The latest figures show that there are now 220,000 more people waiting for treatment than when Rishi Sunak made cutting waiting lists one of his five priorities!

(Ben Zaranko, Senior Research Economist, Institute for Fiscal Studies.)

The latest figures show that there are now 220,000 more people waiting for treatment than when Rishi Sunak made cutting waiting lists one of his five priorities!

(Ben Zaranko, Senior Research Economist, Institute for Fiscal Studies.)

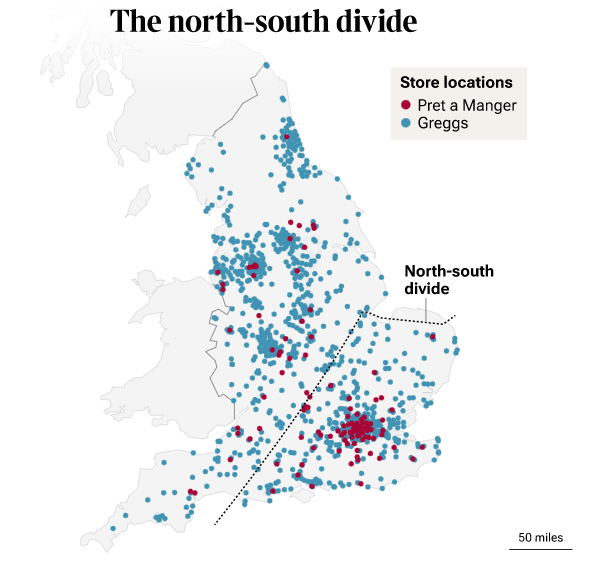

[Makes us, in the SW peninsula, “northerners”]

Or should it be where Morrisons meets Waitrose?

[Categorising us as “southerners”]

This tongue-in-cheek analysis aims to highlight more serious factors highlighting the North-South divide, such as life expectancy, education, and poverty.

(See original article: a Machine Learning analysis of consumer habits as a metric for the socio-economic North-South divide in England) – Owl

Some say it’s the Watford Gap services, some say it’s the Severn-Wash line — but isn’t the true marker of arrival in the north the moment you reach a place where you can’t get a smashed avocado and roasted pepper baguette but can get an impressive variety of sausage rolls?

Tom Whipple www.thetimes.co.uk

That is the contention of mathematicians, who have calculated the location where the writ of poncey southern Pret a Manger sandwiches ends and the rule of honest northern Greggs pies begins — and they have declared it the north-south divide.

And, lest the analysis seems flimsy, they have strengthened it by augmenting it with a separate set of strongly correlated data: the Waitrose-Morrisons Index.

As far as Sophie Maclean, from King’s College London, is concerned, this study ends a discussion that arguably began with William the Conqueror, who noticed that the residents in the north of his kingdom were more unruly and, “In mad fury . . . descended on the English of the north like a raging lion.”

Which were these recalcitrant northerners who resisted the raging lion? Where was their unruly land? “There’s a lot of debate but thankfully mathematicians have worked this out,” said Maclean, speaking at the Cheltenham Science Festival. “Really there is only one way to judge what’s north and what’s south and that is by looking at the distribution of Pret and Greggs.”

The analysis, published in the preprint journal ArXiv, used machine learning to define the optimal north-south boundary, seeking to divide the country in two according to the ratio of Prets to Greggs and, separately, Waitroses to Morrisons. Then, researchers combined the two.

This produced a line that cut off the top of Norfolk and all of Cornwall and Bristol, decreeing these traditionally southern regions spiritually and culinarily northern.

Part of this may be explained by the metric failing in the west country. While most of the country has a preponderance of one of the fast-food chains or another, Cornwall is low on Prets, possibly on socioeconomic grounds, but also resists Greggs, on grounds of pasty-purism.

Less controversially, further east the line confirmed conventional intuition — passing close to the Watford Gap.

Dr Robin Smith, from Sheffield Hallam University, led the study, adapting machine-learning techniques normally used to look at nuclear reactions. He said that in an inevitably subjective area, this analysis was as good as any. “The food we eat is a very good indicator of whether someone is northern or southern. Greggs is very popular in the north, where people do seem to prefer a steak bake.”

The new definition will nevertheless provoke some disquiet, possibly vigorously so. Cheltenham residents, for instance, who like little better than meeting on a Saturday morning in Waitrose to pick up “essential” parmigiano reggiano, might at the very least argue the case they are an exclave of the south.

Maclean conceded there would always be anomalies, but then the same goes for any other measure. There was even sometimes a pathos to the data, where you can see the anomalies in action — for instance in the few individuals trying to eke out a sophisticated culinary lifestyle amid the pastry-based wastelands of the north.

“You could imagine the single Pret in Newcastle surrounded by a swarm of Greggs,” she said. Whereas, she added, “In London, they say you’re never more than 6m from a rat, or a Pret.”

How long this might still be the case, though, is unclear. Smith said there were signs the usefulness of the metric might change. Already, Greggs has begun a southern invasion, with an appeal to more liberal metropolitan tastes. “Since Greggs produced the vegan sausage roll, it has become more popular in the south, so this might not be a marker of northernness for that much longer.”

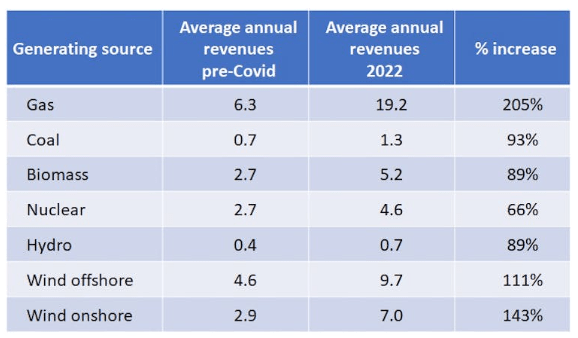

Twenty-nine billion pounds is a lot of money. It’s how much we estimate the total annual revenue to British electricity generating stations increased as a result of last year’s energy crisis – from £20.5 billion before COVID (in 2018 and 2019) to £49.5 billion in 2022. The indications are that these revenues increased by about twice as much as overall generation costs.

Serguey Maximov Gajardo theconversation.com

Getting at the numbers is not easy. Britain has a competitive market for “wholesale” electricity, the bulk electricity sold by major generating companies from fossil fuel (overwhelmingly gas), nuclear and renewable energy power stations.

The price is set in an auction between the electricity consumers (large industries or electricity suppliers that purchase electricity for their clients) and its generators. Consumers submit the demand they are expecting during the next day, and generators offer a block of electricity to meet this demand for a certain price. The price in this “day-ahead” market reflects the cost of the highest-priced block needed to match demand.

Renewables and nuclear plants are relatively cheap to operate. But fossil fuels, although more expensive, are still required to meet demand nearly all the time. This means that gas largely sets the day-ahead price, with a margin. In 2021, the electricity price followed gas prices 98% of the time in Britain, despite gas generating only 40% of the country’s electricity.

But this is just the beginning of the pricing complexities. In practice, much gas and electricity is traded through forward contracts. Your electricity suppliers need to know they can buy the electricity their customers will demand, so they “buy forward” from generators on contracts ranging from months to more than a year ahead – usually at prices reflecting conditions at the time of contracting.

On purely day-ahead prices, the total revenue in 2022 would have soared by almost £40 billion. Our best estimate of forward-contract structures brings this down to the £29 billion indicated for last year.

However, this likely means some of the huge day-ahead prices in 2022 have been shifted forward into this year, whatever happens to gas generation costs (in reality, gas prices fell slightly during the first half of 2023).

Furthermore, gas-powered electricity generators buy their gas in advance, to be sure they have the fuel to generate – so a lot of their generation this year could reflect last year’s gas prices.

Our first conclusion: whatever happens to gas prices, don’t expect electricity prices to drop fast.

A key finding from our research is how revenue changed for different generators, with the growth for renewables of particular note. We estimate their revenue doubled from £7.7 billion pre-COVID to £15.5 billion in 2022 – yet there is no reason to think their costs increased.

Nuclear benefited too – but proportionately less than renewables. Nuclear generators sell more electricity on a year-ahead basis, given its predictable cost and output levels.

How revenues changed for different electricity generators (£ billion/year):

Maximov et al. (2023), CC BY-NC-ND

Perhaps the biggest surprise regards gas generation. Since these companies’ costs shot up following the start of the Ukraine war, it seems no surprise that their prices did too. We estimate their total annual revenue rose by about £13 billion, roughly trebling from the pre-COVID average of £6.3 billion. But the evidence suggests that this increase was, in fact, much bigger than the increase in their costs.

An industry metric called the “spark spread” historically gave gas generators an operating margin of about £5 for each megawatt hour (MWh) of electricity generated. That quadrupled in 2021 and doubled again in 2022, to an average of over £40 per MWh. This correlates with our best estimate that, while gas generators paid more for gas, their bill rose by a lot less than the £13 billion increase in their total revenue.

Electricity is supposed to be a competitive market, with competition holding down prices. But in reality, there is little competition between gas and other generating sources in Britain, since these other sources can’t increase their output or rapidly build more capacity when gas generators put their prices up.

Until at least 2020, a major factor constraining higher prices in the wholesale market was imports through interconnectors from mainland Europe. Yet, factors including post-Brexit trade frictions and low hydro (Norway) and nuclear (France) generation have impeded the inflows of competitive electricity from continental Europe over the past few years.

Exacerbated further by the gas crisis in Europe, this meant electricity generators in Britain were able to raise prices further above costs.

In the final quarter of 2022, the generators also knew that raising their prices even higher would not ultimately matter to customers – because in October last year, the UK government committed to subsidising energy bills down to £2,500 per household through its Energy Price Guarantee.

In addition, gas generators are exempt from paying the new Electricity Generation Levy – which imposes a tax of 45% on the revenues of electricity generators for the fraction of electricity they sell at above £75 per MWh each year. This levy is applied only to those generators who were assumed to be benefiting from the exceptional wholesale prices while their costs hadn’t increased.

The real paradox is that all this happened just as non-fossil sources, with stable costs, started to account for more than half of Britain’s electricity (56% if we include nuclear).

As renewables expand further, we will start to see more periods when renewables and nuclear can meet electricity demand, so that gas no longer sets the day-ahead price and the wholesale price collapses. By 2030, non-fossil generation is expected to account for more than 75% of total electricity generation in both the UK and the EU. However, most of the time, the day-ahead price will still be set by the sliver of fossil fuels that are still required.

Given the experience of the past year, and what we will see this year in terms of high wholesale electricity prices, this doesn’t really make sense. For how long can the declining fossil fuel tail continue to wag the dog of Britain’s renewables-based electricity system?

An example of the government taking your concerns over sewage “very seriously”. – Owl

The storm overflows taskforce set up by the government to tackle raw sewage discharges by water companies in England has only met once in the last year, a freedom of information request has revealed.

Sandra Laville www.theguardian.com

The group, which was promoted by ministers as evidence that they were taking the issue of raw sewage discharges by water companies seriously, is supposed to meet fortnightly, according to its mission statement.

But in response to a freedom of information request by the Good Law Project, officials from the Department for Environment, Food and Rural Affairs (Defra) said the taskforce had only met once in the last year.

The storm overflows taskforce was set up in August 2020 after the Guardian first uncovered the scale of raw sewage discharges into rivers by water companies.

It is made up of representatives from government, regulators, the water industry and environmental NGOs. Its terms of reference state: “The taskforce will meet fortnightly, with exact frequency and timings of meetings at the discretion of the chairperson in consultation with the group members.” Its goals are “to develop: proposals to significantly reduce the frequency and impact of sewage discharges from storm overflows short-term actions to accelerate progress to reduce the harm caused by storm overflows”.

Last August the group published its storm overflows reduction plan, which gives water companies a deadline of 2035 to reduce the amount of sewage flowing into bathing water and areas of ecological importance. Water companies were given a deadline of 2050 to stop dumping raw sewage elsewhere.

The then environment secretary, George Eustice, said water companies would have to invest £56bn over 25 years to tackle storm sewage discharges by 2050. But the plan was heavily criticised as too weak and is to be challenged in court by the Good Law Project and the campaign group WildFish. Since that publication the taskforce has not met again, the freedom of information request shows.

The Good Law Project sought all fortnightly meeting dates of the taskforce between 1 April 2022 to 25 April this year, but Defra revealed it had only met once in that time, on 30 August 2022. There have been no follow-up meetings to drive through the storm overflow reduction plan, or to check progress.

Defra said as the taskforce had published its storm overflows reduction plan in August last year it had not met again. “These proposals were outlined in the storm overflow discharge reduction plan (the plan). The plan was published on 31 August 2022, and we have therefore not called a meeting of the taskforce following the publication of the plan.”

Defra said in its response: “Since last summer officials have continued to take action on sewage discharges, including the development of the water restoration fund, launching the continuous water quality and event duration monitoring consultation and the variable monetary penalties consultation, as well as continuing to work with regulators to hold water companies to account. We have also recently announced a new statutory target for storm overflows and plans to consult on expanding the storm overflow discharge reduction plan.”

England has about 14,500 storm overflows, which are supposed to be used in exceptionally heavy rain to stop the sewage system backing up into people’s homes. But water companies have been routinely dumping raw sewage into rivers and seas even in periods of dry weather.

In 2021 the taskforce published a report that estimated the cost of cutting millions of hours of raw sewage discharges from storm overflows would be between £150bn and £660bn – figures that were challenged by some experts.

Emma Dearnaley, the legal director at the Good Law Project, said: “We now know that the government’s storm overflows taskforce has met only once since April 2022 – and not at all since its plan was published. That is, unfortunately, typical of this government’s laid-back approach to the sewage crisis blighting our country.

“We need the government to impose tougher measures to stop water companies from polluting our waters and bring this unacceptable situation to an end. That is why we are supporting a legal challenge to try to compel the government to put in place a much more robust and urgent plan.”

Ashley Smith, of the Windrush Against Sewage Pollution group, said: “[The taskforce] produced precisely what it was designed to do – nothing. We need an independent inquiry now to make sure this disgraceful scam on the public and environment is ended and never repeated.”

Tough talking from a Tory MP, but its not Simon Jupp – Owl

A South West MP has called for the entire board of the owners of South West Water to resign after approving what he called an ‘obscene’ dividend to shareholders.

Lewis Clarke www.plymouthherald.co.uk

Ian Liddell-Grainger said that for the Pennon Group to line shareholders’ pockets while presiding over long-term water shortages in Devon and Cornwall was totally unacceptable – and consumers were rightly infuriated.

“There may have been worse examples of companies putting two fingers up to their customers but I cannot recall one,” said the Bridgwater and West Somerset MP.

Pennon Group, which also owns Bristol Water, posted a pre-tax loss of £8.5 million in the year to April, compared with a profit of £127.7 million in the previous 12 months. Yet it has raised its shareholder dividend by more than 10 per cent to £112 million.

In April South West Water was fined £2.15 million after being prosecuted by the Environment Agency for illegally dumping sewage into the sea.

It is currently the subject of two Ofwat investigations – one for its management of waste water treatment plants, the other into the accuracy of statements the company made last November about its performance in reducing leaks and on customer consumption rates.

It is one of only two water companies to have drought restrictions in force. These were imposed last year, extended in the spring and are likely to remain in place until December unless there is exceptional rainfall.

In April Pennon Group chief executive Susan Davy, announced she would not be taking her £450,000 bonus because of public anger over sewage pollution in rivers and seas.

Mr Liddell-Grainger said that had been a tacit admission of failure.

“But one highly-paid official declining a fat bonus looks like a token gesture when within weeks millions were being poured into the shareholders’ trough,” he said.

“Those shareholders are being rewarded with money that should rightly have been invested in improving and extending water supplies to the region and the fact that there are now long-term drought orders in force is manifest proof that South West Water has failed to do its job.

“Consumers in Devon and Cornwall are being asked to restrict water use so there is enough to go round when the main tourism season arrives – a highly precarious state of affairs by any measure.

“I lived in Devon for 25 years and even back then all the official agencies were aware that tourist numbers were going to grow year by year and infrastructure improvements would be necessary to cope with all the extra demands that would ensue.

“But South West Water has appeared more concerned about rewarding shareholders than building new storage capacity and the fact that it has been systematically fouling the finest beaches in the UK merely underlines the fact that it has prioritised profit, salaries, bonuses and obscene dividends before everything else.

“This is failure on a colossal scale and the chief executive and the entire board should pack their bags and go.”

If the Ofwat inquiry uncovers discrepancies in SWW’s reporting on leaks and consumption it could face a penalty equivalent to 10 per cent of its turnover.

If it is found to be in breach of wastewater regulations it will be ordered to implement improvements and could also be fined, the cost in both cases falling on shareholders.

A South West Water spokesperson said: “Pennon Group, including its subsidiary South West Water, is delivering record levels of investment, particularly in environmental initiatives such as reducing storm overflows and developing new water resources. We know more than ever before the growing concerns from customers about dividends. As we continue to accelerate the changes we all want to see, dividends are not made at the cost of greater investment.

“Our shareholders include UK pension funds, savings, and charities, as well as customers and colleagues, and most of our ultimate owners are ordinary people in the UK. They have fully endorsed our commitment to invest their money to make Pennon Group better. We are investing record amounts in the most important areas where customers want to see change.

“Alongside this, we have delivered over £85 million of customer support, including the industry leading WaterShare+ scheme, benefiting customers in the South West region.”