- Variation of condition no. 2 (approved plans) of planning permission 20/0346/FUL to enable the use of green technology to be added to the conversion. The amendments are for the addition of solar panels and an air source heat pump to the project, rather than using an oil fuelled heated system.

Lower Marsh Farm Marsh Green Exeter EX5 2EXRef. No: 23/0184/VAR | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

Lower Marsh Farm Marsh Green Exeter EX5 2EXRef. No: 23/0184/VAR | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Variation of condition no. 2 (approved drawing conversion of first floor storage holiday flat with amended ground floor access (22/0565/FUL, 22/0599/LBC) to be replaced with submitted plans.

Strand House The Strand Lympstone Exmouth EX8 5EYRef. No: 23/0194/VAR | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

Strand House The Strand Lympstone Exmouth EX8 5EYRef. No: 23/0194/VAR | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Internal alterations to shop unit, maisonette refurbishment and demolition of dilapidated rear extension to form in-fill extension with flat roof over

Crane And Kind Market Place Sidmouth EX10 8ARRef. No: 23/0192/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

Crane And Kind Market Place Sidmouth EX10 8ARRef. No: 23/0192/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Proposed front, rear and first floor extension, including garage to side and rear balcony and internal alterations.

43 Halsdon Avenue Exmouth EX8 3DWRef. No: 23/0179/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

43 Halsdon Avenue Exmouth EX8 3DWRef. No: 23/0179/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Copper beech – 2m crown reduction. Root extent – application of 8m3 of composted wood-chip mulch to surface; vertical mulch: 3cm deep x 4cm diameter back-filled , composted wood-chip mulch at 3cm intervals. Application of 50kg of slow-release organic fertiliser..

7 Glebelands Uplyme Lyme Regis DT7 3TBRef. No: 23/0173/TRE | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

7 Glebelands Uplyme Lyme Regis DT7 3TBRef. No: 23/0173/TRE | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Demolition of existing garage extension and construction of replacement extension and modifications to the bathroom extension.

Pump Farm Whitford Axminster EX13 7NNRef. No: 23/0167/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision

Pump Farm Whitford Axminster EX13 7NNRef. No: 23/0167/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision - Demolition of existing garage extension and construction of replacement extension and modifications to the bathroom extension.

Pump Farm Whitford Axminster EX13 7NNRef. No: 23/0168/LBC | Validated: Thu 26 Jan 2023 | Status: Awaiting decision

Pump Farm Whitford Axminster EX13 7NNRef. No: 23/0168/LBC | Validated: Thu 26 Jan 2023 | Status: Awaiting decision - Replacement single storey rear extension.

40 Tyrrell Mead Sidmouth EX10 9TPRef. No: 23/0171/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

40 Tyrrell Mead Sidmouth EX10 9TPRef. No: 23/0171/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Permanent agricultural workers dwelling

Stable Roost Sheldon Honiton EX14 4QWRef. No: 23/0154/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

Stable Roost Sheldon Honiton EX14 4QWRef. No: 23/0154/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Change of use from C1 hotel to C3 for the purposes of rented self-catering holiday accommodation

The Orchard Country Hotel Rousdon Lyme Regis Devon DT7 3XWRef. No: 23/0162/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

The Orchard Country Hotel Rousdon Lyme Regis Devon DT7 3XWRef. No: 23/0162/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Proposed 2 storey side extension.

1 Littletown Road Honiton EX14 2DGRef. No: 23/0157/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

1 Littletown Road Honiton EX14 2DGRef. No: 23/0157/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Construction of hip to gable extension, front and rear dormer windows and installation of side window

15 Prestor Axminster EX13 5BRRef. No: 23/0161/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

15 Prestor Axminster EX13 5BRRef. No: 23/0161/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Construction of PVC extension to rear of property. Solid roof construction. PVC windows / door frames. Rendered external masonry.

Rull Cottage Payhembury Honiton EX14 3JQRef. No: 23/0153/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision

Rull Cottage Payhembury Honiton EX14 3JQRef. No: 23/0153/FUL | Validated: Fri 27 Jan 2023 | Status: Awaiting decision - Certificate of proposed lawfulness for development of an outbuilding incidental to the enjoyment of the dwellinghouse at Southtown House, Sowden Lane, Lympstone.Southtown House Sowden Lane Exmouth EX8 5ADRef. No: 23/0140/CPL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

- Creation of three off-street parking spaces

Highfield House Combe Raleigh Devon EX14 4THRef. No: 23/0141/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Highfield House Combe Raleigh Devon EX14 4THRef. No: 23/0141/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Proposed single storey rear extension

35 Woodville Road Exmouth EX8 1SWRef. No: 23/0142/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

35 Woodville Road Exmouth EX8 1SWRef. No: 23/0142/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Change of use to unfettered class E

Unit 35 Skypark Clyst Honiton Exeter EX5 2GERef. No: 23/0143/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Unit 35 Skypark Clyst Honiton Exeter EX5 2GERef. No: 23/0143/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Proposed alterations to Byways including new balcony and roof terrace, re-roofing swimming pool and amendments to windows.

Byways Green Lane Exton Exeter EX3 0PWRef. No: 23/0144/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Byways Green Lane Exton Exeter EX3 0PWRef. No: 23/0144/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - To construct a new dormer window above the garage on the rear side, and construct a single storey, ground floor rear extension behind the garage.

3 Withalls Gardens Greenhill Avenue Lympstone EX8 5JHRef. No: 23/0145/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision

3 Withalls Gardens Greenhill Avenue Lympstone EX8 5JHRef. No: 23/0145/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision - Detailed application for the construction of a manure storage building

Coryton Farm Kilmington Axminster Devon EX13 7RERef. No: 23/0147/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Coryton Farm Kilmington Axminster Devon EX13 7RERef. No: 23/0147/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Detailed application for the construction of a manure storage building

Coryton Farm Kilmington Axminster Devon EX13 7RERef. No: 23/0148/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Coryton Farm Kilmington Axminster Devon EX13 7RERef. No: 23/0148/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Detailed application for the construction of a manure storage building

Coryton Farm Kilmington EX13 7RERef. No: 23/0149/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Coryton Farm Kilmington EX13 7RERef. No: 23/0149/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Detailed application for the construction of a manure storage building

Coryton Farm Kilmington EX13 7RERef. No: 23/0150/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Coryton Farm Kilmington EX13 7RERef. No: 23/0150/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Two storey side extension

Glebe Stables Southleigh Colyton EX24 6SDRef. No: 23/0139/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Glebe Stables Southleigh Colyton EX24 6SDRef. No: 23/0139/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Single-storey rear extension.1 Sanson Close Stoke Canon Devon EX5 4AQRef. No: 23/0146/CPL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

- Erection of a manure store

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0137/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0137/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Erection of a manure store

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0136/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0136/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Erection of a manure store

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0134/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0134/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Screening opinion for residential development

Land Adjacent To Harepath Road Seaton Devon EX12 2WHRef. No: 23/0002/EIA | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Land Adjacent To Harepath Road Seaton Devon EX12 2WHRef. No: 23/0002/EIA | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - 1x Scots pine: fell.

Chowns Cottages Parsonage Way Woodbury Devon EX5 1HYRef. No: 23/0131/TCA | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Chowns Cottages Parsonage Way Woodbury Devon EX5 1HYRef. No: 23/0131/TCA | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - Change of use of land from agriculture to equestrian and construction of menage. Change of use only of agricultural building to equestrian to provide stables (no physical works proposed to building).

Lavenders Branscombe Seaton EX12 3BLRef. No: 23/0130/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Lavenders Branscombe Seaton EX12 3BLRef. No: 23/0130/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - Proposed agricultural building to cover existing silage clamp

Lower Westcott Farm Talaton Exeter EX5 2RNRef. No: 23/0129/AGR | Validated: Mon 23 Jan 2023 | Status: Decided

Lower Westcott Farm Talaton Exeter EX5 2RNRef. No: 23/0129/AGR | Validated: Mon 23 Jan 2023 | Status: Decided - Proposed residential loft conversions to include new dormer windows to the front elevation, rear extension to 3rd floor, new balconies to the front elevation and internal alterations.

8B, 8C, 9B & 9C Trafalgar House Mamhead View Exmouth EX8 1DSRef. No: 23/0128/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

8B, 8C, 9B & 9C Trafalgar House Mamhead View Exmouth EX8 1DSRef. No: 23/0128/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - T36, Sycamore: crown reduction of 2-3m, removing all major deadwood and balancing the remaining canopy to around 16m in height, making dia. cuts less than 50mm

Fern House The Drive Farringdon Exeter EX5 2JDRef. No: 23/0138/TRE | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Fern House The Drive Farringdon Exeter EX5 2JDRef. No: 23/0138/TRE | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - Erection of a manure store

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0135/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Woodend Farm Shute Axminster EX13 7PTRef. No: 23/0135/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Proposed steel framed storage shed plus 2 x storage containers to stand beside shed.

Raxhayes Farm Holcombe Lane Ottery St Mary Devon EX11 1PQRef. No: 23/0121/AGR | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Raxhayes Farm Holcombe Lane Ottery St Mary Devon EX11 1PQRef. No: 23/0121/AGR | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Replacement rear extension, side porch and rear garden terrace.

84 Halsdon Avenue Exmouth EX8 3DHRef. No: 23/0124/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

84 Halsdon Avenue Exmouth EX8 3DHRef. No: 23/0124/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Application for a Certificate of Lawfulness to erect a polytunnel on a fifteen-acre farm.Stockers Farm Wick Honiton EX14 4TYRef. No: 23/0113/CPL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

- Repairs to roof and walls of outbuilding. Build new roof structure. Replace broken tiles with reclaimed. Rebuild collapsed stone walls and make good other walls using lime mortar. Replace rotten timber with black-painted, feather-edge boarding.

37 Church Street Sidbury Devon EX10 0SBRef. No: 23/0104/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision

37 Church Street Sidbury Devon EX10 0SBRef. No: 23/0104/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision - T1, Sycamore : re pollard to exsisting pollard points, to prevent failure of regrowth. T2, Ash tree : remove to ground level.

Myrtle Lodge Millford Road Sidmouth EX10 8DPRef. No: 23/0115/TCA | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

Myrtle Lodge Millford Road Sidmouth EX10 8DPRef. No: 23/0115/TCA | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Proposed first floor front dormer extension, raised decking and change of window, roof and dormer materials.

Whiteoaks Higher Marley Road Exmouth EX8 5DTRef. No: 23/0101/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Whiteoaks Higher Marley Road Exmouth EX8 5DTRef. No: 23/0101/FUL | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - Construction of new dwelling on land behind existing bungalow.

Happy Valley Wiggaton EX11 1PYRef. No: 23/0095/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Happy Valley Wiggaton EX11 1PYRef. No: 23/0095/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Extension to agricultural building

Nags Head Farm Nags Head Road Gittisham Honiton EX14 3AWRef. No: 23/0096/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision

Nags Head Farm Nags Head Road Gittisham Honiton EX14 3AWRef. No: 23/0096/FUL | Validated: Tue 24 Jan 2023 | Status: Awaiting decision - Conversion of outbuilding to residential use

Sutherlake Broadclyst EX5 3BLRef. No: 23/0087/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

Sutherlake Broadclyst EX5 3BLRef. No: 23/0087/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Conversion of outbuilding for holiday use.

Sutherlake Elbury Lane Broadclyst EX5 3BLRef. No: 23/0088/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision

Sutherlake Elbury Lane Broadclyst EX5 3BLRef. No: 23/0088/FUL | Validated: Thu 26 Jan 2023 | Status: Awaiting decision - Single storey rear extension

10 The Grove Sidmouth EX10 8ULRef. No: 23/0055/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

10 The Grove Sidmouth EX10 8ULRef. No: 23/0055/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Outline planning application (with details of access to be considered and all other matters reserved) for mixed use development comprising of up to 130 dwellings to the east of Harepath Road and the laying out of a new community football pitch, parking and welfare facilities to the west of Harepath Road, formation of accesses on Harepath Road and Colyton Road, public open space and other associated infrastructure.

Land Adjacent To Harepath Road Seaton Devon EX12 2WHRef. No: 22/2781/MOUT | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

Land Adjacent To Harepath Road Seaton Devon EX12 2WHRef. No: 22/2781/MOUT | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - A single storey side extension to replace the existing conservatory plus a two storey front extension

29 Brand Road Honiton Devon EX14 2FDRef. No: 22/2784/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

29 Brand Road Honiton Devon EX14 2FDRef. No: 22/2784/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision - Outline application with all matters reserved to demolish existing storage sheds and greenhouse and construct new two storey dwelling

1 Warren Close Payhembury Honiton EX14 3NARef. No: 22/2606/OUT | Validated: Mon 23 Jan 2023 | Status: Awaiting decision

1 Warren Close Payhembury Honiton EX14 3NARef. No: 22/2606/OUT | Validated: Mon 23 Jan 2023 | Status: Awaiting decision - Retrospective application to retain 1.8m fence to front of property, bordering turning area

Touch Wood 3 Hylands Close Higher Broad Oak Road West Hill Ottery St Mary EX11 1XJRef. No: 22/2253/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

Touch Wood 3 Hylands Close Higher Broad Oak Road West Hill Ottery St Mary EX11 1XJRef. No: 22/2253/FUL | Validated: Wed 25 Jan 2023 | Status: Awaiting decision

Daily Archives: 6 Feb 2023

Watch this entertaining simplified economics lecture end-to-end

Watch “The Plan Is To Make You Permanently Poorer | Aaron Meets Gary Stevenson” on YouTube

(Brought to Owl’s attention by two correspondents, one who referenced it in a recent comment.)

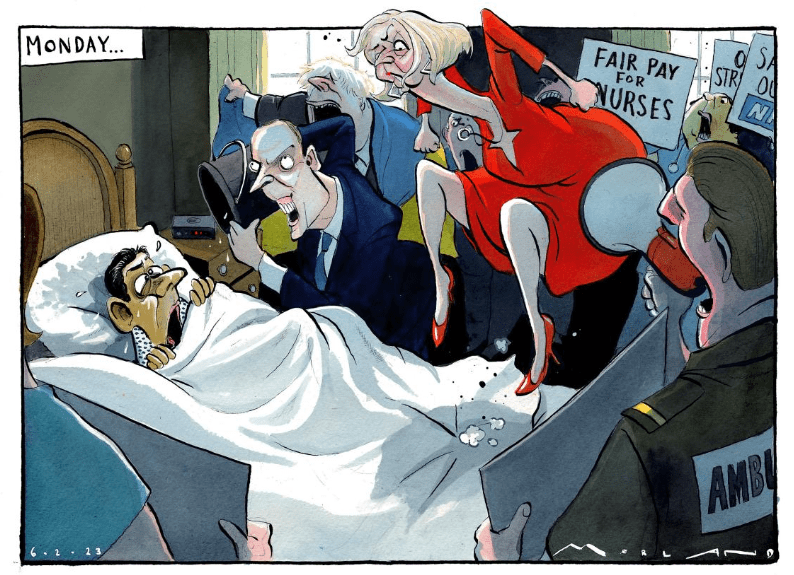

Just another Monday, same old nightmare

Liz Truss “didn’t listen”. Economists say the risks were clear

One of her former cabinet colleagues, Simon Clarke is reported to be still close to her and Boris Johnson. What mark did Simon Clarke leave on his ambitious PPS, our very own Simon Jupp, whilst both were dutifully, even enthusiastically, serving Liz on levelling up (for all of six weeks)? – Owl

Jessica Elgot www.theguardian.com

Senior economists and the former chancellor George Osborne have cast doubt over Liz Truss’s account that she was not warned about the risks to the UK economy as she prepared her mini-budget.

Truss, in her first major intervention since leaving office, wrote that she had “not [been] given a realistic chance to enact my policies by a very powerful economic establishment, coupled with a lack of political support”.

She said she had expected her mandate as prime minister to be respected but admitted mistakes had been made, including that the fallout from her mini-budget had left the UK close to not being able to fund its own debt.

The former prime minister said specifically that no officials in the Treasury had raised concerns about liability-driven investments, which pension funds use to cover their obligations. The Bank of England said pension funds with more than £1tn invested in them came under severe strain with a large number in danger of going bust.

But Dr Charles Read, an economist and proproctor at the University of Cambridge, said he had spoken to civil servants about the risk of a fast rise in interest rates and enclosed a paper sent to the then chancellor, Kwasi Kwarteng, on 8 September, a fortnight before the mini-budget. The Treasury acknowledged receipt of the letter.

“The argument of the paper was that if interest rates rise any faster than they were, Britain’s financial stability will be imperilled and there is likely to be another financial crisis stemming from systemic risks in the non-banking sector,” Read told the Guardian.

“Needless to say, it later emerged that the budget was explicitly designed to force the Bank of England to raise interest rates faster than it was by pushing up market interest rates further; to claim that they were not sent warnings that such a course of action would imperil financial stability is highly misleading and should be called out.”

Writing in the Sunday Telegraph, in the first of a series of interventions before the spring budget, Truss said scepticism about the growth potential of the British economy was “sadly endemic at the Treasury”, blaming pessimism as a barrier to changes.

However, one Whitehall source said there was a “difficult climate” to give advice during the preparations for the mini-budget, after Kwarteng had sacked the permanent secretary, Sir Tom Scholar.

Roger Bootle, the former chief economist for HSBC, said he had been broadly supportive of Truss’s agenda but said she should have realised how the markets would react.

“One of the things I think undid her plan, was that she hadn’t realised just how febrile the markets were … I don’t think she and the chancellor quite realised how different the market circumstances were,” he told GB News.

The former chancellor George Osborne said he agreed that the regulators should have anticipated some of the pension problems. But he said that was not the primary cause of Truss’s downfall. “She was brought down by the free market, the free market in government bonds,” he said. “And that bond market destroyed her government before, actually, the problems then emerged a few days later in those pension funds.

“She dismissed the economic establishment. She fired the permanent secretary at the Treasury. She went around telling everyone, as did her chancellor, that the Bank of England governor was useless. She didn’t consult the office … To then turn around and say ‘no one told me’, well I mean, she went out of her way not to listen.”

Asked about the essay on Sunday, the business secretary, Grant Shapps, said Truss’s mini-budget “clearly wasn’t the right approach” before the government had tackled inflation.

Shapps told Sky’s Sophy Ridge on Sunday programme: “You have got to deal with the fundamentals first. You have got to reduce inflation, which is the biggest tax cut anybody can have.

“I notice she said they hadn’t prepared the ground for these big tax changes. What you have got to do is deal with the big structural issues first, deal with inflation first, deal with debt, and then you look towards tax cuts.”

In the essay, which will be followed by an interview with the Spectator on Monday, Truss said she knew after sacking Kwarteng and reversing most of her positions that she would be unlikely to be able to stay as prime minister.

“Fundamentally, I was not given a realistic chance to enact my policies by a very powerful economic establishment, coupled with a lack of political support,” she said.

“I assumed upon entering Downing Street that my mandate would be respected and accepted. How wrong I was. While I anticipated resistance to my programme from the system, I underestimated the extent of it.”

The former Conservative party chair Sir Jake Berry told BBC One’s Sunday with Laura Kuenssberg that he did still agree with “Liz’s diagnosis of the disease that is facing the country and I think she accepts in this story that the prescription that we wrote – [for] which I have to take part of the blame – wasn’t delivered in the correct way.

“But I think her point of, we need to lower taxes, we need to create a growing economy, that’s what people want.”

Biden has revived democratic capitalism – and changed the economic paradigm

Required reading for Government and Whitehall – Owl

How can inflation be dropping at the same time job creation is soaring?

Robert Reich, www.theguardian.com

It has taken one of the oldest presidents in American history, who has been in politics for over half a century, to return the nation to an economic paradigm that dominated public life between 1933 and 1980, and is far superior to the one that has dominated it since.

Call it democratic capitalism.

The Great Crash of 1929 followed by the Great Depression taught the nation a crucial lesson that we forgot after Ronald Reagan’s presidency: the so-called “free market” does not exist. Markets are always and inevitably human creations. They reflect decisions by judges, legislators and government agencies as to how the market should be organized and enforced – and for whom.

The economy that collapsed in 1929 was the consequence of decisions that organized the market for a monied elite, allowing nearly unlimited borrowing, encouraging people to gamble on Wall Street, suppressing labor unions, holding down wages, and permitting the Street to take huge risks with other people’s money.

Franklin D Roosevelt and his administration reversed this. They reorganized the market to serve public purposes – stopping excessive borrowing and Wall Street gambling, encouraging labor unions, establishing social security and creating unemployment insurance, disability insurance and a 40-hour workweek. They used government spending to create more jobs. During the second world war, they controlled prices and put almost every American to work.

Democratic and Republican administrations enlarged and extended democratic capitalism. Wall Street was regulated, as were television networks, airlines, railroads, and other common carriers. CEO pay was modest. Taxes on the highest earners financed public investments in infrastructure (such as the national highway system) and higher education.

America’s postwar industrial policy spurred innovation. The Department of Defense developed satellite communications, container ships and the Internet. The National Institutes of Health did trailblazing basic research in biochemistry, DNA and infectious diseases.

Public spending rose during economic downturns to encourage hiring. Even Richard Nixon admitted “we’re all Keynesians”. Antitrust enforcers broke up AT&T and other monopolies. Small businesses were protected from giant chain stores. By the 1960s, a third of all private-sector workers were unionized.

Large corporations sought to be responsive to all their stakeholders – not just shareholders but employees, consumers, the communities where they produced goods and services, and the nation as a whole.

Then came a giant U-turn. The Opec oil embargo of the 1970s brought double-digit inflation followed by the Fed chair Paul Volcker’s effort to “break the back” of inflation by raising interest rates so high the economy fell into deep recession.

All of which prepared the ground for Reagan’s war on democratic capitalism.

From 1981, a new bipartisan orthodoxy emerged that the so-called “free market” functioned well only if the government got out of the way (conveniently forgetting that the market required government). The goal of economic policy thereby shifted from public welfare to economic growth. And the means shifted from public oversight of the market to deregulation, free trade, privatization, “trickle-down” tax cuts, and deficit-reduction – all of which helped the monied interests make more money.

What happened next? For 40 years, the economy grew but median wages stagnated. Inequalities of income and wealth ballooned. Wall Street reverted to the betting parlor it had been in the 1920s. Finance once again ruled the economy. Spurred by hostile takeovers, corporations began focusing solely on maximizing shareholder returns – which led them to fight unions, suppress wages, abandon their communities and outsource abroad.

Corporations and the super-rich used their increasing wealth to corrupt politics with campaign donations – buying tax cuts, tax loopholes, government subsidies, bailouts, loan guarantees, non-bid government contracts and government forbearance from antitrust enforcement, allowing them to monopolize markets.

Democratic capitalism, organized to serve public purposes, all but disappeared. It was replaced by corporate capitalism, organized to serve the monied interests.

Joe Biden is reviving democratic capitalism.

From the Obama administration’s mistake of spending too little to pull the economy out of the Great Recession, he learned that the pandemic required substantially greater spending, which would also give working families a cushion against adversity. So he pushed for the giant $1.9tn American Rescue Plan.

This was followed by a $550bn initiative to rebuild bridges, roads, public transit, broadband, water and energy systems. And in 2022, the biggest investment in clean energy in American history – expanding wind and solar power, electric vehicles, carbon capture and sequestration, and hydrogen and small nuclear reactors. This was followed by the largest public investment ever in semiconductors, the building blocks of the next economy.

Notably, these initiatives are targeted to companies that employ American workers.

Biden has also embarked on altering the balance of power between capital and labor, as did FDR. Biden has put trustbusters at the head of the Federal Trade Commission and the Antitrust Division of the justice department. And he has remade the National Labor Relations Board into a strong advocate of labor unions.

Unlike his Democratic predecessors, Biden has not sought to reduce trade barriers. In fact, he has retained several from the Trump administration. But unlike Trump, he has not given a huge tax cut to corporations and the wealthy. It’s also worth noting that in contrast with every president since Reagan, Biden has not filled his White House with former Wall Street executives. Not one of his economic advisers – not even his treasury secretary – is from the Street.

I don’t want to overstate Biden’s accomplishments. His ambitions for childcare, eldercare, paid family and medical leave were thwarted by senators Joe Manchin and Kyrsten Sinema. And now he has to contend with a Republican House.

Biden’s larger achievement has been to change the economic paradigm that has reigned since Reagan. He is teaching America a lesson we once knew but have forgotten: that the “free market” does not exist. It is designed. It either advances public purposes or it serves the monied interests.

Biden’s democratic capitalism is neither socialism nor “big government”. It is, rather, a return to an era when government organized the market for the greater good.

- Robert Reich, a former US secretary of labor, is professor of public policy at the University of California, Berkeley, and the author of Saving Capitalism: For the Many, Not the Few and The Common Good. His new book, The System: Who Rigged It, How We Fix It, is out now. He is a Guardian US columnist. His newsletter is at robertreich.substack.com

The only reason my economic plan failed is because the financial markets are full of communists, by Liz Truss

My economic plan for this country was a work of genius, and the only reason we are not reaping the rewards today is because the financial markets are run by communists and leftist ideologues.

My 2012 opus ‘Britannia Unchained’ laid the foundations for the mini-budget delivered by my new regime, so I fail to see how anyone could have been surprised by the contents. It was all there if any of you had been bothered to look.

I felt that an unprecedented cost of living crisis was the perfect time to introduce a budget that gave a totally unfunded tax cut to higher rate income tax payers, forced 120,000 people on benefits to try harder to get work or face sanctions, and scrapped a number of measures designed to bring in a little bit more tax from people who could afford it.

The only explanation for the catastrophe that followed is that city workers who trade in bonds and currencies are communists and left-wing ideologues who would rather see this country collapse in on itself rather than have give some real freedom to its people.

Scaredy cat risk-averse traders ruined everything, and they did it because of their politics. Not because they saw a disaster unfolding before them in that UK government bonds were no longer worth the paper they were written on and the pound was suddenly a very risky investment indeed, but because they knew their liberal ideals would be made to look like the nonsense they so clearly are if a genuine right-wing government was a success.

They had to ruin my plan, and so ruin it they did.

In years to come my plan to cut the taxes of the rich and make things harder for the poor during an unprecedented cost of living crisis will be seen as the nation’s biggest missed opportunity.

It is an economic philosophy from which I will never waver. I don’t care how many times we try it or how many times it goes disastrously, I will always believe that the next time we try the same thing it will work perfectly.

It’s the very definition of positive thinking.