, so that those who earn the most, and own the most, pay their proper share.”

The number of UK billionaires has increased sharply since the pandemic, from 147 in 2020 to 171 this year, with billionaires now holding about £4bn on average each. There were 15 UK billionaires when the Sunday Times first published its rich list in 1990.

In 2021, the independent Wealth Tax Commission recommended that the government introduced a one-off 1% wealth tax on households with more than £1m, which they said would generate £260bn, more than enough to cover a year’s funding of the NHS and social care spending.

A Treasury spokesperson said: “The UK’s taxes on wealth are on par with other G7 countries and our progressive system means that the top 5% of income tax payers pay half of all income tax, with millions lifted out of paying it altogether.

“We have already built more than half a million affordable homes since 2010 and our £11.5bn affordable homes programme will deliver thousands more right across the country.”

The economy is very sick, thanks to Tory policies and the hangover from Liz Truss

Rishi Sunak has been warned the UK economy could be in recession next year as stubbornly high inflation pushes interest rates to more than 5% before the next general election.

This editorial spells out just how bad things are, (more detail here). – Owl

The Observer view on Britain’s economy: it is very sick, but there are remedies

Observer editorial www.theguardian.com

It has been a week of bad economic news. The latest data from the Office for National Statistics confirmed that inflation has fallen in the UK, but to 8.7%, slightly higher than had been predicted. This triggered a strong reaction in the bond markets, pushing up the cost of government borrowing to almost the same as it was in the wake of Kwasi Kwarteng’s mini-budget that tanked the markets last September.

It is a sobering reminder of the lasting legacy of Liz Truss’s brief premiership. In just 49 days, she and her chancellor undermined long-term investor confidence to the extent that the UK government, once able to borrow at interest rates of almost zero, now faces some of the highest borrowing costs of developed nations, with these costs liable to rise even further as a result of only moderately bad economic news. It means that for the first time in decades, the UK is subject to the same sorts of external market pressures on its investment, tax and spending decisions as much less affluent economies.

The British economy has been subject to the same shocks as others around the world such as the pandemic and the impact of the Ukraine war on energy and food prices. But the UK has fared far worse than its competitors as a result of long-term structural weaknesses and terrible political choices.

The UK was too reliant on financial services to drive its buoyant growth in the 2000s, creating significant regional inequality between London and the south-east, and the rest of the country. This growth masked low productivity in other sectors and an economy too dependent on consumer spending, fuelled by personal debt secured against a housing price bubble, with not enough business investment and spending on skills. These weaknesses were exposed by the world financial crisis of 2008, but instead of trying to redress these imbalances the Conservatives have made the UK’s structural issues even worse.

This is the product of their austerity policies – deep cuts to the welfare safety net, public services and national infrastructure that have not only caused immense hardship in the here and now, but have damaged the long-term productive capacity of the economy. This is evident, for example, in the skills shortages, and in the fact that the pandemic appears to have had a much bigger impact on labour participation rates as a result of people leaving employment due to long-term sickness than in other countries. The UK’s participation rate in the workforce is below where it was before the pandemic, adding to inflationary pressures.

Austerity has been made worse by the hard Brexit pursued by Boris Johnson and other Tory Eurosceptics. By sharply increasing barriers to trade, Brexit has made it more difficult for British companies to grow through exporting and has had a significant depressive effect on growth. It, too, has added to inflation, one study by the London School of Economics suggests that as a direct result of Brexit, British households have collectively spent £7bn more on their food bills than they would have otherwise done since December 2019. All this means that Britain is suffering from the second worst productivity growth in the G7. The impact of these appalling economic decisions will not dissipate when the Conservatives leave office. They will continue to affect the British economy in the long term and will take a new government years to address.

Should Labour win the next election, its shadow chancellor Rachel Reeves will face an unenviable economic inheritance. Unlike in 1997, when the economy and tax receipts were booming, Labour’s overriding focus will have to be how to restore the economy to a healthier growth trajectory in order to fund the expansion of public services and the welfare state the country so desperately needs. That will be a huge task, requiring an ambitious industrial and skills policy. Reeves set out the emerging detail of her approach in a speech in Washington last week. She was reassuringly sober about the scale of the challenge. Labour would pursue an active industrial policy, centred on a £28bn-a-year capital investment programme in greening the economy, and expanding affordable childcare and skills provision to get more people into work.

Improving the productive capacity of the economy from the laggard starting point left by a combination of austerity, Brexit and Truss’s abandoned tax cuts will not be easy. Much will depend on the detail of policy: on exactly how capital investment and extra money for skills will be spent; it is easier to spend money badly than well, and its impact on growth will be a matter of robust policy design. But Reeves is showing how much more she has to offer than the slash-and-burn approach of Truss and Kwarteng, or the acceptance of painfully high interest rates in the absence of any other plan we have seen from Rishi Sunak and Jeremy Hunt.

Britain urgently needs a period of economic renewal, and only a Labour government can deliver that.

Council leader under fire over scrutiny leads

Torbay council “appear to want to mark their own homework’”

[Torbay council political composition: Conservatives 19, LibDemes 15, Independents 2.]

Torbay Council’s new Conservative administration has come under fire from its opponents for turning the council into a “one-party state” by appointing its own members to key positions.

Guy Henderson, local democracy reporter www.radioexe.co.uk

But the Conservatives insist they are committed to engaging with the whole council and have chosen the right people for the job.

At an adjourned meeting of the full council on Friday the majority Tory party put forward its proposals for ‘scrutiny leads’ to oversee council policy in a number of key areas. Apart from one experienced Liberal Democrat councillor responsible for children’s services, the party chose four newly-elected Conservative councillors for the other key jobs.

Cllr Cordelia Law (Lib Dem, Tormohun) has the portfolio for children’s services. She said she was “extremely disappointed and saddened” at her colleague’s rejection, and said the appointments went against prime minister Rishi Sunak’s advice. She added: “They appear to want to mark their own homework using inexperienced teachers.

“This administration has not only chosen to put forward all new and inexperienced councillors, but also take the majority of lead positions on the council and give them to those new and inexperienced councillors.”

Cllr Swithin Long (Lib Dem, Barton with Watcombe) said it was traditional for the key roles to be shared more equally among parties and, he added: “Torbay Council is not a one-party state, and an impartial view would determine that these seats are shared out more equally.”

And former council leader Cllr Steve Darling (Lib Dem, Barton with Watcombe) went on: “Having the confidence that you can be held up to scrutiny results in better outcomes for your community. Choosing to exclude other members from that is not a good look.”

But council leader David Thomas (Con, Preston) insisted: “We are looking to work constructively and engaging across the whole council.”