“Economic optimism is increasing, consumer confidence is increasing, growth estimates are being raised.” (Six months ago)

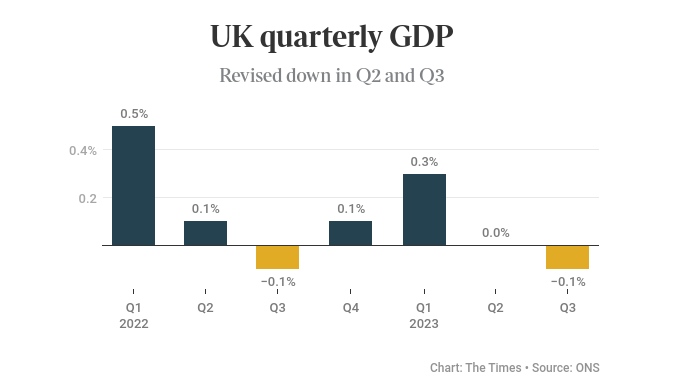

UK economy on brink of recession after growth falls

Economic growth performed worse than expected this year, with official figures for the last two quarters showing the UK is on the brink of a recession.

Mehreen Khan www.thetimes.co.uk

The Office for National Statistics (ONS) cut its initial growth estimates for gross domestic product (GDP) to a fall of 0.1 per cent in the third quarter, from a first calculation of 0 per cent, and said the second quarter’s 0.2 per cent expansion was revised down to 0 per cent.

The downgrades confirm the weak growth performance of 2023 when the economy was hit by the impact of steadily rising interest rates and high inflation for most of the year. The figures also show how close the UK could have come to a formal recession, which is marked by two consecutive quarters of negative growth. Another three months of falling output would confirm a recession at the end of the year.

The downgrades mean that the economy has expanded by 0.3 per cent so far this year, down from economists’ projections of 0.6 per cent, and the economy overall is 1.4 per cent larger than pre-pandemic levels.

Jeremy Hunt, the chancellor, said the country’s growth outlook was “far more optimistic than these numbers suggest”. He said: “We’ve seen inflation fall again this week, and the Office for Budget Responsibility expects the measures in the autumn statement, including the largest business tax cut in modern British history and tax cuts for 29 million working people, will deliver the largest boost to potential growth on record.”

The UK is on course to post growth of about 0.2 per cent to 0.4 per cent in the final quarter of the year, with economists expecting better consumer spending and a recovery in the growth-driving services sector to ensure a recession is dodged heading into 2024.

In the three months to September, the output in the services sector, which makes up around three quarters of the entire economy, fell by 0.2 per cent, with declines in household spending and business investment in the third quarter. There was positive news for households, whose disposable incomes rose by 0.4 per cent when stripping out the impact of inflation, continuing from the 2.3 per cent expansion recorded between April and June.

Thomas Pugh, an economist at professional services firm RSM, said there was still a “significant risk” of a formal recession at the end of the year if weak growth projections for the fourth quarter disappoint.

“The economy will continue to stagnate through most of 2024, though, only returning to sustainable growth in the second half of the year,” Pugh said.

The ONS said its revisions were driven by analysis of the latest monthly VAT data and its regular business surveys, which “show the economy performed slightly less well in the last two quarters than our initial estimates”.

Darren Morgan, director of economic statistics at the ONS, said: “The broader picture, though, remains one of an economy that has been little changed over the last years. Later returns from our business survey showed film production, engineering and design and telecommunications all performing a little worse than we initially thought.”

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said he expected growth to hold steady in the final three months of the year, “before then rising at an average quarter-on-quarter rate of 0.3 per cent during 2024”.