Of the 20 areas with the largest increase in older private renters during 2011 and 2021, ten are coastal areas that are among the poorest local authorities in the country.

Torbay and East Devon are in the list. – Owl

David Byers www.thetimes.co.uk

High rental prices are forcing older tenents to uproot and move to deprived communities with already overstretched public services, an analysis of census data has revealed.

Indepen/dent Age, a charity supporting pensioners in hardship, compared data from 250 English local authorities in the censuses of 2011 and 2021, and discovered widespread migration over the decade from richer to poorer areas for those aged 65 and over.

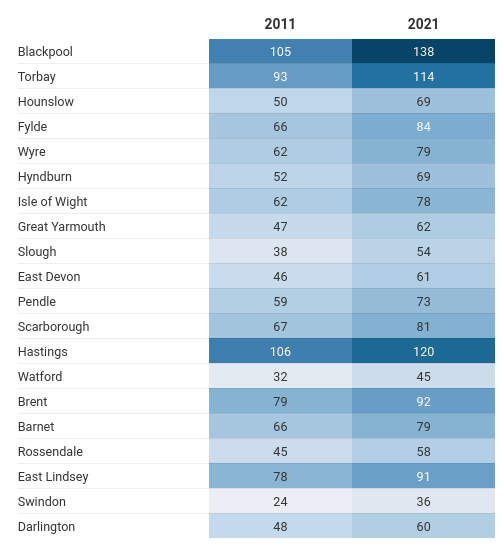

Of the 20 areas with the largest increase in older private renters during this period, ten are coastal areas that are among the poorest local authorities in the country. The area with the biggest rise is Blackpool — officially the poorest town in England — where 138 out of 1,000 older households were renting in the latest census compared to 105 in 2011.

This is followed by Torbay in Devon (114 per 1,000 compared to 93 in 2011), Hounslow in west London (69 instead of 50), and the Lancashire coastal areas of Fylde (84 up from 66) and Wyre (79 up from 62). Overall, Blackpool has the highest percentage of renting pensioners in England, with 14 per cent of all older people living in the private rented sector.

The areas with the most rapid decrease in older renters are the most expensive, dominated by London boroughs. This exodus is because of years of rising rental prices in these areas, which made them ever-more unaffordable, combined with an exodus of landlords who are facing higher taxes.

The biggest decrease of older renters was in the City of London, with 43 out of 1,000 households aged 65 and over renting in 2021 compared to 89 in 2011. This is followed by Camden, down from 92 to 69 between the two censuses, Westminster (157 to 135), Lambeth (73 to 57) and Hammersmith and Fulham (73 to 57).

Harlow in Essex was the local authority with the smallest percentage of older residents in the private rental sector in England, at 2 per cent.

Tenants have faced years of rent increases, particularly in London, as landlords sell up and property becomes unaffordable for many existing renters to buy. In the last year, as landlords’ mortgage rates went up, there have been double-digit rent rises for tenants in most regions.

Some tenants have reported being forced to compete with more than a dozen others for a room, submit personal statements for properties, queue and pay well over the odds to secure the room. However, Joanna Elson, chief executive of Independent Age, said there has been little attention given to how this phenomenon affects older people and the communities they move into.

In a report to accompany its research, Independent Age said older private renters are almost three times more likely to be in poverty than those who own their home mortgage-free.

“Older private renters living on a low income desperately need more protections. If they are forced to move out of the towns they know because of high rent, it is likely they will be cut off from friends and family and move into areas where access to services, including the NHS can be harder, which can lead them to experience worse health outcomes.

“This is not just a disaster for them, but a disaster for our society as a whole. None of us want to live our later years isolated, in poor quality housing or have our freedom to choose where we live taken away. Yet this is becoming a reality for a growing number of older people in financial hardship in the private rented sector, and it looks set to increase.”

Statisticians at Hamptons believe 11.5 per cent of all retirement-age couples will be in the private rental sector by 2033 if current trends continue compared with 5.7 per cent in 2022, a rise from 402,963 to 1,003,382, following an analysis of the English Housing Survey. As well as placing a strain on resources in some areas and driving up rental prices, Hamptons said the trend could also mean smaller amounts of inheritance being passed down the generations in future, creating more problems for already-squeezed younger people.