“After March of 2025 the Government doesn’t have any spending plans.” [aka a scorched earth policy – Owl]

No 10 on collision course with Bank of England and OBR over economy

The Government is on a collision course with the Bank of England and Britain’s budget watchdog as they clash over whether or not the UK economy is on the up.

Hugo Gye, Callum Mason inews.co.uk

The Governor of the Bank warned that the UK was facing years of low growth while the Office for Budget Responsibility (OBR) said the Chancellor’s “vague” plans to cut spending put the public finances at risk.

But No 10 hit back at the warnings, pointing out that previous OBR forecasts have been too pessimistic and insisting that business views of the British economy are “very positive”.

Bank chief Andrew Bailey said this week: “If you look at what I call the potential growth rates of the economy, there’s no doubt it’s lower than it has been in much of my working life.” He suggested interest rates would stay high for an extended period of time to deal with stubborn inflation.

Speaking to MPs, the head of the OBR Richard Hughes said: “It is very difficult to assess the credibility of the Government’s spending plans, because after March of 2025 the Government doesn’t have any spending plans.” Jeremy Hunt has promised to limit growth in state spending after 2025 but has not explained how this will affect individual Whitehall departments.

Mr Hughes added: “In effect because he hasn’t provided any detail about the choices involved in delivering those numbers, we don’t know if they’re plausible or not… I think they are a very big fiscal risk, partly because they are so uncertain.”

In response to the warnings from the two institutions, a spokesman for Rishi Sunak said: “We’ve listened very carefully to the OBR and the Bank of England, but we are firmly of the view that the economy has turned the corner. We have halved inflation, and it is forecast to fall below 3 per cent next year.

“You’ll remember the OBR said a year ago, in the first part of this year the economy would shrink by 1 per cent, and obviously it has grown.

“The revisions we’ve seen mean the UK is now growing faster than France, Germany, Italy and Japan. We’ve recovered faster from the pandemic than France, Germany and Japan. The IMF predicts UK will grow faster than Germany, France, Italy, Japan.”

A No 10 source pointed to the promise by companies to invest an extra £30bn in Britain made at a summit this week, saying: “The Global Investment Summit showed what investors think of UK – the mood music was very positive.”

City Minister Bim Afolami urged regulators to be more pro-growth, telling a gathering of bankers on Tuesday: “If you’re regulating a market, in any area, there’s no point having the safest graveyard. Animal spirits need to be there, we need to innovate, we need to drive growth and initiative.”

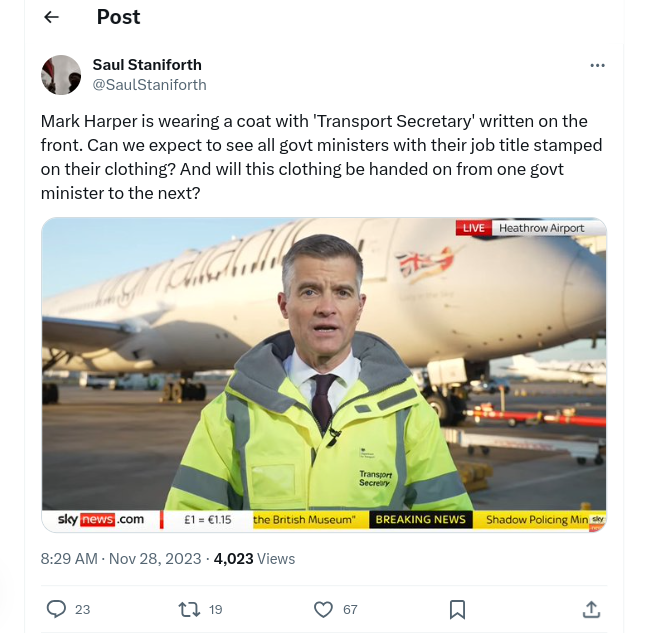

Transport Secretary Mark Harper added: “The forecast that we had last year said we were going to have a recession this year and actually the British economy turned out to be much stronger than that.”

A Treasury source insisted there was no split between the Government and the Bank of England on the need to tackle inflation despite the growing divide in rhetoric, saying: “We are more aligned in policy terms than we have been previously in the efforts to bring down inflation.”

Charles Goodhart, a former rate-setter at the Bank, said that Mr Bailey was right to warn markets of the risk that interest rates would have to stay at their current high level for at least another year.

He told i: “There is great uncertainty about events, particularly political events, in the next year. We do not know how the two major conflicts will develop. Moreover, the greater reliance on fixed mortgage deals means that the effect of tightening monetary policy now involves greater lags.

“So, there is considerable uncertainty about the likely rate of growth of demand and output. What Andrew Bailey is trying to prevent is markets coming to the conclusion now that rates will come down at some stage in 2024, because that would ease monetary policy unduly at this stage.”