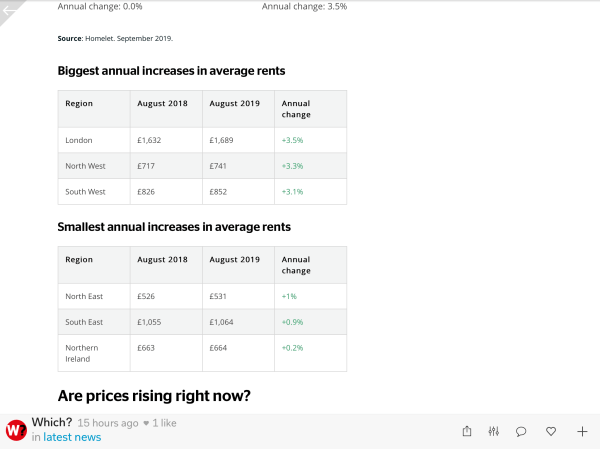

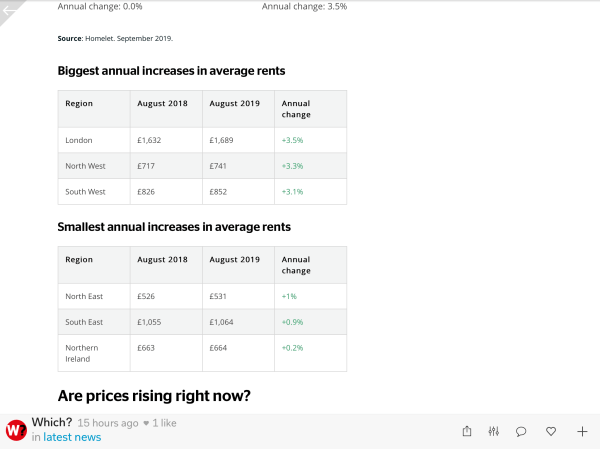

Source: current Which? magazine

Source: current Which? magazine

Seems about the same size as the proposed Sidmouth development at the old EDDC HQ, but without the sea views and parkland location …

“Pegasus Life unveiled proposals to change the use of its recently-completed Marina Gardens project, in Martingale Way, at Portishead Town Council’s meeting on September 11.

The developer completed construction of the 126-home complex – intended for ‘assisted living’ for elderly people – over the summer, but has decided its plans ‘won’t work financially’.

Instead, it will submit an application to North Somerset Council to remove the age restriction to allow the properties to be sold on the open market.

An additional apartment will be created as a result, while 38 will be earmarked for affordable housing schemes.

Emma Webster, Pegasus Life’s head of corporate affairs, said: “As we headed towards the final stages of the development, one of the things we have discovered is quite a lot has gone on.

“In the intervening period (since the application), there have been a number of developments built in North Somerset to address the requirement (for assisted living homes).

“We have taken the decision the application we secured consent for won’t work financially.”

The developer plans to increase parking capacity from 96 to 127 and Ms Webster believes the homes will offer a better ‘quality of life’ for owners.

She also told councillors the firm sees a need for ‘this type of accommodation in Portishead’, and will not be ‘importing people into the area’.

The plans were met with anger from members of the public.

Portishead resident Ken Smith, after hearing Pegasus Life’s presentation, described the development as the ‘worst building in Portishead’.

He continued: “I could probably live with it if you were going to look after old people, but you’ve realised you’re not selling them and you need to make more money by selling to any Tom, Dick and Harry.

“I think you should be ashamed of yourselves.”

Jonathan Mock labelled the building ‘horrific’ in public participation.

“It has all the charm of something from the communist bloc in terms of architecture,” he added.”

https://www.northsomersettimes.co.uk/news/marina-gardens-plans-changed-1-6273316?

As they say: No sh*t Sherlock!

“A parliamentary committee has slammed the government’s £12 billion Help to Buy scheme for tying up vast sums of money in a policy that has mostly supported homebuyers who could already afford to buy a property while failing to boost the provision of affordable housing or reduce homelessness.

The public accounts committee found that three fifths of buyers who took part in the scheme did not need it to buy a home. It said that the “large sums of money tied up could have been spent in different ways to address a wider set of housing priorities and focus more on those most in need”.

The committee has called on the Ministry of Housing, Communities and Local Government to carry out a full evaluation of the scheme’s value and necessity before a new version of the policy is launched in 2021.

Shares in Britain’s biggest housebuilders, which sell a significant proportion of homes through the scheme, fell this morning on the report. Persimmon lost about 53p, or 2.5 per cent, to £20.48; Taylor Wimpey fell by 4p, or 2.4 per cent to 159p; Barratt Developments slipped 9¼p, or 1.4 per cent, to 641¾p.

Help to Buy was introduced in April 2013 in response to a fall in house sales following the financial crash of 2008, when a tightening of regulations around mortgage lending made it more difficult to buy a property. It was originally intended to run until 2015 but will now last for a decade.

The scheme offers buyers with a deposit of 5 per cent a five-year interest-free loan of up to 20 per cent of the purchase price, or 40 per cent in London. The loan must be repaid in full on the sale of the property, within 25 years, or in line with the buyer’s main mortgage if it extends beyond 25 years.

The current scheme, which runs until March 2021, is not means-tested and is open to first-time buyers and those who have previously owned a property. Buyers can purchase properties valued at up to £600,000. From March 2021, a new scheme which is due to run for two years, will be restricted to first-time buyers and will introduce lower regional caps on the maximum property value, while remaining at £600,000 in London.

Help to Buy has increased housing supply by an estimated 14 per cent. Since it launched, it has supported more than 220,000 home purchases. The government has issued loans with a total value of more than £12.4 billion.

However, the committee warned that the government has allowed the scheme to become a semi-permanent feature of the housing market without thinking through the changes needed to improve the value to be achieved from the scheme. There is also no plan in place to prevent a fall in supply when the scheme ends in 2023.

Research by the committee also found that should house prices fall or interest rates increase, the government could make a substantial loss on the scheme. It warned that homebuyers who have used Help to Buy might not be aware of the financial risks if interest rates change. It also found that buyers who wanted to sell their property soon after purchase might find that they were in negative equity as new-build properties typically cost 15 per cent to 20 per cent more than equivalent “second-hand properties”.

Meg Hillier, Labour MP and chairwoman of the committee, said that the scheme had “increased the supply of new homes and boosted the bottom line of housebuilders.” She added: “It does not help make homes more affordable nor address other pressing housing problems in the sector such as the planning system or homelessness”.

“The scheme exposes both the government and consumers to significant financial risks were house prices or interest rates to change. Better consumer protection needs to be built into similar schemes in the future.”

Source: Times (pay wall)

“Unaffordable property prices are down to Britain’s “broken housing market”, to use Sajid Javid’s words as housing secretary in 2017. The chancellor was referring to the undersupply of new homes, and he was not alone in his analysis. Most people accept that Britain is failing to build enough, including the Bank of England.

“The underlying dynamic reflects a chronic shortage of housing supply, which the Bank can’t tackle directly,” Mark Carney, the governor, said in 2014 and has repeated in various formats since. “We are not able to build a single house.”

Yet it turns out we’ve been wrong. Skyrocketing prices, which have risen 60 per cent above inflation since 2000, have more to do with the Bank than the builders. That’s the Bank’s own finding, published on its Bank Underground blog, where it posts research that officials believe is worth airing. The analysis, using housing data for England and Wales, could not have been clearer. “We find that the rise in real house prices since 2000 can be explained almost entirely by lower interest rates,” the authors write. “Increasing scarcity of housing has played a negligible role.”

To make their argument, they disaggregate housing into its two components: the asset, namely the property; and the service, by which they mean having a roof over your head. If the problem was supply, with more people wanting a place than there are homes to accommodate them, the cost of the service ought to have risen. But rents, a proxy for housing services, have increased roughly in line with inflation, the Bank found. That “does imply that housing hasn’t got significantly scarcer over the past two decades”.

But what about the “chronic shortage”? Ian Mulheirn, chief economist of Renewing the Centre at the Tony Blair Institute for Global Change, says there isn’t one. Official figures show that since 1996 English housing stock has grown by 168,000 per year, while household numbers have increased by 147,000. We have a surplus of 1.1 million homes now, he estimates. Amended figures suggest that England needs only 160,000 homes a year, not the 250,000 in Mr Javid’s 2017 white paper.

What that means, as both the Bank and Mr Mulheirn state, is that the explosion in house prices has been driven by falling interest rates. To many, that may seem obvious. Low rates mean that borrowers can afford more debt— and what they can afford banks will lend. More money means higher prices and, hey presto, a boom. But not a bubble, even though house prices are now eight times average incomes, compared with 4.5 times in the 1990s. Mortgages are as affordable today as they have always been because money is so cheap. In the 1990s the rate on a five-year fixed mortgage was 8 per cent above inflation. Today the margin is 2 per cent.

The Bank cannot be blamed for this price escalator effect. The cause has been near-zero rates and quantitative easing globally, which have pushed borrowing costs down everywhere, as well as fierce competition in the British mortgage market. Nor can it claim innocence. Its own analysis shows that central bank policies are driving up house prices, as it knew in 2014 when, on tightening the mortgage rules, it said that low rates pose “risks to housing markets”.

Rather than economic, the consequences have been social: pushing homes out of reach for those without rich parents, causing home ownership levels to tumble and leaving new borrowers with frightening levels of debt. Dame Colette Bowe, an incoming member of the Bank’s financial policy committee, calls housing “a social issue” and has questioned whether the commitee is getting its approach wrong. The Bank’s new analysis may be a good place for her to start.

Source: Times economic editor

“Swathes of green belt in the heart of England have been earmarked for new homes for people who may never exist, in a trend fuelled by the drive to double the number built annually nationwide, campaigners have warned. …

… The city council believes it needs land to accommodate 42,400 new homes in the next 12 years, based on population predictions by the government’s Office of National Statistics (ONS), which predict the population will surge by almost a third between the last census, in 2011, and 2031. Green belt in neighbouring areas, including Warwickshire, Nuneaton and Rugby, has also been earmarked for housing to help Coventry meet its target.

Analysis presented at the British Society of Population Studies, in Cardiff, on Tuesday suggested homes earmarked for open fields were being planned for “ghosts”, because there is no wider evidence of the sharp predicted population growth. Just 15,000 new homes were needed, requiring the loss of far less green space.

“If there has been hyper population growth in Coventry, they are ghosts or vampires,” said Merle Gering, a Coventry-based campaigner whose analysis has been endorsed by leading demographers. “They don’t go to school, don’t attend A&E, don’t have babies, don’t own cars, don’t claim state pensions, don’t use gas or electricity, and don’t put waste into their bins … The net result? The death of the green belt.”

Similar fears have been raised elsewhere. Last week campaigners in Birmingham claimed housing need had been deliberately over-estimated after a scheme for 5,000 homes by 2031, on fields near Sutton Coldfield, was halved in size. In January, Andy Burnham, the mayor of Greater Manchester, accused the government of making it impossible to reduce the amount of protected green belt allocated to housing through the use of old population growth figures, which are higher than the most recent projections.

Housebuilders prefer to build on open land because they consider it quicker, cheaper and easier than previously-used brownfield sites. The government wants 300,000 new homes to be built annually by the middle of the next decade – more than double the output over the last 10 years. Campaigners fear planning inspectors are facing political pressure not to query ambitious targets set by councils, even when they involve the destruction of green belt.

“We agree with him entirely in terms of these crazy projection figures,” said John Wareham, the chairman of the Campaign for the Protection of Rural England in Warwickshire. “Coventry has forecasts of around 30% increase in population compared to Stratford-upon-Avon and others which are 10%, which makes no sense. This land between large urban settlements has been there for many hundreds of years and is valuable for leisure and for farming.”

Housebuilding targets set by councils are based on ONS population projections but Gering believes the figures for Coventry are skewed by a large number of foreign students, many of whom will not settle in the area. The ONS, which said it was always looking to improve its statistics to inform policymakers, said it used methods assessed by experts in the field and “we look to produce these estimates as accurately as we can”.

A spokesperson said: “We will continue to engage with the group of concerned residents in Coventry, as we would with any users who need assistance in understanding our estimates.”

Coventry city council said the population projections and the green belt site allocations were assessed by the government’s planning inspectorate.

A spokesperson said it saw “no evidence at this time that the housing requirements identified within its local plan are wrong or failing”.

It added it “will continue to work with our neighbours to monitor housing delivery and supply to inform any need to review the plan in the future”.

Gering’s analysis of the 2011 census and ONS predictions found the rate of growth predicted for Coventry was well over twice the regional average. He found attendances at A&Es over the last decade grew faster in Wolverhampton, Birmingham and Burton; increases in car registrations grew no quicker than in many other areas; and birth rates fell slightly as in most areas.

There was a lower-than-average increase in gas meters, electricity use fell quicker than in other areas, school admissions were average and the number of people on the electoral roll remained steady from 2011 to 2017. He also checked the volumes of domestic waste and found that it was trending in line with other areas.”

Anyone remember the “good old days” when the likes of Diviani, Twiss, Thomas and others extolled the virtues of the “new” town – and even got themselves not one but TWO awards for it? Many people wondered how that had come about at the time!

https://www.theexeterdaily.co.uk/news/uk-news/two-national-awards-cranbrook

Devon County Council pointed out its flaws FIVE ago in a 2014 in a damning reporht which identified ALL its current problems, but no-one at EDDC listened:

https://eastdevonwatch.org/2015/09/14/what-mainstream-media-isnt-telling-you-about-that-dcc-cranbrook-report/

Now the price is being paid – this is what you get when your government and your council is developer-led.

And what does the current council leader suggest: ANOTHER talking shop!

Owl thinks a few heads should roll first for the mess the council finds itself in … starting with lead officers CEO Mark Williams and Deputy CEO Richard Cohen who have masterminded the omnishambles …

“… East Devon District Council’s cabinet on Wednesday night heard that the legal agreement that plays a critical role in establishing the trigger points for the delivery of facilities has become ‘an inflexible legal document which was negotiated in a different financial era’ and some of the facilities were ‘no longer fit for purpose’.

Among the current obligations is the Cranbrook Consortium must provide a children’s centre at 2,500 occupations. Devon County Council has now served notice on the consortium and requires them to design, construct and complete them by either June 10, 2021, or when 2,500 homes are occupied.

Andy Wood, projects director, told the meeting: “We are therefore in danger of defaulting to a scenario that may not be fit for purpose or affordable over the longer term. Given the looming trigger points we are rapidly approaching the point of no return. …”

https://www.devonlive.com/news/devon-news/how-basic-cranbrook-gone-pioneering-3288218

“… as one eagle-eyed hack pointed out today, before the taxpayer-funded scheme, Barratt made £14,000 profit on each house it built. Now, after six years of Help to Buy, it makes more than £50,000 profit per house. …”

“… More than 5,500 households with an annual income of over £80,000 have been given help-to-buy loans in the past year compared with 4,142 households earning less than £30,000, the government’s own figures have revealed. Well over 2,000 of the richest households who were awarded taxpayer-funded loans, allowing them to buy new-build houses with only a small deposit, had incomes in excess of £100,000. …”

“Bosses at Britain’s FTSE 100-listed companies are raking in 117 times more a year than a worker on the average salary of just under £30,000.

Chief executives at the UK’s top 100 companies were paid £3.46million on average last year, down 13 per cent from £3.97million the year before.

Former Persimmon boss Jeff Fairburn was the biggest FTSE 100 earner last year, trousering £38.97million.

Five biggest FTSE earners: Chief executives at the UK’s top 100 companies were paid £3.46million on average last year

Fairburn’s salary for 2018 was 1,318 times more than the median salary of a full-time worker in the UK.

It would take an average worker nearly three days to earn what Fairburn raked in during a single minute, according to Chartered Institute of Personnel and Development and High Pay Centre analysis. …”

“Britain’s soaring house prices and ‘broken housing market’ have long been put down to a chronic shortage of homes, but new evidence has emerged that building more homes is unlikely to bring prices down.

A paper written by Tony Blair Institute chief economist Ian Mulheirn argues that building 300,000 homes a year wouldn’t make homes in the UK more affordable. Nor, he says, would more homes mean that more people manage to get onto the housing ladder.

The paper, published today by the UK Collaborative Centre for Housing Evidence, suggests that 160 per cent of the growth in house prices since the late 1990s has had nothing to do with a shortage in housing supply. Instead, Mulheirn claims that rock bottom interest rates for more than a decade have made borrowing so cheap that those able to buy have ratcheted up their borrowing, causing prices to soar.

‘Building 300,000 houses per year will do very little to bring down house prices in Britain, and next to nothing to raise home ownership,’ he wrote.

‘The real culprit for sky-high house prices is low global interest rates that have made it easy for homeowners and investors to take on large amounts of mortgage debt and pay ever more for houses.’

The figure of 300,000 new homes needed a year has been largely undisputed for the past decade.

In 2004, Kate Barker wrote a landmark review on housing supply for the then Labour government, concluding that 245,000 new private-sector homes a year were needed, plus another 17,000 social housing units, to keep house price inflation down to 1.1 per cent annually. She later revised that number up to 300,000 homes a year.

But Mulheirn disagrees. He points to official data showing that since the 1996 nadir of house prices, the English housing stock has grown by 168,000 units per year on average, while growth in the number of households has averaged 147,000 per year. Even in London and the South East, the number of houses has grown faster than the household count.

As a result, while there were 660,000 more dwellings than households in England in 1996, this ‘surplus’ has since grown to over 1.1 million by 2018. Similar trends are also apparent in Scotland and Wales, suggested Mulheirn.

Nevertheless, UK house prices have spiralled from around 4.5 times median household income in 1996 to a multiple of around 8 today.

The most recent figures from the Office for National Statistics showed across Britain, prices rose 0.7 per cent in June to an average of £230,292 – up 0.9 per cent compared to June 2018.

Mulheirn argued cheap mortgage finance is to blame.

‘Since the late 1990s, mortgage rates have tumbled, with inflation-adjusted interest rates on five-year fixed-rate mortgages, for example, falling from 8 per cent to around 2 per cent today,’ he said. ‘Since mortgage interest rates tend to be the dominant element of the cost of capital for home owners, this change can be expected to precipitate a substantial increase in house prices of a similar magnitude to the 160 per cent increase seen since 1996.’

Meanwhile, he said, a shrinking social rented sector, cuts to housing benefit and slow wage growth among young people are making rented housing less affordable for many even as though private sector rents are stable.

He added: ‘Neither our ownership or rental affordability problems will be solved by hitting the 300,000 target.’

According to the paper a 1 per cent increase in the stock of houses tends to lead to a decline in rents and prices of between 1.5 per cent and 2 per cent, all else equal. This implies that even building 300,000 houses per year in England would only cut house prices by something in the order of 10 per cent over the course of 20 years. ‘This is an order of magnitude smaller than the price rises of recent decades,’ said Mulheirn.

‘If we are to create more affordable houses to buy and rent, the solutions lie elsewhere.’ …”

.”A housing developer has been accused of ‘blackmail’ over a refusal to pay any contribution to the NHS.

Councillors had previously agreed to a land swap between the Exeter Science Park and Eagle One that would make the next phase of the Science Park expansion more deliverable and allow the 150 new homes to form an extension of the Redhayes/Mosshayne development.

The plans were agreed by councillors in April, subject to a viability assessment of a £216,000 contribution towards the NHS due to the impact of the development.

At last Tuesday’s East Devon District Council development management committee meeting, Chris Rose, the council’s development manager, said that the NHS contribution would not have a sufficiently detrimental impact on scheme viability to cause the proposed land transfer to fail.

But he said that Eagle One have said that as the overall transaction would not be in their interest, they will not agree to provide any NHS contribution.

Officers had recommended that councillors approve the application, even without any NHS contribution.

Mr Rose said: “In pure viability grounds, our viability consultant considers that with the contribution to the Trust, the development is still just viable but could certainly support a reduced sum of £81,422 as officers have tried to negotiate.

“However, the applicant is not prepared to enter into a S106 agreement which includes any contribution to the Trust as they consider it doesn’t meet the tests for acceptability and that the land deal is on the basis of what was previously agreed without the contribution to the Trust.

“The options open to the council are therefore to either refuse planning permission on the basis that the development does not adequately mitigate its impact on health services, or accept that no contribution to the Trust will be forthcoming and proceed.

“The main risk with a refusal is that the proposed land deal would be lost which would negatively impact on the delivery of the Science Park.

“To issue an approval of planning permission without the contribution to the Trust would secure the land deal and have huge benefits to the progress of the Science Park. Members would need to be clear that to do this would accept no mitigation for the impact of the development on health services.

While at the current time, significant weight should be attached to the request for a contribution to the NHS Trust, it is considered that greater weight should be attached to the proposed land transfer which will facilitate significant long terms gains for the delivery of a major science park integrated with the other development happening in the area.

“While there are grounds to secure a contribution to the Trust, nevertheless the applicant will not agree to a contribution and have advised that they will not enter into the land transfer on this basis. “The only way for the Council to proceed with confidence that the land swap transaction will go ahead would be without the NHS contribution.”

He added though that late documentation had been provided by the applicant from neighbouring councils to support Eagle One’s assertion that the NHS’s request was not justified, but that officers had not had the chance to fully assess the documentation.

Cllr Kevin Blakey, portfolio holder for economy, said that the application should be approved due to the benefits it would bring to the Science Park, and that if it was refused, the land swap deal was almost certain to fail.

He added: “Although the request is legal, this deal won’t proceed if there is a requirement for Eagle One to make a contribution. It may be unpalatable but if we want to see this happen and introduce opportunities for highly paid and highly skilled jobs, this deal should proceed.”

But Cllr Mike Allen, lead member for business and employment, said that while the land swap should proceed, there should be a contribution for the NHS as it was viable. He added: “This has been rejected by Eagle One and I think they have stepped over the line from negotiation to bullying.”

Cllr Steve Gazzard said that he had real concerns about the application and that Eagle One’s behaviour was ‘tantamount to blackmail’. He said: “They will build 150 homes so that could be up to 500 people, and it will increase pressure on the NHS. It is not an undemanding request that they should provide something.”

He proposed that the application be deferred to seek further advice on the legitimacy of the health contribution following additional information being submitted by the applicant.

Cllr Paul Hayward supported him, although said: “I wouldn’t use the word blackmail. I think undue pressure may be better. I am sure there is a reason why the NHS has asked, so we have to take it into account. We have asked for something, and they are saying they won’t pay and won’t move their position at all. We need to see the evidence.”

The council’s solicitor, Henry Gordon Lennox, said that officers had considered the benefits from the land swap were sufficiently great that the application should be approved, even if there is no contribution towards the NHS.

He said: “We were content that the contribution was justified, and we have now been given information that it isn’t, and we haven’t had a chance to look at it properly. But as they aren’t paying a contribution anyway, so it is irrelevant.

“Our officers are suggesting you approve it without any contribution to the NHS. If you are not willing to do that, then deferral is the right option, as we need to understand the legitimacy of the health contribution.”

The committee agreed to defer a decision for a further month to seek further advice on the legitimacy of the health contribution.”

https://www.devonlive.com/news/devon-news/blackmail-claims-over-housing-developers-3205288

Not the first time Eagle One has hit the headlines:

Owl says: So, a developer gets another developer to lead an “independent review ” into its practices that chooses its particicipants … you COULD NOT make this up.

“More than 100,000 people are being asked for their views on housebuilder Persimmon as an independent review into the company enters its next stage.

Customers, employees, suppliers, trade bodies, local authorities and civil servants will all be contacted on Tuesday in a bid to gather information about customer care and the quality of the group’s work.

The process, which was launched in April, is set to rigorously assess every aspect of the firm’s construction and inspection regime as it sets out to rebuild its image in the wake of controversy over payouts to executives. …

… Clive Fenton, the former chief executive of fellow housebuilder McCarthy and Stone, is providing assistance to the review as an industry expert.

The consultation period closes on September 16, with findings of the review due by the end of the year. …”

The average house price in East Devon is £295,208 (Zoopla).

“Nearly 400 people struggling with their housing costs had to be helped out by East Devon District Council last year, to the tune of £223,400.

A spokeswoman for East Devon District Council said:

“We have helped around 287 customers who claimed housing benefit and 93 customers who were in receipt of Universal Credit housing costs.

“All awards were made to customers in difficulties, whether it was due to the benefit cap, removal of the spare room subsidy, LHA restrictions, in debt, struggling on a low income due to the welfare reforms, or a combination of those mentioned and other circumstances too.

“The awards have been to single people, couples, single parents, families, working-age or pensioners, with or without disability.

“Each customer’s circumstances are looked at on an individual basis.”

The amount spent on Discretionary Housing Payments in East Devon has increased by 23 per cent since they were introduced in 2013-14.

Last year the amount paid out exceeded the Government allocation of funding by £19,000, meaning East Devon had to use money from its benefits budget.

The chief executive of Shelter, Polly Neate, has criticised the system.

“Discretionary Housing Payments are vital in many cases and can be the difference between people losing their home or not, but they shouldn’t be a replacement for a fit-for-purpose welfare system,” she said.

“These payments shouldn’t be needed in the first place – they’re simply a quick fix to structural problems,” she said.

“To solve the underlying crisis for good, the Government must commit to building 3.1 million social homes in the next 20 years, as well as making sure housing benefit is enough to actually cover rents.”

A DWP spokeswoman said the Government spent £23 billion a year helping people in the UK with their housing costs.”

https://www.sidmouthherald.co.uk/news/discretionary-housing-payments-in-east-devon-1-6212190

EDDC fight CDE – not on your life say officers …unless, of course, councillors instruct them to do so …

https://www.sidmouthherald.co.uk/news/newton-poppleford-home-appeal-meeting-1-6194658

As at June 2019, ast Devon to bear the brunt of new housing:

Page 10:

“Barratt Developments’ boss follows Berkeley founder’s lead and sells more than a third of his shares for £3.3m.

Barratt Developments’ boss has sold more than a third of his shares for £3.3 million.

David Thomas sold 500,000 shares for 660p each. He still has 823,000 Barratt shares worth £5.3 million.

The move came just weeks after Berkeley founder Tony Pidgley cut his stake in his company by a fifth – cashing in £37.2 million of shares.

The sales raise concerns that housing bosses believe the market has peaked.

And Taylor Wimpey warned rising costs and ‘flat’ house prices were putting pressure on its profits.

It reported first half sales of £1.7 billion, almost unchanged from the previous year, and said profits fell from £301 million to £299.8 million. The firm has proposed a 2019 dividend of 18.34p per share.”

“One of Britain’s biggest mortgage lenders has found that 70% of young people now believe that the homeownership dream is over for their generation.

Having carried out the largest-ever survey of potential first-time buyers, Santander said its own figures suggest less than 25% of 18- to 34-year-olds will be in a position to buy a home by the year 2026.

The Spanish-owned bank said that while 91% of the young people interviewed still aspire to own a home, over two-thirds said it was unlikely to happen unless they received the deposit from their parents. Back in 2006, around half of those under 34 were able to get on the property ladder, the bank said.

The study found that the sharpest fall in first-time buyer homeownership has been among those on middle-incomes – those earning between £20,000 and £30,000 this year. Of the new buyers who had been able to buy, two-thirds reported having household incomes of more than £40,000….”

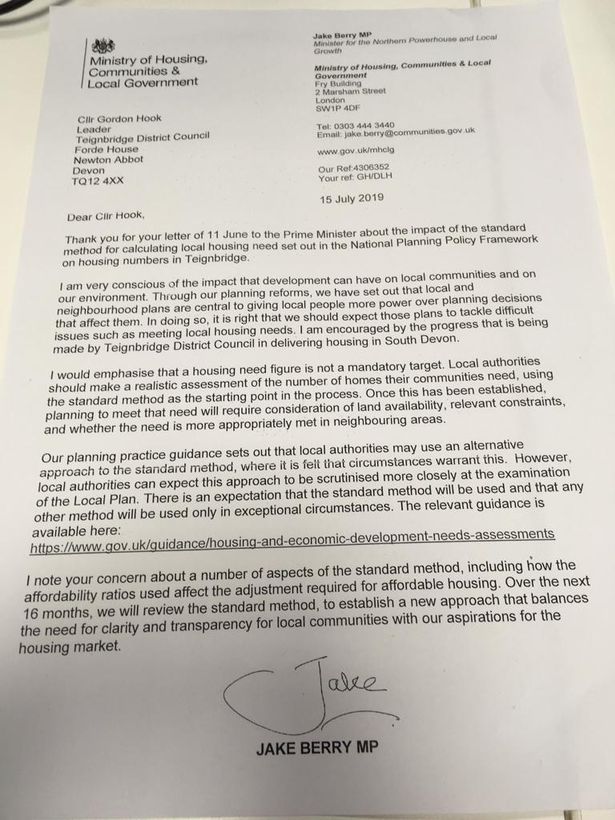

Letter from Department of Communities and Local Government to Teignbridge Council, which queried its raised target:

For background, see:

https://www.devonlive.com/news/devon-news/glimmer-hope-housing-need-rise-3153098

“The cost of homes in Devon has risen by 3.2 per cent over the past 12 months, with the average homeowner in the county seeing their property value jump by around £44,000 in the last five years. …

IN EAST DEVON:

Those wanting to buy in East Devon saw a slight drop in prices in May this year of 0.6 per cent, despite witnessing a 1.4 per cent rise over the last 12 months.

The latest ONS data shows the average property in the area sold for £282,602. Buyers who made their first step onto the property ladder in East Devon in May also spent an average of £217,225 – around £37,000 more than it would have cost them five years ago.

A total of 3,031 homes were sold in East Devon, five per cent fewer than in the previous year – according to the data for between April last year and March this year.

The average homeowner in East Devon will have seen their property jump in value by around £50,000 in the last five years.”

https://www.midweekherald.co.uk/news/house-prices-in-devon-statistics-1-6180451