Tory pledge not to reform ‘increasingly absurd’ council tax system in England blocks levelling up, says IFS

Andrew Sparrow www.theguardian.com

The Institute for Fiscal Studies thinktank has published a damning assessment of the Conservative party’s decision to rule out reform of the way council tax operates in England in the next parliament. (See 9.28am.)

In the briefing, David Phillips, an associate director at the IFS, said:

The new ‘family home tax guarantee’ [the Tory term for its new pledge] would mean perpetuating the increasingly absurd situation whereby the council tax that households pay is based on the value of their property relative to others in England on 1 April 1991 – a third of a century ago, when Mikhail Gorbachev was President of the Soviet Union and Chesney Hawkes topped the charts with The One and Only.

Since this one and only valuation of houses, values have increased by massively different amounts around the country, meaning that at least half are now effectively in the ‘wrong band’. Households in the north and Midlands are often in too high a band – and pay too much – while those in London and its environs too low a band – and pay too little – compared to what they would under a modernised tax. In other words, in its current form council tax works against levelling up.

And here are three charts from the briefing that prove this point.

This one shows how people living in low-value homes have to pay much more in council tax, as a proportion of the value of their home, then people in expensive properties.

Cost of council tax as % of value of your home

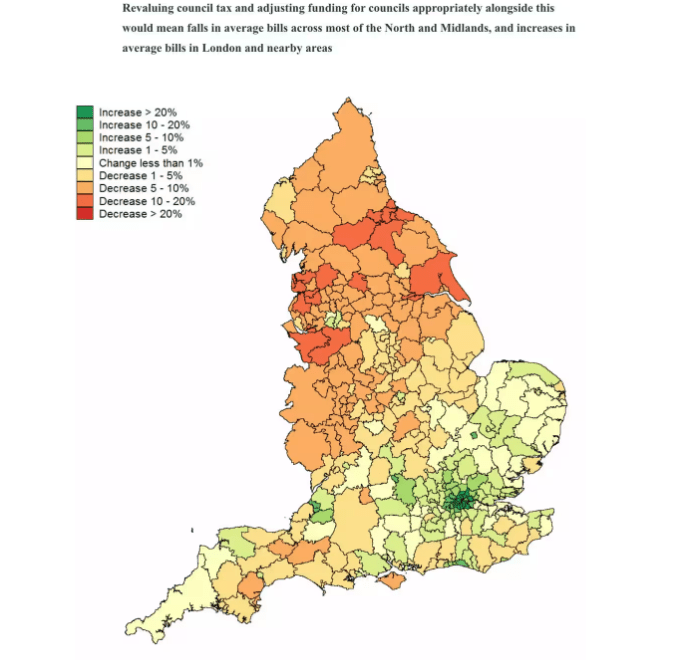

This shows how, if council tax was now based on current property values, instead of 1990 values, people in most of the north of England and the Midlands would gain, because their homes have not risen in value over the last 30 years as much as properties in the south. But people in London would face a particularly big increase, and other people in the south or east of England might pay more too.

Winners and losers from potential council tax revaluation

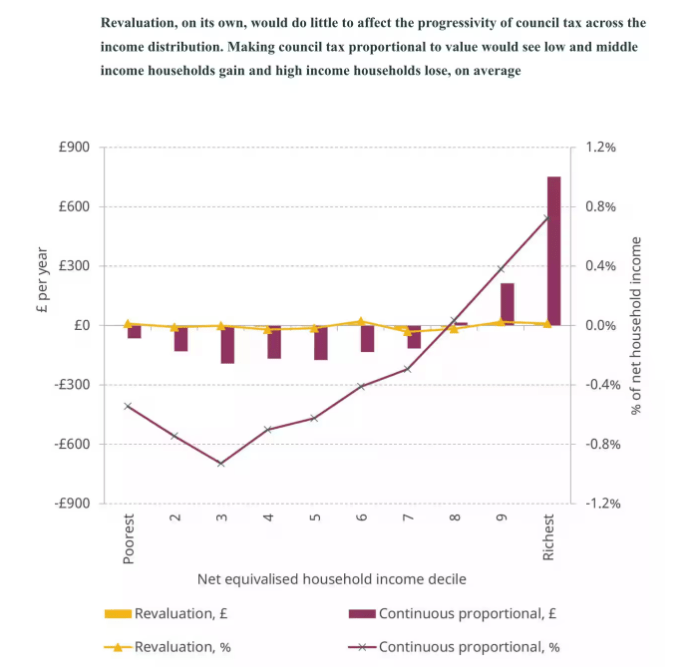

But the IFS is also in favour of reforming the system to make council tax proportional to the value of property. It set out the case for this in a report four years ago and this chart show how around seven out of 10 households – all but the richer ones – would gain from this approach.

Winners and losers from making council tax proportional to value