“I don’t think there is a way out.”

It’s breathtaking to hear that judgement on Liz Truss’ problems from a seasoned former Conservative when the prime minister has not been in charge for a month.

By Laura Kuenssberg www.bbc.co.uk

But instead of a honeymoon Liz Truss’s first weeks in office have resembled a horror film.

A crash in the pound, since recovered, a crash in the polls and the Bank of England having to pump billions into the markets to stop pensions being wiped out.

Tory MPs tell me about phone calls from constituents who are in tears – fearful of losing their homes or businesses as borrowing costs soar.

And those higher costs – and inflation – will hit the government hard, bringing the prospect of dramatic spending cuts.

So instead of anticipating their new leader taking the stage in triumph at the Conservative Party conference this week, the question many MPs and members of the public are asking is how can Liz Truss – who is on our show this week – get out of this mess?

Does she ditch her plans? Stick firmly to the script? Or muddle through?

First, remember what happened to prompt the last wild week.

The government announced a hugely expensive package to freeze energy prices before following that up with a promise of chunky tax cuts that gave back more money to the wealthiest people in the country.

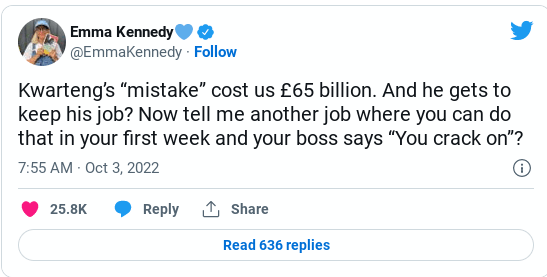

But what they crucially did not do was show how they planned to pay for it – by refusing to publish an assessment from the Office for Budget Responsibility – which examines the government’s tax and spending plans. And on our programme last week, Chancellor Kwasi Kwarteng suggested there would be more tax cuts to come.

Of course, there’s a healthy political debate about the rights and wrongs of those policies on their own. But what financial markets detest is the notion of spending and borrowing at huge levels without spelling out how and when the bills will be paid.

As one weary sounding Tory MP put it: “The problem wasn’t the numbers, it was that there weren’t any.”

It’s perfectly normal for governments to borrow billions of pounds from the markets but the reaction last week suggested the City had precious little faith that the government’s plans added up.

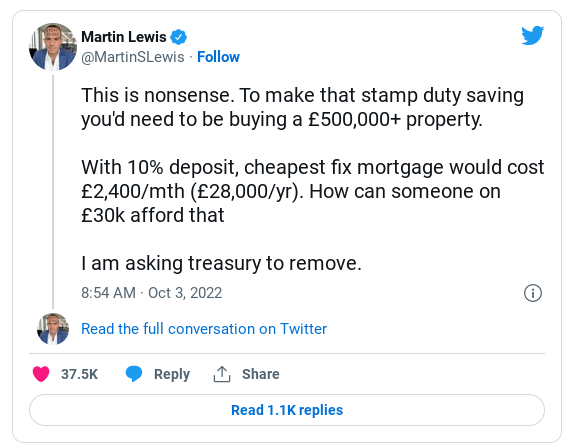

That’s toxic, because without that confidence, it makes it more expensive for the government to borrow the cash it needs. That makes the cost of loans and mortgages go up for everyone and could mean less money for public services too.

One party insider says that the hit to the Tories’ reputation for running the economy could have “all the hallmarks of a generation-defining setback”.

But all the signs are that the prime minister has zero intention of shifting an inch on this. Here’s what her supporters have told me:

- One cabinet minister: “They have to stick to it now – the idea there can be a volte-face, forget it”

- A minister: “She’s trying to change the direction of the country – the issues are the day to day handling of the politics”

- A Truss backer: “‘What’s happening is a political loss of nerve – it’s entirely within our gift to recover it”

Yet No 10 faces a double nightmare of trying to recover economic and political credibility at the same time. Can they really do nothing?

The head of a large foreign investor said the UK was now “uninvestable”. Trying to keep calm (ish) and carry on just may not be possible.

The pound has recovered much of its losses but it seems a tall order for confidence to bounce back in the same way.

The last week suggests there are serious doubts about the chancellor’s strategy. As one senior investor told me: “I don’t know a single person in the City who thinks he knows what he is doing.”

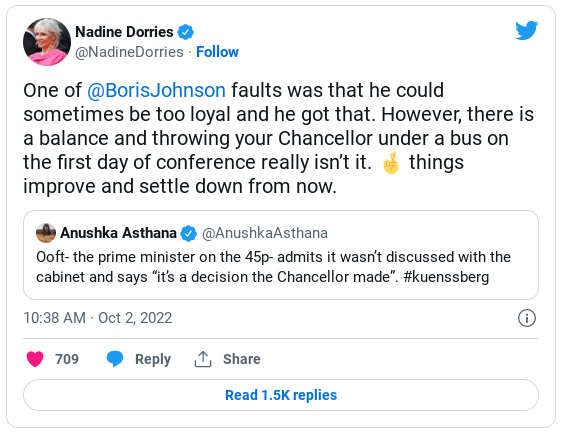

Politicians I’ve spoken to – fans of the new government or not – suggest moving Mr Kwarteng would be “cowardly” or “wouldn’t make a difference”.

Liz Truss is politically close to her chancellor and a major move like that could cause even more instability. But there is no doubt that No 11’s authority is part of the problem.

A source close to Mr Kwarteng says “we make no apology for reversing an unsustainable high tax path”. But a cabinet minister told me while there’s no chance of an exit now “history shows that chancellors who have moments like this don’t necessarily survive in the medium to long-term”.

While it’s clear neither No 10 nor No 11 will consider a change of approach right now their own party may force them to make some changes so they can muddle through.

First off, there is a rising hunger for ministers to bring forward their full plans for the economy, including spelling out the costs and consequences of their spending.

As things stand No 10 is adamant this won’t be until 23 November. But plenty of backbenchers want it brought forward. One minister suggested the government will have to budge before November, saying: “Give the markets what they want with some more detailed forecasts and some attempt to show that this will work.”

There’s a thirst too to bring forward announcements of the other changes the government wants to make to get the economy going. One senior MP said the chancellor has a chance this week to talk about his “big productivity plans” to show “it’s a wider package, not just tax cuts”.

But the government may yet have to ditch some of its ideas. “They’ll have to walk back some of the things that have caused the most offence,” says an MP.

This could be scrapping the 45% top tax rate which I’m told the whole cabinet was not consulted on and which raised the most eyebrows in the mini-budget.

And it’s clear many Conservative MPs would be reluctant to back it, with one telling me: “If there is a vote on 45p or bankers’ bonuses I won’t vote for them, and neither will colleagues.”

There is growing unease too about the costs and implications of the decisions that have already been made for public spending, and specifically about the possibility of going back on Boris Johnson’s promise that benefits would rise in line with inflation.

One former minister told me the idea was “stupidity squared” because cutting tax for the best-off while giving those on benefits a real-terms cut is a total political non-starter.

Another senior figure predicts a classic climbdown where the government will stick to cutting the basic rate of tax with the classic promise to “consult” on the more controversial elements.

But what if Ms Truss can’t or won’t budge’?

Several MPs say one approach to get the government’s attention would be a kind of strike. They could make it plain the government doesn’t have backbench support by not turning up in the Commons.

But others are already contemplating even more. Extraordinary as it is to say this so soon into a new leader’s tenure, there are already conversations in the party about taking the ultimate action. In other words, if the PM won’t change her plans, her party might have to change her job.

One MP told me baldly in the last week: “They have lost the privilege of governing – I’m going to try and get rid of her.”

A former minister said there was a lot of “bluster and chest-beating” going and talk of removing the PM was “hysteria”, but added: ‘Four weeks of polls like this and we might move.”

Crazy? Perhaps. Wild talk in Westminster is often subdued by inertia. Things change quickly. There are many Conservatives who believe Liz Truss’ plans are an important and badly needed reset.

But if the Tories carry on being battered in the polls, and the market turmoil continues for weeks, all bets could be off.

And if it becomes a question of personal survival, arguably Liz Truss may not have helped her case by giving all the plum jobs to MPs who backed her in the leadership contest.

Remember she wasn’t the favourite choice of MPs to start with. As one senior figure reflects: “There is already a cohort of people who are saying ‘this is nothing to do with us’.”

Liz Truss has a huge chance in Birmingham this week to calm her party, the country and the financial markets, as well as explaining more clearly what she is trying to achieve.

And while there is no remote sense she will backtrack on her ambitions, these first steps in power have created serious doubts in her party, and among the public, about whether she has the right ideas and the backing to make radical changes to the country. Downing Street could very, very quickly become a lonely place.