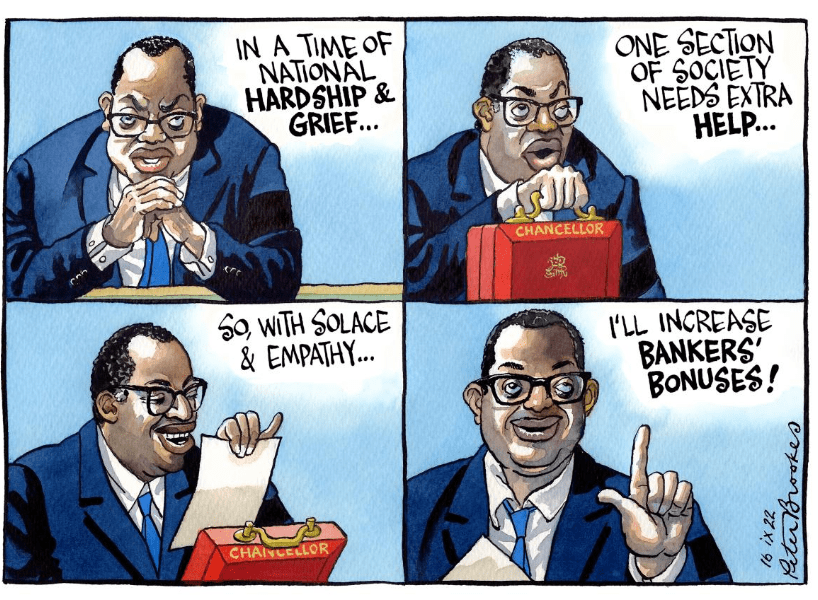

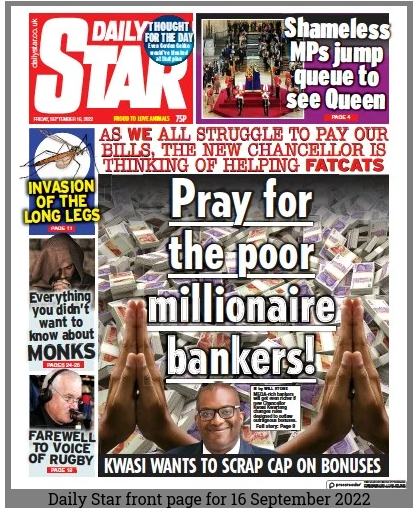

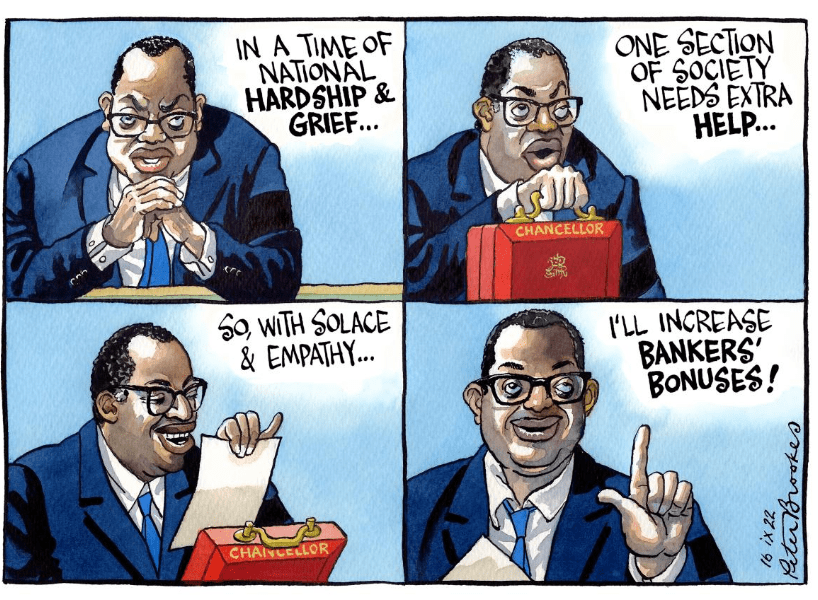

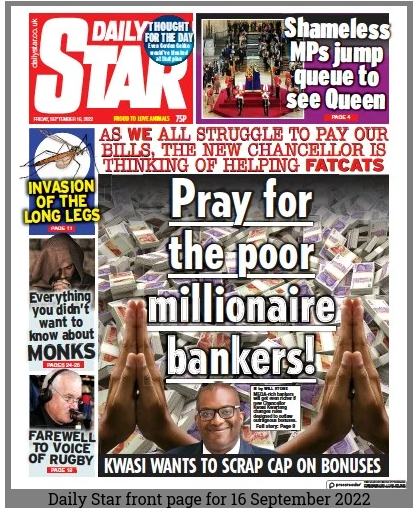

From two ends of the press spectrum, same message.

From two ends of the press spectrum, same message.

First rise since 2015

The cost of residents’ parking permits is set to rise under plans revealed by Devon County Council.

Ollie Heptinstall, local democracy reporter www.radioexe.co.uk

If approved, the price of permits will increase to £35 for a property’s first vehicle, a rise of £5. Second permits will then be priced higher depending on the vehicles’ carbon emissions, while extra permits on top of that will cost £65.

All residential permits currently cost £30; a price the council says hasn’t increased since 2015. The price for a business permit for one vehicle is also going up to £35.

Explaining the move, which does not apply to Plymouth and Torbay, the county council said the consumer price index has increased approximately 19.5 per cent since the last rise – more than the planned base permit increase of approximately 17 per cent.

Under the proposed new scheme, which follows a public consultation, the only residential permits that will be priced according to a vehicles’ carbon emissions will be the second one in a household.

They will be £45 for electric and low-emitting vehicles in Band A (less than 100g/km), £55 for Bands B – K (101-225g/km) and £65 for the worst emitting vehicles in Bands L – M (226+ g/km)

A property’s first permit will be £35 irrespective of carbon emissions, as will the £65 price for a third vehicle or any additional ones.

Permits will also be required for motorcycles (first permit £35, second permit £45, extra permits £65).

Once the new scheme has been adopted all future permits will be issued virtually, which the council says will benefit the environment and see a reduction in waste.

It claims the new pricing structure will “positively affect a reduction in consumption of fossil fuels in private vehicles by encouraging the uptake of fuel efficient/low emission vehicles and discouraging multiple car ownership.

“It is hoped more [people] will consider changing the mode of travel or adopt other sustainable modes of travel.”

Other changes to the permit scheme include:

A report, due to be presented to a meeting of the cabinet later this month – rescheduled because of the queen’s death – also provides information on how Devon’s system compares to neighbouring local authorities.

Plymouth and Torbay currently charge £30 each for residents permits, with a maximum of two per household, while the prices differ completely in Cornwall and Somerset.

A first Cornish household permit costs £50 and £75 for the second. Only two are allowed per household.

Somerset’s scheme is based on the carbon emissions of vehicles for the first permit. They cost £60 as standard, but are discounted by either 100 or 50 per cent if a vehicle emits less than 100g or 110g/km. Second permits cost a flat fee of £100.

Devon’s ruling cabinet will consider and vote on the changes at a meeting on Monday 26 September.

Markets think the Bank of England will unveil the biggest hike in interest rates for over three decades when its decision makers gather for a delayed meeting.

The Monetary Policy Committee (MPC) is expected to increase rates by 0.75 percentage points to 2.5%.

It would be the highest interest rate that the UK has had since the financial crisis. In December 2008 the base rate was slashed from 3% to 2%.

It would also be the highest single increase to interest rates since 1989.

Next week’s Bank of England meeting is crucial

“Investors think the most likely outcome is that the MPC will increase the Bank rate by 75bp (0.75 percentage points) on Thursday,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

But he said that economists are expecting a smaller rise, to 2.25% – the same 0.5 percentage point change as the Bank’s last hike.

“For a start, hawkish surprises from the MPC have been far less common than dovish ones over the last year,” he said.

“In addition, Governor Bailey openly referred to a 50bp hike ahead of the August meeting, but has not given markets a nudge to price-in a 75bp hike.

“We think that the MPC still will deem a 50bp increase to be consistent with its pledge to act ‘forcefully’, if it sees signs of more persistent inflationary pressures.”

ING economist James Smith said that the Bank of England will have to react to recent falls in the price of the pound. Sterling hit a new 37-year low against the dollar on Friday.

“Next week’s Bank of England meeting is crucial,” he said.

“It will tell us not only how worried policymakers are about the slide in sterling and other UK markets, but also how the Government’s decision to cap household/business energy prices will translate into monetary policy.”

“We narrowly favour a 50bp hike on Thursday, taking the Bank Rate to 2.25%, although 75bp is clearly on the table and we would expect at least a couple of policymakers to vote for it.”

He said that rates will likely rise again in November and December, hitting 3% by the end of the year.

The decision to hike interest rates is a bid to keep inflation under control. It is the best tool that the Bank of England has to steer inflation – currently at 9.9% – back to its 2% target.

But the decisions will also have major impacts on people’s finances, not least those with mortgages who will need to start paying more for their home loans.

The MPC was originally set to announce its decision on Thursday September 15, but delayed this for a week due to the Queen’s death.

This is reported as costing £24m within the county.

Stand up all those, mostly Conservatives, who backed the closure of the community hospitals. – Owl

Edward Oldfield www.devonlive.com

Plans are being put in place to open more beds at Devon hospitals to head-off a winter healthcare crisis after one of the busiest ever summers for the NHS. An extra £5million is being spent in Plymouth which alongside Cornwall is among the worst in England for ambulance handover delays.

Some of the money will go on 41 extra beds at Derriford Hospital and community hospitals to ease the pressure on the emergency department. In the rest of Devon, £19million is being spent on creating extra capacity in the NHS for the winter. That includes £6million on creating 37 extra beds and spaces at Torbay Hospital, 18 at the Royal Devon & Exeter Hospital, and 11 at North Devon District Hospital in Barnstaple.

The extra £24million has been secured from national funding to tackle the pressure across the NHS in Devon. More patients will be treated at home in so-called ‘virtual wards’, where support from clinical teams is provided remotely through the use of apps, platforms and devices which can monitor pulse, heart rate and breathing.

The £5million project will create three virtual wards covering Plymouth, Torbay and South Devon, and East and North Devon, creating the equivalent of around 75 hospital beds. The first of the schemes will go live in December 2022, and will be scaled up through to March 2024.

Patients will be given a choice of being an inpatient or receiving treatment at home, and their home circumstances and available support will be taken into account.

Devon will see £9.8million invested in the hospital discharge process, including for care hotels, agency support, rehabilitation care and support, and for patients with complex dementia. It includes extra capacity for mental health, on top of £219,000 already allocated for winter pressures.

An extra £900,000 is being invested in the handover of integrated community urgent care services to a new provider, Practice Plus Group, in October.

A communications strategy will focus on persuading people to contact the 111 service before going to an emergency department, take up the flu and Covid vaccines, use pharmacies, and use online services.

A report outlining the measures to Devon County Council said: “Devon’s system remains under sustained pressure due to a range of complex and multi-faceted issues – including the pandemic, increased demand, staff shortages, and vacancy rates in health and adult social care providers.

“The cost-of-living crisis is also impacting on health and social care services, not only for our population and our staff, but also in the care market. Staff nationwide have faced one of their busiest summers ever with record numbers of Emergency Department attendances and ambulance services facing extreme pressures, high demand for social care and mental health services, and the impact of another wave of COVID-19.

“As a result, bed occupancy levels in hospitals are high, people are staying in hospital for longer than they need to, and ambulance handover delays are increasing. Ultimately, it means many patients aren’t getting the care they need in a timely way. The past two years has seen significant pressure upon our urgent and emergency care (UEC) services. The workforce is stretched and exhausted, yet it continues to deal with high levels of demand against a backdrop of constraints which affect our ability to treat people.”

The rise in ambulance handover delays at hospitals has been blamed on shortage of beds and delayed discharges to social care. Figures at the start of September showed that in Plymouth, Exeter and Torbay, around one in 10 beds was occupied by a patient who was fit to leave, but was waiting for care to be arranged. In North Devon the proportion was 27 per cent – more than a quarter. GPs are seeing more patients and more complex needs, with appointments up by 8 per cent in the past year. Meanwhile the vacancy rate in the NHS has increased in line with the national picture. In July, there were more than 4,500 vacancies in health and social care in Devon.

National ambulance data for July showed record calls to the most serious incident, and the highest level of patient handover delays.

Last week a senior doctor warned that the NHS is facing a winter crisis as figures show 1,200 emergency patients in Devon waited more than 12 hours for a bed in August. Dr James Gagg said the latest data from the region’s emergency departments was “shocking”, with large numbers of patients “facing extremely long waiting times”. He called on MPs and councils to acknowledge a “looming crisis” facing the health service in the winter and to “act now before it is too late”.

The NHS in Devon says it is facing a “challenging” budget for this financial year, with a need to find savings of £142million. The county council, which funds social care, was forecast in July to face an overspend of £40million, including £6million on adult social care.

The proposals in the winter winter plan after learning from last year, when the health and care sector faced “severe and sustained pressure” due to an increase in demand and the impact of the pandemic.

Brexit is hitting the UK export market, according to data from HMRC.

This comes just as Kwasi Kwarteng has told Treasury officials to adapt to a new approach focused on boosting annual economic growth to 2.5 per cent.

One might ask what contribution overall government policies are supposed to play in this dash for growth – Owl

Joe Mellor www.thelondoneconomic.com

The number of UK businesses exporting goods to the EU fell 33 per cent to 18,357 in 2021, from 27,321 in 2020.

Michelle Dale, a senior manager at accountancy firm UHY Hacker Young, pointed out the fall is due to the extra red tape UK businesses must now comply with when exporting to the EU.

“Businesses are not getting enough support from the Government to navigate the post-Brexit trading minefield,” she said, reports City A.M.

“A lot of SMEs can’t afford professional advice to cope with Brexit-related red tape. Many are likely to have decided trading with the EU is not worth the cost,” Dale added.

“Fewer UK companies exporting to the EU will result in lost opportunities for growth and expansion in Europe.”

EU receives UK’s response to legal threats

Meanwhile, the European Union is considering its next steps after receiving the UK’s response to legal threats over the failure to comply with the post-Brexit Northern Ireland Protocol.

Despite politics as normal being paused while the nation mourns the Queen’s death, the Government responded to the action ahead of Thursday’s deadline.

The bloc had requested a response to its raft of infringement proceedings over the UK’s failure to comply with the rules before the end of the day.

European Commission spokesman Daniel Ferrie said: “I can confirm we have received a reply from the UK. We will now analyse the reply before deciding on the next steps.”

What the UK’s response contained was unclear, but the Government was expected to set out how it believes that no operational changes on how the protocol works are required.

European Commission president Ursula von der Leyen will be in Westminster for the Queen’s funeral on Monday.

It is unclear if she will be meeting Prime Minister Liz Truss while in London, although Ms Truss is expected to hold some talks with political leaders during their visits.

There have been unconfirmed suggestions that Ms Truss will speak to Irish Taoiseach Micheal Martin on the margins of the funeral amid tensions over the protocol.

Housebuilder Redrow’s revenue has climbed above pre-Covid-19 levels, as it continues its withdrawal from the London market.

(To concentrate on the regions – Owl)

By: Millie Turner www.cityam.com

Revenue grew 10 per cent to a record £2.14bn in the year to 3 July. While profit before tax hit £246m, down from the £314m, it reported a year prior due to one-time fire safety costs of £164m.

The group is expected to have completely exited the capital’s property market, except the Colindale development in north west London, by the end of the year.

“In addition to the record revenue achieved, the group still ended the year with an order book of £1.44bn,” non-executive chairman Richard Akers said in a statement.

“Excellent progress has been made during the year executing our strategy to grow in the regions. The new Southern business, based in Crawley, officially opened at the end of June but the team has been active in the land market for some time. This division is expected to make a positive contribution to profits in the current financial year.”

The London-listed company, like most housebuilders in the UK, has been boosted by rising house prices and demand.

Charlie Huggins, head of equities at investment firm Wealth Club, cautioned: “Make no mistake – the biggest reason for Redrow’s success is high house prices, and the general strength of the housing market.

“That is something over which it has no control, and the big bad wolf of recession could be about to blow away the good times.”

A former pub landlord who has been jailed for sexually assaulting women at his bar has been stripped of his licence by East Devon officials.

Local Democracy Reporter eastdevonnews.co.uk

Peter Hayball had his personal licence revoked and will be unable to reapply until long after his release from prison, writes local democracy reporter Philip Churm.

The decision made by East Devon District Council’s licensing and enforcement sub-committee on Wednesday, August 24 was only disclosed this week (Wednesday, September 7).

Members agreed to revoke Peter Hayball, 56, of his licence after he was jailed in May for 18 months and placed on the sex offenders’ register for 10 years for offences committed between 2016 and 2018.

During the trial, the court heard how Hayball, who was running a pub in Devon at the time, would pull open women tops and push money into their cleavage.

He touched the breasts of at least one woman and was stopped from doing so by another.

Hayball claimed he was just using ‘Carry-On humour”, saying it had been misunderstood as sexual advances and never went beyond a joke.

He was prosecuted on 13 charges relating to four women and was found guilty of three sexual offences.

Independent Councillor for Cranbrook and chair of the licensing sub-committee Kim Bloxham said: “The licensing authority takes matters such as this very seriously.

“All licence holders are required to promote the ‘licensing objectives’ – including maintaining public safety and preventing crime and disorder.

“The committee considered whether the holder of the licence remains a ‘fit and proper’ person to continue to hold a personal licence with these two objectives in mind.

“The committee considers that the revocation of the personal licence on this occasion is a necessary and proportionate decision to ensure that the public remain safe where alcohol is being served, either in East Devon or wherever the holder might be operating in the future.”

All sales of alcohol must be made by, or under the authority of a personal licence holder.

The council’s legal advisor Giles Slater explained the long-term impact of Hayball’s conviction.

“Obviously if he applies for personal licence again, that will come up on his application that he’s debarred for the next 10 years and he will be unable to apply until 2032,” he said.

Mr Slater also said, under the Rehabilitation of Offenders Act, Hayball’s conviction would affect other areas of employment.

“A custodial sentence of 18-months imprisonment means that the rehabilitation for most other jobs is four years from the date on which the sentence is completed. So, he won’t be rehabilitated until 2026.”

A new tourism strategy has been approved by Cabinet.

Beach walking. Image credit: Jay Cross

Building on East Devon District Council’s support for the tourism industry with the EastDevonly campaign, a new tourism strategy has been approved by Cabinet.

The new 5-year strategy aligns with the new East Devon Cultural Strategy and will help the tourism sector to grow sustainably and bring prosperity to the area. The vision is for “East Devon to be the leading, year-round tourism destination in Devon, whose diverse ecosystem of outstanding natural environments, distinctive, high-quality businesses, towns and villages, all thrive and grow through a commitment to Net Zero, accessibility and collaboration”.

Councillor Nick Hookway, East Devon District Council’s Portfolio Holder for Tourism, Leisure, Sport and Culture, said:

I am delighted that this new strategy has been approved by Cabinet as it aligns perfectly with the Council’s vision for a clean and greener future, improved accessibility, good quality employment and higher wages across the area. Tourism plays an important part of this work and brings many economic and social benefits, helping support our local cultural activities within our vibrant towns, villages and hamlets.

The tourism strategy builds on the quality of the existing tourism offer and encourages growth through an increased focus on sustainability and inclusivity.

The strategy is based on strong evidence including existing strategies, stakeholder engagement, national analysis and trends. The strategy is achievable but ambitious, identifying a direction, actions and the role for East Devon District Council as an Enabler that will create lasting impact for the area’s tourism sector.

The strategy has already helped shape EDDC’s UK Shared Prosperity Fund Investment Plan. Next steps include securing tourism data for 2021 to act as a baseline for future measurement and procuring a partner to run an East Devon Tourism Network to facilitate collaboration and sharing of best practice. In addition, the tourism strategy will inform relevant policy within the district’s new Local Plan, due later this year.

[Apologies for the delay in posting these – Owl]

Granary House Granary Lane Budleigh Salterton EX9 6JDRef. No: 22/1957/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

Granary House Granary Lane Budleigh Salterton EX9 6JDRef. No: 22/1957/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision 46 Clyst Valley Road Clyst St Mary EX5 1DDRef. No: 22/1955/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

46 Clyst Valley Road Clyst St Mary EX5 1DDRef. No: 22/1955/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision Little Westcott Sheldon Devon EX14 4QSRef. No: 22/1960/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

Little Westcott Sheldon Devon EX14 4QSRef. No: 22/1960/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision Court Place Farm Wilmington EX14 9LARef. No: 22/1953/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

Court Place Farm Wilmington EX14 9LARef. No: 22/1953/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision 5 Pankhurst Close Exmouth EX8 2TBRef. No: 22/1934/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

5 Pankhurst Close Exmouth EX8 2TBRef. No: 22/1934/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision Cottington Court Sidmouth EX10 8HDRef. No: 22/1933/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Cottington Court Sidmouth EX10 8HDRef. No: 22/1933/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Land At Hanger Farm Stafford Hill BroadhemburyRef. No: 22/1932/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Land At Hanger Farm Stafford Hill BroadhemburyRef. No: 22/1932/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision 4 West Hill Lane Budleigh Salterton Devon EX9 6AARef. No: 22/1937/TRE | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

4 West Hill Lane Budleigh Salterton Devon EX9 6AARef. No: 22/1937/TRE | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Home Cottage Burridge Axminster EX13 7DFRef. No: 22/1938/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Home Cottage Burridge Axminster EX13 7DFRef. No: 22/1938/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Thorntree Cottage 12 Drupe Farm Court Exmouth Road Colaton Raleigh Sidmouth EX10 0LERef. No: 22/1939/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

Thorntree Cottage 12 Drupe Farm Court Exmouth Road Colaton Raleigh Sidmouth EX10 0LERef. No: 22/1939/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision Ivy Cottage Stockland Honiton EX14 9BSRef. No: 22/1919/TCA | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Ivy Cottage Stockland Honiton EX14 9BSRef. No: 22/1919/TCA | Validated: Tue 30 Aug 2022 | Status: Awaiting decision 4 Eastfield Orchard West Hill Ottery St Mary Devon EX11 1FSRef. No: 22/1920/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

4 Eastfield Orchard West Hill Ottery St Mary Devon EX11 1FSRef. No: 22/1920/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Higher Coxes Farm Weston Sidmouth EX10 0PGRef. No: 22/1922/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Higher Coxes Farm Weston Sidmouth EX10 0PGRef. No: 22/1922/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Silverdale Bickwell Valley Sidmouth EX10 8SGRef. No: 22/1924/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Silverdale Bickwell Valley Sidmouth EX10 8SGRef. No: 22/1924/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision 58A Salterton Road Exmouth EX8 2NFRef. No: 22/1927/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

58A Salterton Road Exmouth EX8 2NFRef. No: 22/1927/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision The Wandle Fore Street Beer EX12 3JHRef. No: 22/1918/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

The Wandle Fore Street Beer EX12 3JHRef. No: 22/1918/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Burlands Mead Feniton EX14 3BSRef. No: 22/1926/TRE | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Burlands Mead Feniton EX14 3BSRef. No: 22/1926/TRE | Validated: Wed 31 Aug 2022 | Status: Awaiting decision 12 Clyst Valley Road Clyst St Mary Devon EX5 1DDRef. No: 22/1914/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

12 Clyst Valley Road Clyst St Mary Devon EX5 1DDRef. No: 22/1914/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Berry Manor House Hawkchurch EX13 5XLRef. No: 22/1916/LBC | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Berry Manor House Hawkchurch EX13 5XLRef. No: 22/1916/LBC | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Berry Manor House Hawkchurch EX13 5XLRef. No: 22/1915/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Berry Manor House Hawkchurch EX13 5XLRef. No: 22/1915/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Devoncourt Hotel 16 Douglas Avenue Exmouth Devon EX8 2EXRef. No: 22/1910/MFUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision

Devoncourt Hotel 16 Douglas Avenue Exmouth Devon EX8 2EXRef. No: 22/1910/MFUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision Windsor Bungalow Membury EX13 7TGRef. No: 22/1903/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Windsor Bungalow Membury EX13 7TGRef. No: 22/1903/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Cooksmoor Farm Stockland Devon EX14 9NHRef. No: 22/1904/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Cooksmoor Farm Stockland Devon EX14 9NHRef. No: 22/1904/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Land Adjoining Town Dairy Church Road Lympstone Devon EX8 5ELRef. No: 22/1901/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Land Adjoining Town Dairy Church Road Lympstone Devon EX8 5ELRef. No: 22/1901/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Myrtle Cottage Feniton Honiton EX14 3BERef. No: 22/1892/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Myrtle Cottage Feniton Honiton EX14 3BERef. No: 22/1892/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision 1 Manor Cottages Rockbeare Exeter EX5 2FERef. No: 22/1898/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

1 Manor Cottages Rockbeare Exeter EX5 2FERef. No: 22/1898/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Little Acre Woodbury Lane Axminster EX13 5TLRef. No: 22/1884/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Little Acre Woodbury Lane Axminster EX13 5TLRef. No: 22/1884/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Land South Of Money Acre Road Farway EX24 6EFRef. No: 22/1887/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

Land South Of Money Acre Road Farway EX24 6EFRef. No: 22/1887/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision Roman Catholic Church Guardian Angels Day Nursery Ottery Moor Lane Honiton EX14 1APRef. No: 22/1856/TRE | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Roman Catholic Church Guardian Angels Day Nursery Ottery Moor Lane Honiton EX14 1APRef. No: 22/1856/TRE | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Knappe Cross Nursing Home Brixington Lane Exmouth EX8 5DLRef. No: 22/1873/FUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision

Knappe Cross Nursing Home Brixington Lane Exmouth EX8 5DLRef. No: 22/1873/FUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision Knappe Cross Nursing Home Brixington Lane Exmouth EX8 5DLRef. No: 22/1874/LBC | Validated: Thu 01 Sep 2022 | Status: Awaiting decision

Knappe Cross Nursing Home Brixington Lane Exmouth EX8 5DLRef. No: 22/1874/LBC | Validated: Thu 01 Sep 2022 | Status: Awaiting decision Land Off Gosling Walk Harepath Road Seaton EX12 2SXRef. No: 22/1846/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Land Off Gosling Walk Harepath Road Seaton EX12 2SXRef. No: 22/1846/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Hux Shard Church Hill Exeter Devon EX4 9JJRef. No: 22/1840/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Hux Shard Church Hill Exeter Devon EX4 9JJRef. No: 22/1840/FUL | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Old Clockhouse 12 Fore Street Sidbury Sidmouth EX10 0SDRef. No: 22/1833/LBC | Validated: Tue 30 Aug 2022 | Status: Awaiting decision

Old Clockhouse 12 Fore Street Sidbury Sidmouth EX10 0SDRef. No: 22/1833/LBC | Validated: Tue 30 Aug 2022 | Status: Awaiting decision Podburys Cottage Higher Way Harpford Devon EX10 0NJRef. No: 22/1813/LBC | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Podburys Cottage Higher Way Harpford Devon EX10 0NJRef. No: 22/1813/LBC | Validated: Wed 31 Aug 2022 | Status: Awaiting decision Podburys Cottage Higher Way Harpford Devon EX10 0NJRef. No: 22/1812/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

Podburys Cottage Higher Way Harpford Devon EX10 0NJRef. No: 22/1812/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision 19 Meadow Road Budleigh Salterton EX9 6JLRef. No: 22/1760/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision

19 Meadow Road Budleigh Salterton EX9 6JLRef. No: 22/1760/FUL | Validated: Wed 31 Aug 2022 | Status: Awaiting decision 6 Trefusis House, Flat 1 Trefusis Terrace Exmouth EX8 2AXRef. No: 22/1763/FUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision

6 Trefusis House, Flat 1 Trefusis Terrace Exmouth EX8 2AXRef. No: 22/1763/FUL | Validated: Thu 01 Sep 2022 | Status: Awaiting decision 1 Amyatts Terrace Sidmouth Devon EX10 8PERef. No: 22/1738/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

1 Amyatts Terrace Sidmouth Devon EX10 8PERef. No: 22/1738/FUL | Validated: Fri 02 Sep 2022 | Status: Awaiting decision 1 Amyatts Terrace Sidmouth EX10 8PERef. No: 22/1739/LBC | Validated: Fri 02 Sep 2022 | Status: Awaiting decision

1 Amyatts Terrace Sidmouth EX10 8PERef. No: 22/1739/LBC | Validated: Fri 02 Sep 2022 | Status: Awaiting decisionWe are still waiting for Liz Truss’ and Kwasi Kwarteng’s “special fiscal operation” which will bypass much of the analysis and scrutiny a formal budget gets. – Owl

Alexandra Rogers www.huffingtonpost.co.uk

The EU is planning to bring in a windfall tax on energy firms so their huge profits can be “shared and channelled to those who need it most”.

Ursula Von der Leyen, the European Commission president, said it was “wrong” for companies to make “extraordinary” profits on the back of consumers and the war in Ukraine.

The move is in stark contrast to the approach taken by Liz Truss, who last week ruled out bringing in a fresh levy on the companies’ excess profits.

The EU is also proposing to cap the revenues of electricity-producing companies that are making extraordinary profits thanks to the war in Ukraine and climate change.

Von der Leyen told the European Parliament in Strasbourg that the proposal could raise 140 billion euro (£121 billion) to help people hit by spiralling energy prices.

During her state of the European Union address, Von der Leyen said: “These companies are making revenues they never accounted for, they never even dreamt of.

“In our social market economy, profits are OK, they are good.

“But in these times it is wrong to receive extraordinary record revenues and profits benefiting from war and on the back of consumers.

“In these times, profits must be shared and channelled to those who need it the most.”

She added: “And because we are in a fossil fuel crisis, the fossil fuel industry has a special duty, too.

“Major oil, gas and coal companies are also making huge profits. So they have to pay a fair share – they have to give a crisis contribution.”

The EU’s intervention is likely to lead to increased calls for a further windfall tax on UK firms.

A windfall tax on the UK’s oil and gas sector introduced on May 26 remains in place but there have been calls from Labour for it to be extended due to the worsening economic situation.

In her first week as prime minister, Truss unveiled a £150 billion package to cap energy bills at £2,500 for the next two years, saving the typical household £1,000 a year.

The policy has been welcomed as a much-needed intervention but the funding of it — through government borrowing — has been criticised by those who do not believe the taxpayer should shoulder the burden.

During prime minister’s questions last week, Truss ssaid she was against a further windfall tax when challenged by Keir Starmer.

“I believe it is the wrong thing to be putting companies off investing in the United Kingdom, just when we need to be growing the economy,” she told the Labour leader.

The 27 member states that make up the EU are also struggling with the cost of living crisis that has taken hold in the UK.

Since the outbreak of Russia’s invasion of Ukraine, EU member states have sought to wean themselves off Moscow’s exports, which in turn has pushed prices up as demand for other supplies intensifies.

Russia has already cut gas supplies partially or entirely to 13 member countries in response to the EU’s decision to impose sanctions of Moscow for its continuing aggression against Ukraine.

In her speech, Von der Leyen said there needed to be a “deep and comprehensive reform of the electricity market” to reduce the influence of natural gas on the way that prices are set.

This month Southern Water announced changes to the Beachbuoy map, which means it will no longer automatically flag all raw sewage releases into bathing waters via storm overflows.

This is a result of a “software upgrade” apparently – Owl is unconvinced

Sandra Laville www.theguardian.com

A water company has changed its pollution alert map for the public to stop issuing automatic red alerts after a discharge.

Southern Water attracted public criticism this summer for releasing raw sewage via storm overflows after heavy rain along coastal Kent. Campaigners used social media to widely share the company’s Beachbuoy map, which marks beaches at risk of pollution from raw sewage discharges with a red cross, often revealing that much of the coast has been affected.

After storms in August at least nine Kent beaches were issued with pollution alert warnings and the Environment Agency issued a “do not swim” warning for beaches across much of the north and south-east Kent coasts.

This month Southern Water announced changes to the Beachbuoy map, which means it will no longer automatically flag all raw sewage releases into bathing waters via storm overflows.

Instead Southern Water is analysing the overflows by modelling tides and weather, before deciding which are likely to cause water quality problems at beaches.

Explaining the change on its website Southern said: “In September 2022, we upgraded the map to take into account the impact a release has on a local bathing water, based on the location of the outfall, the duration of the release and tidal conditions at the time.

The Southern Water Beachbuoy map marks beaches at risk of pollution from raw sewage discharges. Photograph: Southern Water

“For instance, if the outfall is 5km [3.1 miles] out to sea, the release was short and the tidal conditions meant there could be no impact on a bathing water, we no longer turn the bathing water icon red.”

The company said the releases were still available on its website in the accompanying table of combined sewer overflow (CSO) locations. It said most of its outfalls were long sea outfalls and where they are close to bathing waters they were designed with bathing waters in mind.

Ed Acteson, of campaign group SOS Whitstable, said he believed the changes were a way of turning a red map to blue to avoid bad PR.

“They are no longer indicating every CSO release on to beaches on their map, which is what it was set up for,” said Acteson. “They say they are taking into account the impact the release has on local bathing water but they don’t have the information to make that decision. The map has been covered in red recently; it is bad PR for them. It has been shared across social media and caused an outcry. That is what they are trying to avoid.”

Mike Owens, of Hayling Sewage Watch, analysed the data on the map on Wednesday morning. He assessed there were 15 out of 83 beaches marked blue that would have been red before the latest software update because outfalls were discharging raw sewage nearby.

“This is a question of trust in Southern Water to provide accurate, open and transparent information,” said Owens. “They say that they want to improve the user’s experience but manipulating data without giving us detail is most unhelpful and frankly neither open or transparent.

“They say they are using tide and weather and location to determine whether the discharge impacts on water quality on a beach but there are not showing us how they are making the calculation.

“I don’t know how they are doing it and how they have implemented it so quickly.”

Owens said for 246 outfalls the company would need to analyse the granular detail for every parameter in making a decision about whether a discharge impacted on water quality – including data for several different tide times, wind speeds and weather.

“If you multiply those together that is quite an astonishingly large amount of data.”

Martin William, Beachbuoy product owner at Southern Water, said: “This is an important step for the tool, ensuring we provide accurate, fair and clear information to wild swimmers, kayakers, paddleboarders and all users of the beautiful beaches across our region.

“Beachbuoy is leading the way in providing near-real time data about storm releases, but we must ensure it goes further to inform the public about the impacts to the watercourse and not limit their enjoyment of their local bathing water. We’ll never hide data though, with all releases still available on the website.”

A Court has fined South West Water £233,000 for supplying water unfit for human consumption affecting Bratton Flemming and other communities in North Devon in 2018.

South West Water had told customers to add a slice of lemon to the water but the court found that blaming the weather wasn’t acceptable and that South West Water should have reacted earlier to algal bloom in summer 2018.

According to a report on last night’s BBC Spotlight.

This is why your drinking water tastes weird at the moment

(Extract) www.devonlive.com

“It’s the terrible taste of it, so earthy and mouldy flavour. How much longer do we have to put up with it?”

“Why is our water slightly brown and tastes like mud? What’s going on?”

“Some customers in north east Devon may have noticed a change to the taste or smell of their tap water over the last two weeks.

“The warm, dry weather has caused a natural change in the raw water at Wistlandpound reservoir, which supplies Bratton Fleming and Horedown Water Treatment Works.

“The earthy or musty taste is not harmful to health.

“We have installed an extra treatment stage at both water treatment works, and customers should notice a return to normal over the next few days.

“In the meantime, chilling a jug of tap water in the fridge and adding a dash of lemon can assist with lessening the taste and odour issue.”

Got to get your priorities right.

Let’s hear it for the Bankers! – Owl

Kevin Schofield www.huffingtonpost.co.uk

Kwasi Kwarteng wants to scrap the cap on bankers’ bonuses in a bid to make the City of London more globally competitive.

The new chancellor is reported to be considering the move as he steps up government attempts to boost economic growth.

However, ending the cap – which was introduced in 2014 by the European Union – is likely to draw fierce criticism from the government’s political opponents.

The cap limits the amount bankers can receive in bonuses to twice their annual salary.

Its supporters say it is necessary to prevent bankers taking unnecessary risks like those which led to the 2008 financial crash in order to pocket huge bonuses.

But the Conservatives have long argued that the cap hampers the UK’s attempts to attract the best global banking talent.

Former prime minister Boris Johnson was in favour of ending the cap, but feared a huge political backlash if his government went ahead with it.

When the idea was first proposed in June, Labour leader Keir Starmer described it as “pay rises for bankers, pay cuts for district nurses”.

But according to the Financial Times, Kwarteng has told City bosses: “We need to be decisive and do things differently.”

The new chancellor will unveil his plans to boost economic growth in a mini-Budget when parliament sits again next week following the period of national mourning for the Queen’s death.

He will confirm that the government is ending the rise in national insurance payments, as well as scrapping plans to increase corporation tax.

The government has already courted controversy by refusing to bring in a fresh windfall tax on the excess profits being enjoyed by energy firms as a result of the war in Ukraine.

Ursula von der Leyen, the European Commission president, yesterday announced that the EU would be bringing in its own windfall tax so the firms’ huge profits can be “shared and channelled to those who need it most”.

Looks like Simon Jupp MP, great supporter of the hospitality sector, won’t be back in the commons until 17 October.

Liz Truss and Kwasi Kwarteng have other priorities e.g. scrapping the cap on bankers’ bonuses – Owl

Jon Stone www.independent.co.uk

The government has been urged to cancel a “ludicrous” parliamentary recess and recall MPs to work so that they can pass energy bill measures before prices rise in October.

Businesses in sectors such as hospitality and manufacturing have warned they could go out of business this autumn due to soaring prices without urgent government assistance.

The government has pledged to help – but in contrast to its plan for households, support for businesses will require parliamentary time so that fresh legislation can be brought in.

Yet parliamentary business has been suspended following the death of the Queen, and this break is expected to dovetail with a planned recess for parties to hold their conferences.

As a result MPs will not even begin to look at legislation until the second half of October, meaning business may have to wait until November for energy support.

Hospitality chiefs on Wednesday urged the governemnt to cancel the conference recess to get a move on.

“This [delay] is because energy plans require legislation – unlike domestic support – and with Parliament going back into recess next week there may be insufficient time to pass it before price hikes take effect from 1 October,” said Kate Nicholls, chief executive of industry group UK Hospitality. “This is why it seems ludicrous to go ahead with conference recess.”

The prime minister has promised support for businesses “equivalent” to her £2,500 annual price cap for households, but legislation is required to bring it in because there is no existing system like the domestic Ofgem energy price cap for firms.

The government says the details of the legislation is being worked on and it will be delivered in a “timely” manner.

But business chiefs have reportedly been warned in recent meetings that the scheme may not be ready until November.

“It is not worked through yet,” one government official told the Financial Times. “I don’t know whether it will come in before November. There’s some debate about whether it can be brought forward and happen before then.”

Some small firms like pubs and takeaways are already closing as they receive revised energy bills, with predictions that as many as 7 out of 10 nightlife venues could have to shut down.

The 10 day parliamentary suspension plus the conference recess beginning on 22 September means MPs are only expected to return to work in Westminster on 17 October.

Conference season is important to political parties because the events give them a significant media spotlight – but the gatherings are also financially important.

Parties bring in significant revenue selling stall pitches to lobbyists in their conference halls, and there could be significant costs associated with a last-minute cancellation of a major conference venue.

A government spokesperson said: “We will confirm further details of the business support scheme next week. The scheme will support businesses with their October energy bills, including through backdating if necessary.”

Citizen scientists are being trained as the best hope to protect rivers from pollution and over-abstraction as data suggests the Environment Agency’s new monitoring programme leaves waterways unprotected.

(See also this post)

Sandra Laville www.theguardian.com

A £7m programme to set up citizen science testing in 10 river catchments across England is under way in an attempt to standardise the way volunteers carry out the monitoring.

Modelled on the testing carried out by volunteers at Chesapeake Bay in the US, the third largest estuary in the world, the project aims to create thousands of volunteer scientists who will monitor their local rivers and provide a grassroots voice to protect them.

“What we want eventually is to have thousands of people volunteering and monitoring their local rivers,” said Simon Browning of the Rivers Trust. “These could be 15-minute surveys or more detailed invertebrate surveys, which give us another level of data. We are trying to formalise the volunteer structure and standardise the monitoring so that we know the data is reliable.

“We want to bring along as many people as possible over all the river catchments across the country, so that by the end of the three years of the project there is no going back, we will see volunteers operating across the country.”

The aim is for the monitoring to be complemented by a network of sensors and the information will be gathered and shared into a central visualisation platform. The project, which is led by the Rivers Trust and United Utilities, is funded via the water regulator Ofwat’s first water breakthrough challenge, and involves academic partners. Browning, who set up a citizen science monitoring project for the Westcountry Rivers Trust which is ongoing, said the Environment Agency testing regime was no longer widespread or comprehensive enough.

The EA should monitor the chemical quality of rivers, focusing on levels of phosphates, nitrogen, ammonia and dissolved oxygen. But citizen data gathered in Devon exposed the holes in the new EA testing programme, adopted last year, which involves randomly selected sites for spot testing.

“Some of our river catchments have gone from being monitored 12 times a year to nothing,” said Browning. “So it is not so much a question of whether citizen science is better than EA monitoring but where there is no data at all, citizen science monitoring can empower communities and get them involved in understanding the issues in their rivers so that they can speak up and protect them.

“We want to see real benefits at a local level, with communities in towns and villages taking the local environment by the scruff of the neck and speaking up for rivers.”

Data from the River Creedy in Devon suggests the EA’s phosphate tests have dramatically reduced in 20 years. In 2000 the EA tested 12 sites for phosphates on the Creedy 12 times a year; totalling 144 tests. Testing started to drop off in 2014 with sample frequency reduced dramatically to a low of four times a year. By last year monitoring of the original 12 sites was abandoned altogether. Sites have been replaced with randomly selected areas as part of the new EA spot test system and there were 67 phosphate tests at these new sites in 2021, compared with a high of 189 tests conducted in 2002.

On the Creedy one of the new sample points is upstream of all sewage discharges, population centres or productive farmland. Critics say the new system is likely to misrepresent the scale of water pollution across the country.

“This detailed, local level spatial analysis [of the Creedy] reveals a huge shift in monitoring approach,” said Browning. “Long-term sampling sites have been wound down and abandoned, new ones initiated with a much-reduced sampling regime – one year in five – and at ‘random’ locations that are in no way representative of overall water quality at the waterbody scale.”

Annual funding from the government for monitoring activity has halved in recent years. The agency said its new River Surveillance Network testing was designed to provide a robust assessment of the health of rivers nationally over time. The agency said it welcomed the various emerging citizen science initiatives, which promised to deliver practical results in a collaborative manner.

An Environment Agency spokesperson said: “We continue to take tens of thousands of water quality samples every year as part of our work to keep rivers clean. In recent years technological advances and increased efficiency has enabled us to concentrate our resources, and target areas where the environment will benefit most.”

“We’ve had seven housing ministers in the last five years and none of them have sorted it out.”

Dave Doyle www.bristolpost.co.uk

The cost of private home rental in our region grew by the fastest rate ever in the twelve months up to June, Bristol Live can reveal. Prices were 4.1 percent higher in June of 2022 than in June of 2021 – the largest year-on-year increase since comparative records began in 2006.

Taking the twelve months to July 2022, private rental prices had risen by 4 percent – the third largest rise of any UK region. Only the East and the East Midlands saw faster increases, of 4.1 and 4.3 percent respectively.

The record-breaking hike in home rental came at the same time that workers across Britain saw their regular pay fall by 3 percent, according to separate figures from the Office for National Statistics (ONS).

Ashley Day is the founder and director of Bristol Property Centre, an award-winning independent letting agent based in Redland. He called the average rise of 4.1 percent “quite modest”, suggesting that prices had jumped by much more in many cases.

“I’ve run BPC for ten years and supply has never been like this,” said Ashley. “Some tenants are offering up to £100 more than the landlord is asking for.”

The difficulty and expense of renting in the city is a popular topic amongst members of the Reddit forum r/Bristol, as suggested by the title of the weekly general discussion thread: “Buying, selling, moving, renting, lost property and general chat should go here.”

“I would say it’s an average price, not the best deal but equally nothing super high,” replied Party-Efficiency7718. “Good value in the current market I’d say in that location. Unfortunately, the market is messed up.”

“Just been notified that our rent is going from [£1,400] per month to [£1,900] in Horfield, and I am in disbelief,” wrote user Beardy_Will, in another thread. “Landlord reckons it is reasonable as the local letting agents told him to charge [£2,000]. Of course they tell him that as it is in both their interests to do so.”

Jeetz88 replied: “I really struggle to understand how they can justify a massive rent increase just cos some other locals are charging more. Pure greed.”

Spiralling rents come down to supply and demand, the property expert explained. “There’s simply not enough property,” he said. “There was a time we were advertising 30 properties in a month – at the moment it’s about 10 or 15.”

Many landlords are selling up due to changing regulations, which are making it less profitable to let. “Landlords can’t claim back the interest on their mortgages any more,” said Ashley. “It’s perhaps one of the only businesses in the country where they can’t claim back a legitimate business expense.

“They are also talking in Parliament about making the minimum energy efficiency band C, so landlords are exiting before they have to spend to bring property up to that standard. It can be very expensive, especially in older properties.”

He added that some landlords are capitalising on a buoyant post-pandemic sales market, cashing out and further reducing the stock of housing available in the city. And there is very little renters can do about it.

“There isn’t a situation I can see where people are going to be renting in Bristol for what you might call a reasonable amount,” said Ashley. “You can look at areas slightly further out, like Mangotsfield or Warmley, but it’s still very competitive out there.”

He added: “Try and stay where you are, if you can. If I was a tenant now, I’d probably come armed to a viewing with a tenant CV which you can hand to the agent. And offer what you feel you can afford – but don’t go beyond your means.”

The solution to the situation is “supply, supply, supply,” Ashley says. “There’s not enough student housing, so students are coming into the private sector. The council aren’t building enough social housing, and the private sector is shrinking because landlords are selling.

“We’ve had seven housing ministers in the last five years and none of them have sorted it out.”

Investigations have begun after a South West construction went bust leaving hardly any cash to pay £15m in debts and a huge black hole in its pension fund. Liquidators sorting out the affairs of Henry W Pollard and Sons Ltd, which had been in business for 161 years before it went belly up in 2021, have sent a confidential report on the directors’ behaviour to the Government.

Remember the £60million collapse of Midas – Owl

William Telford www.devonlive.com

Furthermore, the liquidators, at South West accountancy and business consultancy Bishop Fleming LLP, revealed, in documents filed at Companies House, that they are also probing “alleged pension-related misrepresentations in the company’s financial statements.” The company’s pension scheme is owed £4,954,000.

The documents revealed the liquidators have recovered pension documents from the company’s books and records, and from relevant third parties but, as of July, were awaiting further information. Meanwhile they have sent a report to Whitehall, under the Company Directors Disqualification Act 1986, and said: “We can confirm that we have submitted a report on the conduct of directors of the company to the Department for Business, Energy and Industrial Strategy. As this is a confidential report we are unable to disclose the contents.”

Pollard, which had worked across the region, ceased trading and entered creditors’ voluntary liquidation in July 2021 leaving buildings such as Plymouth’s £13m Teesra House apartment block in limbo. The business was headquartered in Bridgwater but had a key office in Plymouth, where it opened a base at Millbay’s Cargo building in 2015. Pollard had also been leasing three units at Queen Anne Place, Cattedown and documents reveal it owes cash to small firms throughout Devon and Cornwall.

The newly published joint liquidators’ annual progress report reveals that assets of nearly £1m have been collected so far and two freehold properties are on the market. One secured creditor, a bank, has been paid £400,000 from cash in the Pollard bank account, and claims from ordinary preferential creditors, 29 employees, have been dealt with. A claim from HM Revenue and Customs for £256,145 in taxes is being reviewed but it is expected this will be paid.

But it is estimated by the liquidators that there will be just £612,563 available for unsecured creditors, meaning they will get just 4p in the £1. If this turns out to be the case it means the pension fund, for example, would receive only £198,160 of the near £5m it is short.

Pollard’s statement of affairs indicated there were 265 unsecured creditors whose debts totalled about £8.7m. But liquidators have already received claims totalling about £15.25m from 196 creditors.

In the progress report the liquidators said: “The significant difference in value relates, principally to four claims totalling about £5m which pertain to live contracts and which had not been incorporated within the directors’ statement of affairs.”

Out of the unsecured creditors, trade creditors are claiming £4,482,999, employees want £182,368, Somerset District Council is owed £1,089,150, and contract counterclaims amount to £4,542,728. When the pension scheme deficit of £4,954,000 is added in it brings the total to 15,251,245.

The liquidators said it is not known how much cash they will be able to collect, and said: “The extent to which retentions and book debts are recoverable is entirely uncertain at this stage.” Future legal costs and fees are unknown at the moment too.

Other documents filed at Companies House have revealed that many of the unsecured claimants are small and mid-sized companies spread across the South West. Among the dozens of companies owed money are Plymouth firm XCAV8 (SW) Ltd, which is claiming £130,181; Bridgwater’s Blake Joinery Co, owed £221,950; Plymouth’s Beaumont Drylining Ltd, owed £97,595; another Plymouth firm, PCB Electrical Service, which is claiming £134,393; and DMH Interiors, in Weston Super Mare, which is £105,243 short.

The smallest claim is for £17 but most are for hundreds or thousands of pounds, and they come from companies in the aforementioned towns and cities and in Bristol, Exeter, Newton Abbot, Tavistock, Bath, Taunton, Saltash, Torpoint, St Austell and Swindon, among many places in the South West, and even from outside the region, including companies in Birmingham, Bolton, Coventry and Manchester.

Pollard had been involved in multi-million pound building projects throughout the West Country and was in profit before the coronavirus pandemic and had a healthy turnover, but the administration of an important client in 2019 left it £715,000 out of pocket.

Among projects Pollard worked on was Kingsditch Industrial Units in Cheltenham, and it was working on Weston Mews townhouses in Bath, Alexander House care home in Exeter, and the eight-storey Teesra House block, at Mount Wise in Plymouth, was close to completion but still covered in scaffolding at the time of the Pollard collapse.

Pollard directly employed about 50 people and its most recent results revealed turnover of £24m, up 20%, in 2020 and a profit of £170,888. That was before the Covid pandemic, although accounts released in January 2021 said the firm has been able to maintain work at all its sites and was tendering for £40m of contracts.

Chris Philp, the new chief secretary to the Treasury, is facing questions over his financial interests, after it emerged he still has a substantial stake in a property finance group and is director of an investment company.

Out with the old orthodoxy and in with the new? Nothing new in questionable links between Tories and business. – Owl

Rowena Mason www.theguardian.com

Philp, who is the chancellor’s deputy and sits in the cabinet, is a member of a partnership that owns Pluto Finance, which offers multimillion pound loans to property developers.

It has provided loans for developments including £260,000+ “pocket” flats in Croydon and luxury blocks in the City of London whose developers earlier this year applied for an exemption to avoid having to offer affordable housing.

In his government job, Philp has responsibility for Treasury spending policy in relation to housing and planning.

The Treasury declined to say whether Philp would be required to sell off his interests, put them in a blind trust or be recused from discussions on housing policy.

Asked how Philp would be managing his financial interests, a government spokesperson said: “The ministerial code sets out the process by which ministers, following their appointment to a new role, should declare and manage their interests, working with their permanent secretary. The chief secretary to the Treasury is now going through this process in line with the ministerial code, following his appointment just last week.”

The Treasury is currently without a permanent secretary, after Tom Scholar was removed from his post by the chancellor, Kwasi Kwarteng, last week. The role is now being shared by two acting directors, Beth Russell and Cat Little.

According to the register of members’ interests, Philp has a shareholding of more than 15% and is a partner in Pluto Partners LLP, Pluto Silverstone Co Invest LLP, Pluto Monza Co Invest LLP, Pluto Development Partners LLP, and Pluto Capital Management LLP.

Pluto Partners is ultimate owner of Pluto Finance (UK) LLP, a firm that arranges loans for property developers.

It is also part owned by the Universities Superannuation Scheme as well as other members of the partnership.

Philp is also a director of an investment, consultancy and advisory company that he fully owns, Millgap Ltd. It is understood that Philp considers it to be not actively trading, although it is still registered as active at Companies House and is not recorded as dormant on the MPs’ register of interests or the list of ministerial interests from May this year.

His promotion to chief secretary of the Treasury comes at a time when Liz Truss and Kwarteng are prioritising growth above all other concerns.

Truss also appointed another businessman, Andrew Griffith, a former Sky executive, to financial secretary to the Treasury, but he has given up his interests in business since entering parliament.

However, Philp is not the only minister sitting in cabinet who has retained substantial business interests. Jacob Rees-Mogg, the business secretary, still has a stake in Somerset Capital Management, an investment firm that he co-founded.

The practice of allowing ministers to retain substantial business interests appears to have increased under Boris Johnson’s government. Previously, ministers would have expected to sell substantial stakes in companies and give up directorships, or put them immediately in blind trusts.

The ministerial code states that it is the personal responsibility of each minister to decide whether and what action is needed to avoid a conflict or the perception of a conflict, taking account of official advice from the permanent secretary and the adviser on ministerial interests. Truss has indicated, however, that she may not appoint a new adviser on ministerial interests following the resignation of Sir Christopher Geidt.

This is what a libertarian government looks like – Owl

The UK government could scrap its entire anti-obesity strategy after ministers ordered an official review of measures designed to deter people from eating junk food, the Guardian can reveal.

(In the 2019 survey, it found that 28.0% of adults in England were obese and a further 36.2% were overweight, making a total of 64.2% who were either obese or overweight.)

Denis Campbell www.theguardian.com

The review could pave the way for Liz Truss to lift the ban on sugary products being displayed at checkouts as well as “buy one get one free” multi-buy deals in shops. The restrictions on advertising certain products on TV before the 9pm watershed could also be ditched.

The review, commissioned by the new health secretary, Thérèse Coffey, is seen as part of the prime minister’s drive to cut burdens on business and help consumers through the cost of living crisis.

Whitehall sources said the review was “deregulatory in focus” and is expected to lead to the new government jettisoning a raft of anti-obesity policies inherited from Boris Johnson, Truss’s predecessor in Downing Street.

It will also look at possibly ditching calorie counts on menus in many cafes, takeaways and restaurants – designed to encourage people to choose healthier dishes – which only became mandatory in April.

The review is so radical in scope that it may even look at whether the sugar tax, which began in 2018 and has helped make soft drinks much less unhealthy, should go too. Health experts have hailed the levy as a key initiative in the fight against dangerous obesity.

“There doesn’t seem to be any appetite from Thérèse for nanny state stuff,” one source said. Truss also made Coffey her deputy prime minister after taking office last week.

Officials at the Office for Health Improvement and Disparities, the part of the Department for Health that formulates policies to tackle major public health problems, were said by a source to be “aghast” at the prospect of Truss potentially discarding strategies to counter junk food that have been agreed and approved by parliament.

Almost two-thirds of adults Britons are overweight or obese. Obesity costs the NHS an estimated £6.1bn a year to treat because it is an increasingly common cause of cancer, diabetes, heart conditions, painful joints and other health problems.

Johnson decided to make tackling foods high in fat, salt or sugar a personal priority as a result of his own admission to intensive care with Covid-19 in April 2020. A large majority of people who have needed life-saving care after becoming infected during the pandemic had high levels of excess weight, studies have shown.

The Obesity Health Alliance, a grouping of 50 health charities and medical organisations, said setting aside the government’s main weapons against obesity would be “a kick in the teeth”.

“We are deeply concerned. It would be reckless to waste government and business time and money rowing back on these obesity policies, which are evidence-based and already in law. These policies are popular with the public, who want it to be easier to make healthier choices,” said Katharine Jenner, the alliance’s director.

The unpublicised review has also provoked unease in Conservative ranks. James Bethell, a health minister until last year, said such a major U-turn could exacerbate Britain’s obesity problem. He challenged Truss’s apparent rationale for contemplating such an unexpected departure, which is that it would cut red tape faced by business and help promote economic growth – her key priority and the focus of the chancellor Kwasi Kwarteng’s emergency mini-budget, expected next week.

“Improving the nation’s health is one of the best ways we can increase productivity and workforce capacity and thereby drive growth. So I would be very surprised by any decisions that actually strive to make the UK less heathy,” the Tory peer said.

Truss pledged during the Tory leadership campaign to light a bonfire of obesity rules if she won. “Those taxes are over. Talking about whether or not somebody should buy a two-for-one offer? No. There is definitely enough of that,” she told the Daily Mail last month.

“What people want the government to be doing is delivering good roads, good rail services, making sure there’s broadband, making sure there’s mobile phone coverage, cutting the NHS waiting lists, helping people get a GP appointment. They don’t want the government telling them what to eat”, she added.

A leading health campaigner, who did not want to be named, said Truss’s readiness to abandon the approach to obesity was “ideological” and driven by her belief in minimal regulation of business.

Johnson legislated to ban junk food ads on TV before 9pm and online, multibuy deals, and sweet treats at checkouts, aisle ends and entrances in supermarkets. The measures were due to affect a wide range of foods such as snacks, breakfast cereals, pizzas, cakes, confectionery and desserts.

However, in May he delayed until 2023 and 2024 the introduction of all but the last measure, which is due to take effect on 1 October, subject to the review, citing soaring inflation and the pressure on families’ budgets as the reason.

That move led Jamie Oliver to stage a protest at Downing Street. The celebrity chef said: “To use cost of living as an excuse is wrong. It [action on obesity] is absolutely urgent and the excuses that he’s used for not doing it are absolutely not true.”

The Department of Health has been approached for comment.

“During today’s hearing it was revealed that the Independent Office of Police Conduct had made a request to the Office of the Police and Crime Commissioner to “record and refer” a conduct matter in regards to the Chief Constable in their corporate sole under the Health and Safety at Work Act. However, it was noted during the hearing that the commissioner had declined this and the IOPC chose to refer the matter to themselves.”

(Devon and Cornwall police are facing a criminal investigation into alleged breaches of health and safety rules before the Plymouth mass shooting. Police sources emphasised that no individual faced criminal investigation. A “corporation sole” is a legal entity consisting of a single incorporated office. See report in national press)

Lisa Letcher www.devonlive.com

A watchdog investigation has been launched into Devon and Cornwall Police following the mass shooting in Plymouth last summer. The IOPC is investigating over potential breaches of health and safety legislation.

It related to the running of its Firearms Licensing Unit prior to the mass shooting in Keyham, in which five innocent people lost their lives. Jake Davison, 22, killed his mother Maxine, 51, after a row and then shot dead four others in a 12-minute attack.

The pre-inquest review (PIR) into the deaths of the five people murdered in Keyham on August 12, 2021 was held earlier today (September 13) at Plymouth Crown Court with the aim of preparing for the full hearing. That will now take place on January 17 next year.

During today’s hearing it was revealed that the Independent Office of Police Conduct had made a request to the Office of the Police and Crime Commissioner to “record and refer” a conduct matter in regards to the Chief Constable in their corporate sole under the Health and Safety at Work Act. However, it was noted during the hearing that the commissioner had declined this and the IOPC chose to refer the matter to themselves.

In a statement released after the hearing, a spokesperson for the Independent Office of Police Conduct said: “We can confirm we have begun an investigation into Devon and Cornwall Police for potential breaches of health and safety legislation in the running of its Firearms Licensing Unit prior to the mass shooting in Plymouth in August last year.

“At the conclusion of our investigation into the force’s granting of a shotgun certificate and later return to Jake Davison of a shotgun, we sought specialist legal advice and have since decided to conduct a criminal investigation. Our investigation will examine whether the Office of the Chief Constable of Devon and Cornwall Police, as corporation sole, may have committed any offences contrary to the Health and Safety at Work etc. Act 1974. We have advised the force, the Police and Crime Commissioner, the Coroner and families of our decision.”

A statement in response, from Devon and Cornwall Police’s assistant chief constable, Jim Nye, said: “Devon and Cornwall Police’s thoughts remain with those families, victims and survivors a year on from the events of August 2021 in Keyham. Throughout the last year the Force has co-operated fully with the IOPC investigation, the coronial process and commissioned an independent review of the Force’s firearms licensing procedures by Durham Constabulary.

He continued: “We are aware of the latest developments from the IOPC investigation and continue to co-operate fully with them, while considering next steps the Force may choose to take on this matter. The Force notes this development is in its early stages and no determination in terms of potential corporate culpability has been decided.

“We continue to respect the coronial process in preparation for a full inquest in January 2023.”