“Unless your readers live in a new house on an estate they will have little understanding of what happens today.

I moved onto a new estate which had a grassed open area. I was aware that there was some infrastructure to prevent flooding beneath it and knew that I would have to pay a share of the upkeep. I did not fully understand was that it was a public open space which was available for anyone’s use, not just the residents on the estate.

Maintenance charges have rocketed whilst quality of service has been poor. Any talk of with holding service charge payments is referred promptly to debt recovery. The whole system is unregulated and frankly, stinks.

I have dug deep to try to understand how a simple purchase of a freehold house is suddenly caught up in a land charge where I am compelled to pay for maintenance of land owned by someone else.

The root cause of the problem seems to have started with the council. In this case EDDC. As part of the planning condition for the estate the developer had to provide a public open space and a SUDS system to prevent flooding. In all probability it was an attempt by the council to stick their fingers up at the developers and force them to provide facilities for public benefit at no cost to the local authority.

The next stage was to make the developers responsible for the maintenance of the new open spaces. They could either do that themselves or pay a lump sum to the council to maintain it for the next 25years. Clearly the developers were unable to afford that so they passed the maintenance charges on to the residents within the title deeds for each house.

That was very unpopular and most developers, wanting to distance themselves from the problem, gave the piece of public land to a land management company. It seems that none of those companies are regulated and can charge what they like. If you don’t pay their bill they could apparently seize your house. All quite outrageous.

There has been lots of bad press about these land management companies and the matter discussed in Whitehall although the housing minister has taken little interest.

In East Devon our Conservative council has decided to stick their nose in the trough and has decided to offer to take over the public open spaces at Cranbrook and offer to carry out the maintenance of the public open spaces and charge F band houses £370 per annum and H band houses £512 per annum. Both of those figures are in addition to the normal council tax which is supposed to cover supply and maintenance of public open spaces !!

So lets look at this…. EDDC created the problem by insisting that the developer provide the public open spaces which the council had no intention of maintaining. When it all starts to go wrong EDDC offer to take the responsibility over but only by penalising the residents who live on those estates.

To make it clear those public open spaces are available for use by anyone. So maintenance of those public open spaces should be maintained at public expense. The costs must be paid out of council tax revenue.

This mess has been created by EDDC who enjoy a massive Conservative majority. Any proposals are just nodded through without opposition.

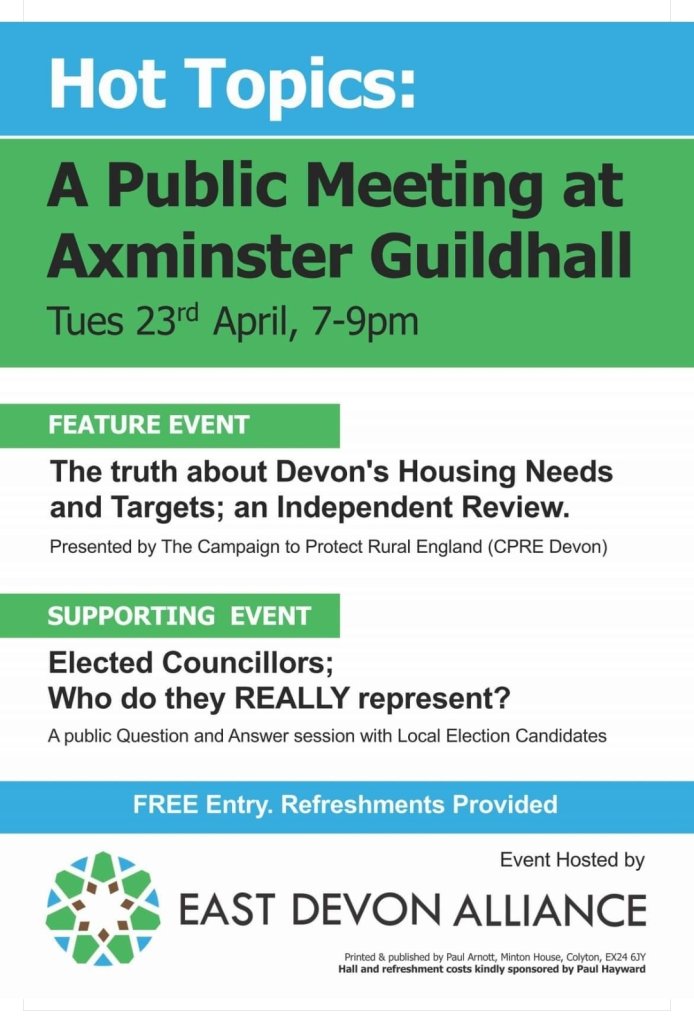

I have always voted Conservative in the past but things have got out of hand. Things must change. The public has a chance to voice their opinion in the local elections on 2nd May.

I know I won’t be for any Conservative Councillor and no, it’s got nothing to to with Brexit….”